Operating system: Windows, Android, macOS

Group of programs: Business automation

Accounting for short-term credits and loans

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

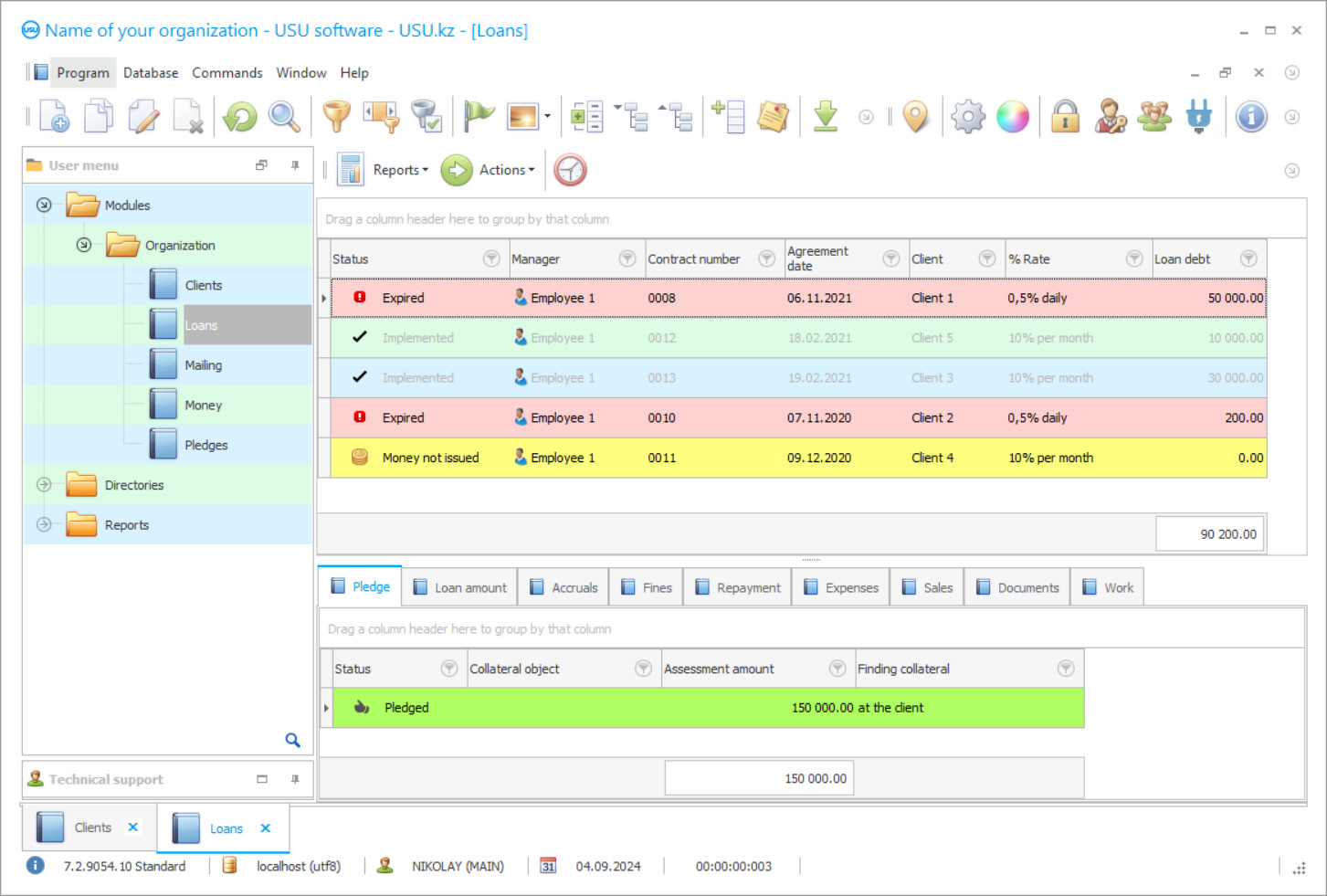

Program screenshot

Accounting of short-term loans and credits is automated by the USU Software, which increases the efficiency of the accounting itself and the speed of accounting procedures, coupled with the calculations that accompany each accounting transaction. Banks provide short-term loans for the current expenses of the enterprise at interest and with a mandatory return condition. Loans can be obtained from any organization that specializes in short-term loans and credits, or even from an individual, at interest or on a netting basis, which is accepted by accounting as a method of repayment.

Short-term loans and credits, the accounting of which does not differ from the accounting of loans, have an interest as payment for the use of other people's funds, while such interest has some peculiarities in their reflection in accounting as it depends on the purpose for which a short-term loan was taken. Accounting of short-term loans and credits, automated in the USU Software, is carried out without the direct participation of the accounting service in its operations since automation excludes the participation of personnel in all accounting and settlement procedures, thereby ensuring the accuracy and speed mentioned above. The user's responsibilities include only entering operating values and registering the execution of operations. Everything else is performed by an independently automated system of accounting of short-term loans and credits. It collects disparate data from different users, sorts them by processes, objects, subjects, processes, and presents the finished results, which become estimates in all activities that are controlled by this program.

