Operating system: Windows, Android, macOS

Group of programs: Business automation

Accounting of clients in MFIs

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

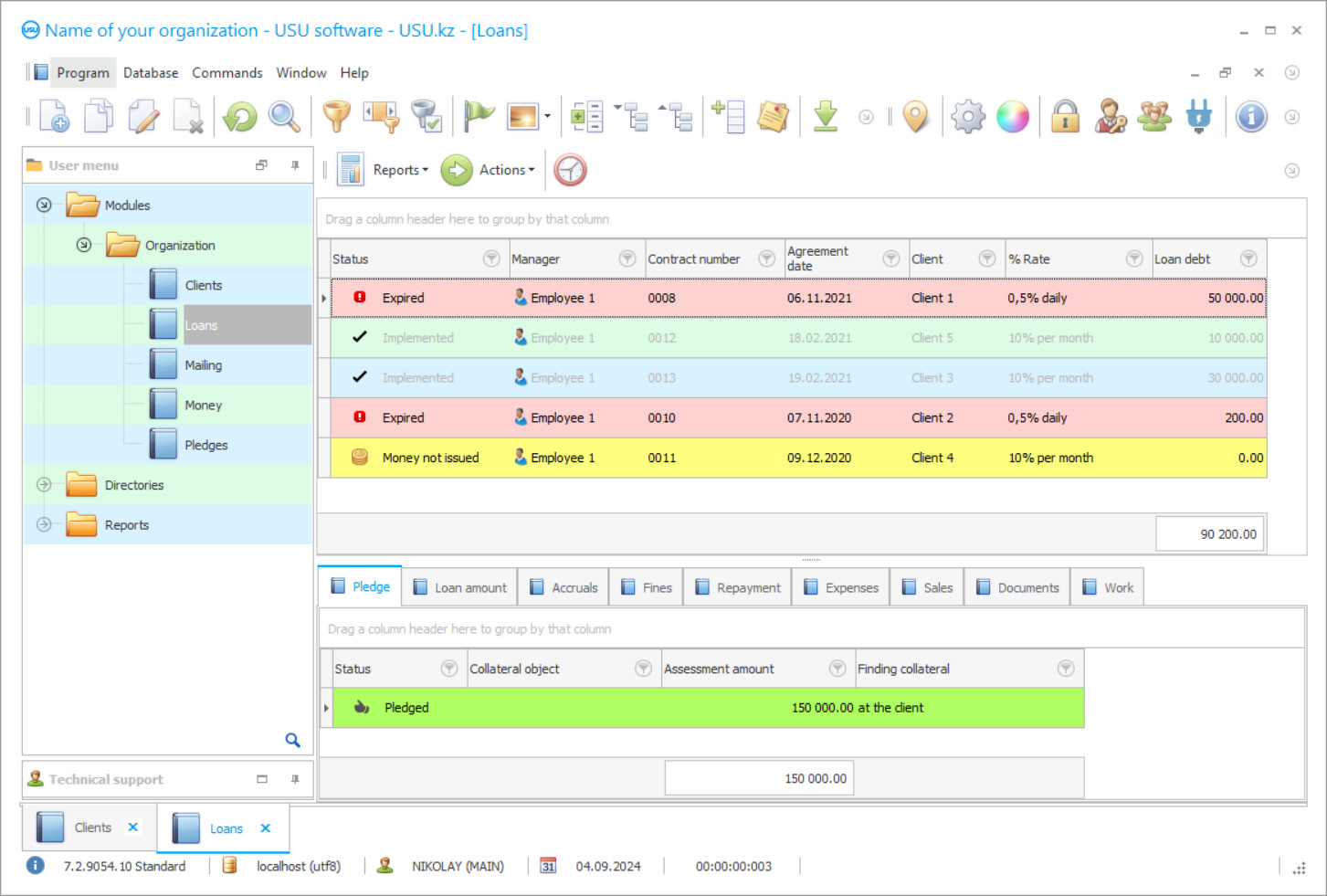

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

Program screenshot

One of the main conditions for the successful development of the lending business is the development of effective marketing strategies and the promotion of services on the market, therefore, the accounting of clients in MFIs is of great importance. A thorough study of CRM processes helps to identify the most promising areas of development, strengthen market positions, and expand the scale of activities. Consolidation and high-quality processing of data on all credit transactions is a laborious task, the best solution of which is the automation of settlements and operations. The use of specialized accounting of clients in MFIs improves the company's management process and maximize profits.

