Operating system: Windows, Android, macOS

Group of programs: Business automation

Accounting for overdue interest on a loan

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

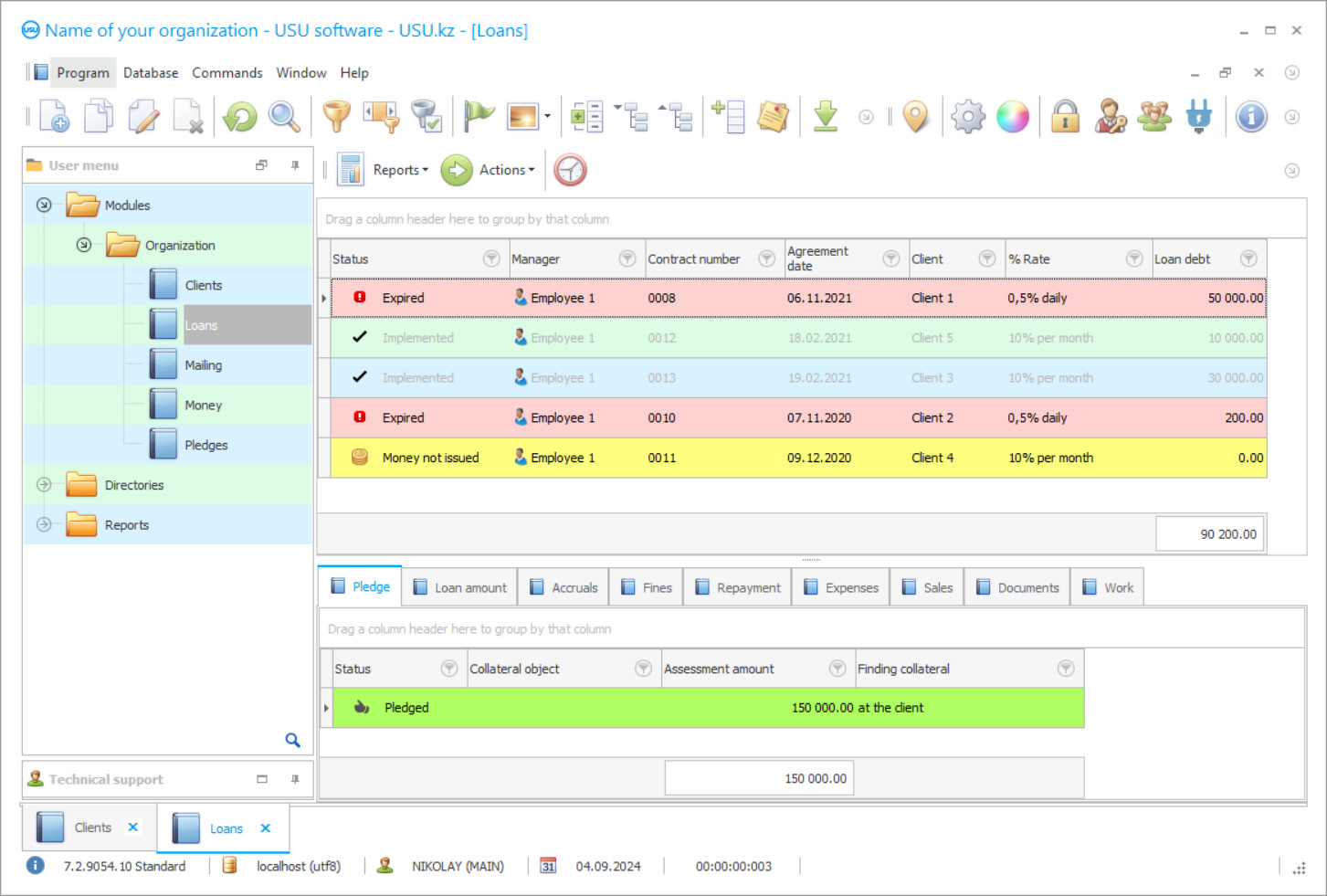

Program screenshot

In the field of microfinance organizations, automation trends are more and more noticeable, when representatives of the financial market need to accurately manage resources, put paperwork in order, and build clear and understandable mechanisms for interacting with clients. There is the basic range of support and accounting for overdue interest on a loan, which deals exclusively with this aspect of the bank's activities. At the same time, the program also provides information assistance in any of the accounting categories, promptly draws up analytical reports, and performs calculations.

