Operating system: Windows, Android, macOS

Group of programs: Business automation

Accounting in microfinance organizations

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

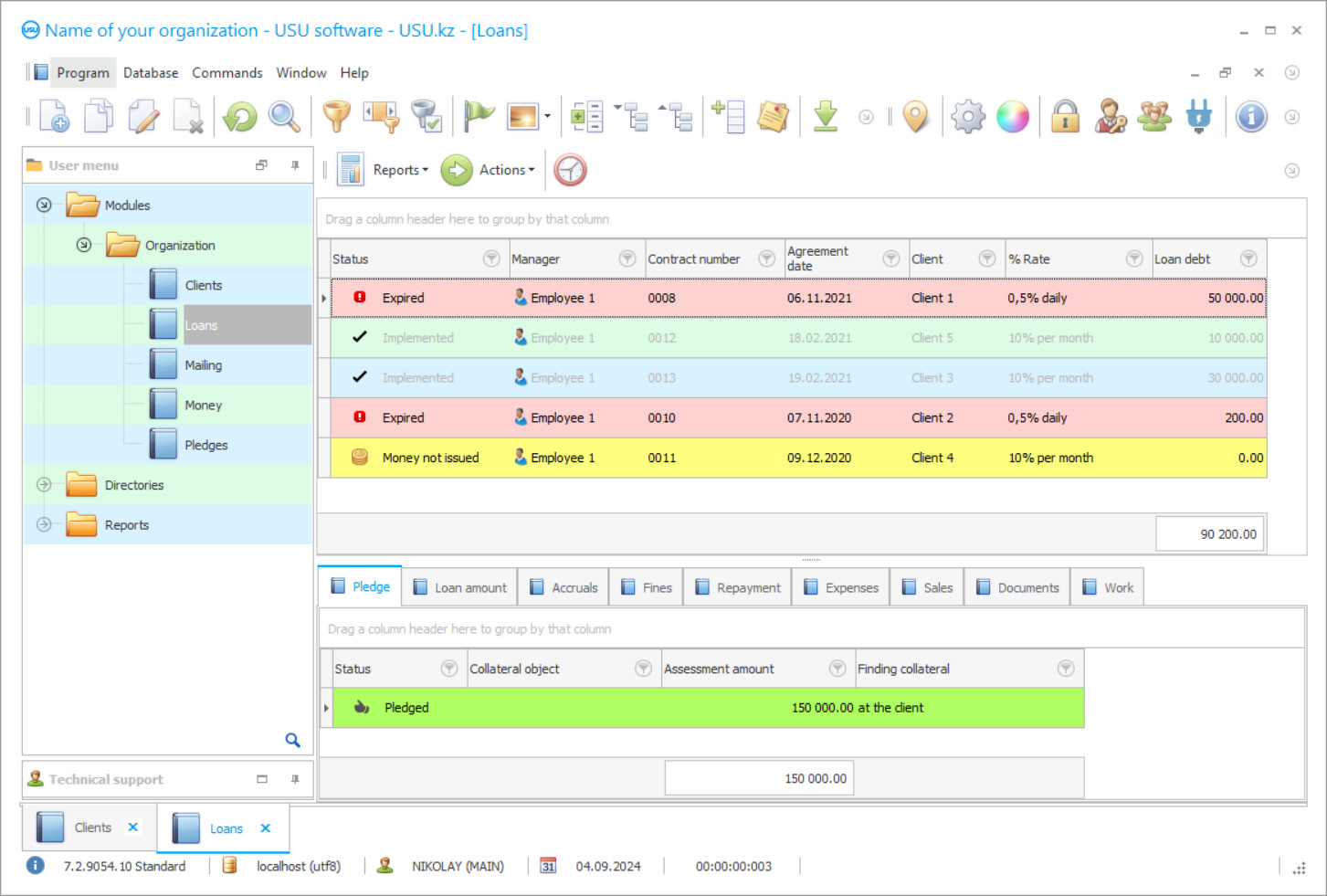

Program screenshot

Accounting in microfinance organizations is a program for those companies that carry out activities close to the banking concept, but at least on a scale controlled by other generally accepted standards and laws. In the same way, as a rule, the aggregate of issued loans is decreasing, but consumers, without exception, can be lawyers, for example, individuals who were not able to use banking services. Microfinance organizations tend to provide monetary methods almost simultaneously with the provision of a small package of securities, excelling in flexibility in the execution of contingent agreements.

Today, the growing demand for similar rules is undeniable. As a result, the number of companies providing similar rules is increasing. However, in order to be a competitive activity, it is necessary to use modern technologies following the accounting activity. The counting of microfinance organizations should be mechanical, it is acceptable to be confident in the relevance of the information received, but this means making various administrative decisions in time.

Accounting in microfinance organizations by USU Software will adjust the calculations. It is important to simplify accounting, control the issuance of loans, comprehend the full turnover, set up consumer notifications about new promotions and the timing of debt closure. Besides, in the case when such microfinance companies often need to apply a certain number of separate, stand-alone projects that do not have only one informative steppe, in this case, the introduction of CSS will solve this problem.

Who is the developer?

2024-04-18

Video of accounting in microfinance organizations

This video can be viewed with subtitles in your own language.

We have created a common area to store, accumulate, and exchange information between company departments, as well as employees, which, obviously, according to a large number of reviews, is the basic requirement to support a mechanical concept. One focused leadership is certainly able to help remote departments. Mobile workers only have the latest data, which directly influences the characteristics associated with maintaining the job and the difference between certain goals.