You can purchase a separate CRM program, however, in order to optimize costs, management, and control processes, you must use a multifunctional system. USU Software is distinguished by the high efficiency of the provided tools for various areas of work. Not only active conclusion of transactions and replenishment of the client base are under close control, but you also can maintain universal information directories and regularly update them, monitor debt repayment, make various, even the most complex calculations, keep records in any currencies, control cash flows in bank accounts, monitor employee performance, conduct financial and management analysis, and much more. Due to the wide functionality of the accounting of clients in MFIs, you are able to systematize all the processes carried out in MFIs, without additional efforts and investments.

Who is the developer?

Akulov Nikolay

Expert and chief programmer who participated in the design and development of this software.

2024-04-24

Video of accounting of clients in MFIs

This video can be viewed with subtitles in your own language.

The client base deserves special attention in our software. Managers will be able to register not only the names and contacts of each borrower but also attach accompanying documents and even photographs taken from a webcam to the record about a particular borrower on the MFI. Regular replenishment of the database allows not only assessing the activity of concluding deals and the effectiveness of the work of managers but also contributes to more efficient service. When drawing up each new contract, your employees will only have to select a client's name from the list, and all data on it is filled in automatically. Faster service has a positive impact on both reviews and loyalty levels, and clients will always use your MFI. This approach increases the volume of lending and, of course, the income of the organization.

However, the accounting of clients of MFIs in our program is not limited to data systematization. USU Software provides its users with tools for complete transaction support and communication with borrowers. Your staff has a variety of tools at their disposal to inform borrowers. To notify of arising debts or special events, managers can send clients e-mails, send SMS alerts, use the Viber service or automatic voice calls. These features allow you to optimize your working time and focus on more strategically important tasks and improving the quality of service. Moreover, in the computer system, the operative formation of various official letters is available. Download a notification about the default by the borrower of its obligations, about holding trades in collateral, or changing exchange rates in the MFIs.

Download demo version

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

For regular clients, the accounting of MFIs allows you to calculate various discounts, and in case of delay in payment, it determines the amount of the fine. Among the capabilities of the CRM module, there is also personnel control: due to information transparency, you can see which of the tasks have already been completed, whether they were done on time, what result was obtained. Also, determine the amount of remuneration of managers, considering the effectiveness of their work in the MFI, using the download of the income statement. The program improves the conduct of accounting and organization of MFIs and achieves high-performance indicators.

The program is configured according to the accounting and management requirements of each individual company to ensure a personalized approach and maximum efficiency. USU Software is suitable for MFIs, private banking enterprises, pawnshops, and any other credit companies of various sizes. You can consolidate information about the work of each branch and combine the activities of all departments in a common resource to make the management process easier. Moreover, you can configure the execution of transactions in any currency and different languages, as well as choose any interface style that suits you and upload your logo, so clients are aware. According to your requirements, not only visualization and work mechanisms are configured but also the type of generated documentation and reporting. Users of our system can generate in an automated mode various documents required in the accounting of MFI, as well as contracts and additional agreements. Drawing up a contract takes a minimum amount of working time since managers need to select several parameters - the amount and method of calculating interest, currency, and collateral.

Order an accounting of clients in MFIs

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Accounting of clients in MFIs

Your MFI for clients accounting can lend in foreign currency to make money on exchange rate differences since the software automatically updates exchange rates. The monetary amounts are converted at the current exchange rate upon renewal or loan repayment. Tracking credit transactions is now easier since each transaction has its own status, which allows you to quickly identify the presence of overdue debt. Monitor the cash flows of each branch of the MFI in real-time, evaluate financial performance, and control the availability of sufficient balances on accounts and cash desks. You will have at your disposal various analytical data for financial and management analysis, which allow you to assess the current state of the MFI. A clear display of the dynamics of income, expenses, and profits helps to identify the most promising areas of development and draw up appropriate projects. The automated mode of settlements and operations makes accounting not only prompt but also of high quality and eliminate the likelihood of errors, which is also beneficial for clients. Using the accounting of clients in MFIs, you can easily monitor the implementation of the developed plans and solve the most complex strategic tasks.