On the website of the USU Software, you can download any of the software solutions developed specifically for banking standards, including digital accounting of overdue interest on a bank loan. The software is distinguished by reliability, efficiency, and excellent tools. The project is not complex. Just a few practice sessions are enough to learn at a good level how to manage operational accounting, track overdue payments, apply penalties to debtors, and fill out regulatory documents regulated by banks.

Who is the developer?

2024-04-19

Video of accounting for overdue interest on a loan

This video can be viewed with subtitles in your own language.

It is no secret that the principles of work on overdue payments are based on high-quality information support, where key data on loans and clients are published, contracts and contractual agreements are posted, the rate and interest are clearly indicated, and debt collection methods are spelled out. Of course, banks are structurally different from each other, while the general characteristics of accounting can be called contacts with a customer base, control over document flow, credit operations, and financial assets. All this is included in the standard set of functional tools of the program.

Do not forget that the accounting application seeks to take control of the main communication channels with borrowers, namely, voice messages, Viber, SMS, and E-mail. It will not be difficult for bank employees to master the tools to manage targeted mailing, which is a very promising area of work. If borrowers have not paid loans for a long time, then the system will not only deal with overdue interest but will proceed directly to penalties. It will send the client an informational notification to remind them of the late payment and will automatically charge the penalty.

Download demo version

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

The loan agreement with the bank is often tied to the current exchange rate, which will not be a problem for digital support. It automatically performs online monitoring of the exchange rate in order to instantly display the slightest changes in electronic registers and regulatory documents on loans. Also, the accounting program is able to determine the most profitable interest, schedule payments in detail for a given period of time in order to reduce the risk of overdue payment. One of the tasks of software support can be called minimization of risks so that the structure does not elementarily lose financial resources.

There is nothing surprising in the fact that modern microfinance organizations are striving to switch to automated accounting as soon as possible in order to effectively work with credit operations, automatically calculate interest, check the current exchange rate and overdue interest on a loan, and prepare documents. At the same time, a key feature of the configuration is high-quality work with clients and debtors, where you can avoid overdue payments, warn borrowers about the deadlines in time, share advertising information, attract new customers, and gradually improve the quality of service.

Order an accounting for overdue interest on a loan

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Accounting for overdue interest on a loan

The software assistant regulates the key operations of a bank or microfinance organization on loans, monitors the correctness of documentation, and evaluates the performance of staff. Accounting parameters of the program for overdue interest on a loan can be changed at your discretion in order to comfortably work with any accounting categories, quickly prepare documents, and collect reports on current processes. Overdue applications and loans are displayed in a timely manner, which will allow you to quickly correct deficiencies and start management decisions.

The configuration completely takes care of the calculations, including calculating the loan interest, detailing the payment period according to the specified time frame, specifying the terms and conditions for the return of the collateral. Accounting of the main channels of communication with borrowers includes voice audio messages, SMS, Viber, and E-mail. It will not be difficult for employees to master the tools to manage targeted mailing.

If there are overdue applications, penalties will be immediately taken. Penalty interest is calculated automatically. Interest is formed according to the given algorithms, where you can independently set the time frame, listen to the wishes of customers, be guided by the regulations and standards of the sphere. Each loan can be worked on individually. It is enough to open a category to get comprehensive arrays of analytical information. The maintenance of an electronic archive is provided. Synchronization of software with payment terminals is not excluded in order to improve the quality of service and somewhat expand the target audience. Accounting of the current exchange rate involves online monitoring, where you can instantly display changes in the exchange rate and automatically enter updated data into the registers. If the current indicators of overdue orders exceed the established limits, the profit falls, then the software intelligence will immediately report this.

In general, working with loans will become much easier when each step is regulated by an automated assistant. Not only interest positions are included in the basic range of support but also financial addition, repayment, and recalculation processes. Each of these processes is displayed visually. The release of the original turnkey application opens prospects for the customer to get a new design, add certain extensions, and functional options. It is worth checking the performance and functionality of the free demo version.