The system of accounting of short-term loans and credits has one of its purposes to accelerate work processes, therefore, it provides for any, at first glance, little things that could reduce the time costs in keeping records, including short-term loans. The system of accounting of short-term loans and credits offers to work exclusively with unified electronic forms that have the same presentation of information, the same data entry principle, and the same management tools for all databases.

Who is the developer?

Akulov Nikolay

Expert and chief programmer who participated in the design and development of this software.

2024-04-26

Video of accounting for short-term credits and loans

This video can be viewed with subtitles in your own language.

The system of accounting of short-term loans and credits contains several databases, including the client's in CRM format, the nomenclature series, the loan database, and others, formed in each type of activity. All databases have the same structure of information placement. This is a general list of all positions with an indication of general characteristics and a panel of tabs with details of qualitative and quantitative parameters of each position from the general list. The names of positions and tabs differ in the content and purpose of the base.

The system of accounting short-term loans and credits has a simple menu, which includes only three information blocks, and they also have the same internal structure and headings, despite the different tasks performed. Everything to satisfy the user, convenience, and saving of working time to bring manual operations to automation, without which the system of accounting of short-term loans and loans cannot perform.

Three sections – ‘Directories’, ‘Modules’, and ‘Functionality Reports’ are three stages of one process called accounting, whose maintenance can be decomposed as ‘accounting organization’, ‘accounting maintenance’, and ‘accounting analysis’, where each stage corresponds to the mission of the information block. The section ‘Directories’ in the system of accounting of short-term loans and borrowings is the organization of accounting, all other work processes and settlements, information about the credit enterprise is placed here, based on which the rules to maintain processes and procedures, calculation of operations and pricing, ‘auxiliary’ regulatory documents. There is a regulation of all types of activities.

Download demo version

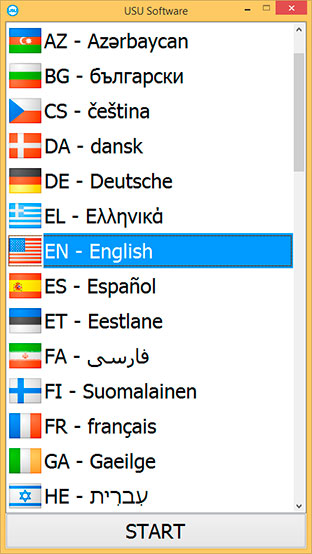

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

The ‘Modules’ section in the system of accounting of short-term loans is responsible to maintain the implementation of operational activities - current work with clients, finances, documents. Users work here since they are not allowed to enter the other two blocks. There are other processes and ‘system files’ that are stored, and access to them is prohibited. The ‘Reports’ section in the system of accounting of short-term loans and credits analyses operational activities, its current performance indicators and forms of assessment of each process, object, entity, and on its basis the enterprise makes strategic decisions on correcting work processes, personnel, financial activities, looking for additional resources to improve their efficiency and, therefore, profitability.

Analytical reporting is ready by the end of each period and allows you to monitor the dynamics of changes in indicators, look for factors influencing profit, assess the activity of clients and the feasibility of their expenses. In addition to analysis, the automated accounting system offers statistical reporting, which makes it possible to conduct effective planning for a new period and forecast future results. The program provides the entire volume of current documentation, forming it independently by the date specified for each document, and all of them meet the requirements and purpose. When confirming a loan application, all accompanying documents are drawn up, including an agreement with filled in details, payment orders, and a repayment schedule. The automatic document flow includes financial statements, which are obligatory for higher authorities, and additional agreements when credit conditions change.

The program independently performs all calculations, including the calculation of payments considering the interest rate, commissions, fines, and recalculates the payment when the exchange rate changes. These calculations include the calculation of piecework wages to users in the reporting period, considering the amount of work performed, saved in work logs. In the absence of registration of finished tasks in electronic format, they are not credited, so the condition contributes to an increase in the activity of personnel in data entry.

Order an accounting for short-term credits and loans

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Accounting for short-term credits and loans

If the organization has remote offices, a common information network functions, including their work in general accounting, an Internet connection is needed to form a network. The program does not provide a subscription fee. Its cost is fixed and determined by services and functions. The expansion of functionality implies additional payment. The formation of the nomenclature range allows you to keep records of the collateral base, products of internal activities, and automated warehouse accounting reports on the inventory. Compatibility with modern warehouse equipment improves the quality of operations in the warehouse, accelerates inventories, search and release of goods, collateral positions.

The program has a built-in reference and information base, which contains the provisions on the conduct of financial transactions, norms, and standards of performance, recommendations of accounting. The reference and information base monitors changes in the preparation of financial documents, calculation methods, ensuring the relevance of indicators and documents. The reference and information base allows you to calculate operations and assign a value expression to all, which ensures the conduct of any automatic calculations.

The formation of the client base is in the CRM format. It contains personal information about each borrower, contacts, the history of relationships, and personal assessment. The staff works individually. Each has personal electronic forms to record their activities and enter information, an individual login, and a security password to it.