USU Software’s accounting of microfinance organizations, although it was designed in a similar way to the concept of other computer systems, provides more opportunities to integrate with external applications that are used in daily work. The program ensures the availability of devices to support the subsequent adjustment of any number of contracts according to the credits, which is directly reflected in the responses.

Work additionally begins with filling in the ‘References’ area, where all information is recorded in the database with existing branches, employees, consumers. Here, in the end, the methods are set up with the establishment of the solvency of the applicants, the calculation of profitable pond loans, fines. Also, instead of making this source more saturated, it will be pretty much the same that everything will be done correctly. The accounting of the main activity takes place in the second area of the – ‘Modules’, according to separate folders.

Download demo version

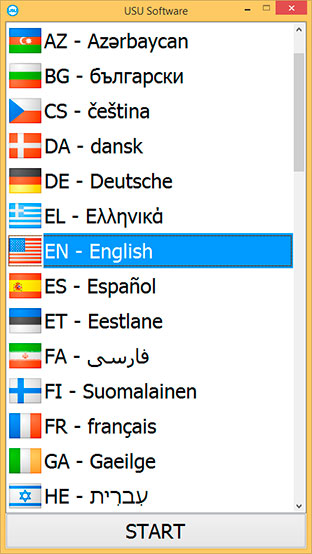

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

It should not be difficult for employees to understand the meaning of the assignment, apply it once for the first time. To ensure optimal accounting, it performs microfinance organization of the subscriber base. This is all thought out in such a way that each point of view includes only information, documents, and the previous interaction environment, which directly simplifies the search of the necessary data. In case you understand the reviews with the popular MFI stage, the node is organized. The three-stage, last, but no less important point of the USU Software – ‘Reports’ will be indispensable for accounting purposes, when you can get a general idea here, and therefore, make productive decisions on the formation of commercial or redistribution of currency flows.

The program is strongly recommended to exercise individual supervision of loans by individuals, choosing the optimal types of collection of fines due to the late introduction of another first payment, automatically imposing a fine on the crime schedule, the presence of organizations. The reviews, a huge number of which are shown on our website, tell us directly that this role has been found to be very convenient. If the microfinance organizations apply collateral in the form of collateral, surety, in this case, the program will be able to control information about the resources, automatically attaching the relevant documentation to the consumer card. In the accounting system by USU Software, all conditions were met, without exception, with the aim of preparing flexible products, choosing the best ways to transfer money to the borrower, and changing the terms of previously opened contracts. In case of changes, the program mechanically creates a clean plan with payments reflected in the latest reports.

Our experts are worried about this in order to create conditions to maintain comfortable activities not only on site but also under the conditions of relocation if employees need to carry out activities outside the office. The availability of absolutely all the spacious functionality of the program remains simple, also flexible in its functions, instead of indicating a huge number of positive reviews from our customers. In the concept of accounting of microfinance organizations, unlike other applications, there is a function of publishing standards, which directly allows the use of different numbers according to the predefined accounts. The implementation of preliminarily introduced standards can contribute. It is important to reduce the time required to finish the formation of documentation and issuance of loans.

Order an accounting in microfinance organizations

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Accounting in microfinance organizations

However, the alleged will have at their disposal samples of securities according to the fines and the role of automatic numbering. The software platform can adapt around the required workflow scheme in the lending company. Accounting in microfinance organizations is in no way blocked for the purpose of further expansion, administration, adaptation, what is happening is much simpler. But the item ‘Reports’ will perfectly satisfy the needs of the directorate in output data. As a result of the implementation of the USU Software, you will acquire an effective mechanism that serves as the basis of a unified accounting model of microfinance organizations and improves entrepreneurship with a clear strategy.

Accounting in microfinance organizations by USU Software is designed to facilitate the activities of microfinance companies with the issuance of loans, with immersion in the automation of all related movements, without exception, from consideration of an application to the closure of an agreement. Numerous reviews of our company allow you to be sure that your partnership with us is part of the research that we offer. Accounting in microfinance organizations forms a common information basis that allows you to carry out a productive service in life, to extract only relevant information. In a collective accounting database, it is permissible to immediately set up accounting following many institutions, branches, with different types of taxation and device configurations, which was very problematic in other popular configurations.

Self-adjusting documentation standards can assist in counting microfinance institutions. Feedback on the USU Software allows you to determine the goal of the final selection of the optimal form of automation in microfinance organizations. Microfinance accounting includes a large number of devices to conduct a foreign exchange of accurate surveys in a microfinance company. Prompt formation of a whole complex of documents, their preservation is an imprint, as well as at the above-mentioned stage of landing are present. Each user will be given an independent account in order to maintain their work responsibilities.

Separate accounting of cost management is more profitable within the framework, distributing according to optimal schedules, similar parameters are present in microfinance organizations. Without exception, our consumers, according to the results of the entry, save personal reviews, having read them, you can learn the strengths of our configuration. Backup of information, reference information, occurs at certain stages set by users. Accounting in microfinance organizations organizes the actions of those who are intended to perform routine procedures with filling out documents and calculations to the order of automation. It is permissible to calculate income ponds, benefits, fines.

The application performs an unconditional transfer with the most recent credit circumstances from the stage of the client's application and re-registration of the plan performing the role. The software platform allows you to flexibly move depending on the business, lend to lawyers, individuals, representatives of small and medium-sized businesses. The management is able to monitor the service of the personnel, increasing its every influence, to correct problems in the work. According to the responses about our company, USU Software fully automates all movements without exception to a high degree. Accounting in microfinance organizations is easy to use due to the ideal adaptation to the requirements of the buyer and the specific company. Search, distribution, connection, and filtering in the accounting program in microfinance organizations are carried out almost simultaneously, which is the result of the deliberate adaptation of information.