Operating system: Windows, Android, macOS

Group of programs: Business automation

Accounting of credits

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

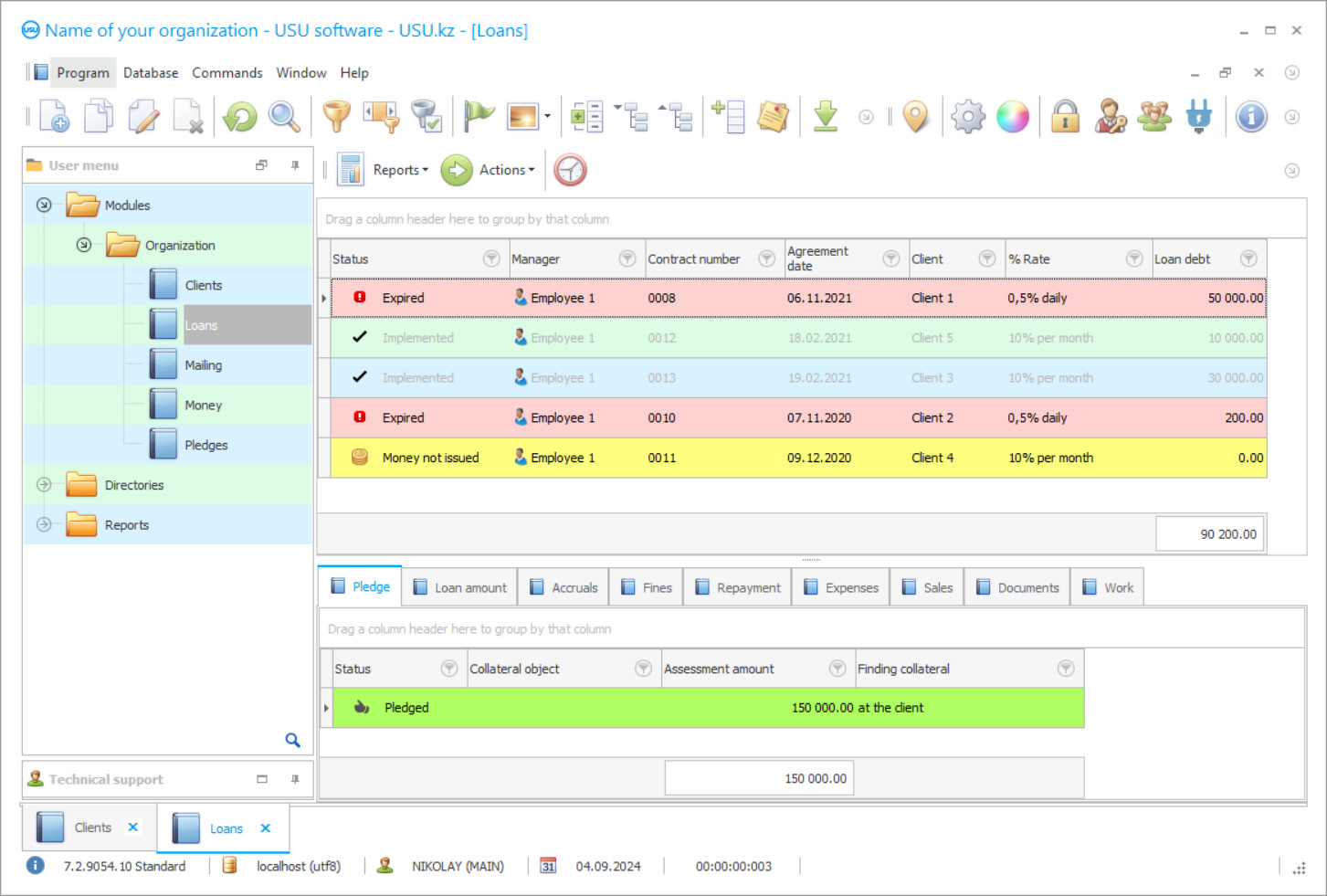

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

Program screenshot

In the modern world, credit institutions are important in the development of the economic sector. They help provide the population with funds to meet their needs, and commercial companies start their activities. Correct accounting requires modern technology, so you need to use high-quality software. Loans are recorded systematically using electronic journals to ensure that the values are reflected correctly.

USU Software monitors the actions of personnel, cash flow, as well as credit accounting. For their maintenance, it is necessary to create separate tables of each type. This helps in analysing the demand for types of services and their relevance. The main feature of this distribution is the definition of income of each principle. The company's management focuses on customer service so that it takes a minimum of time. The more applications are created, the higher the level of employee development will be. This, in turn, increases the total amount of revenue and credits.

Who is the developer?

Akulov Nikolay

Expert and chief programmer who participated in the design and development of this software.

2024-04-26

Video of accounting of credits

This video can be viewed with subtitles in your own language.

The specifics of credit accounting are spelled out in the legislative documents. Every company must follow government regulations in order to operate legally. The features of the loan are the following indicators: interest rates depend on the term and type of agreement, the repayment amount varies from the number of payments, a commission is charged to service other banks, the payment is postponed only upon a written application from the person, and much more.

In the accounting of credit, the first place is taken by the amount, interest rate, and term. These indicators form the content of the contract. When making an application, the client indicates characteristics of creditworthiness, namely all types of income. It is worth noting that in the absence of official sources, the credit institution refuses to issue loans. Further, all data is analysed, including the history of loan repayment. Service requests are also accepted via the Internet, which in turn reduces the workload of office employees. Thus, the number of potential customers increases. An increasing number of people need credit every year.

Download demo version

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

USU Software helps transport, manufacturing, construction, and other organizations work. It consists of several sections that are tailored to specific activities. Each employee can create a desktop at their own discretion. Built-in reference books and classifiers automate the process of entering information. A single client base with contact information is maintained. This approach makes customer service easier and helps new hires get started.

Accounting of credits in modern software optimizes business operations. Reducing time costs, eliminating downtime, and automating document creation take the enterprise to the next level. This allows you to increase your competitive advantage over other firms. Stable profitability indicators are the main goal of any business activity. All performing processes should be performed without any mistake in order to ensure the correctness of indicators and consequently reports, which are used to estimate expenses and profits gained from credits. Due to the human factor, sometimes it is impossible to guarantee accuracy during work operations. Therefore, an automation program of credit accounting is needed, with the aid of which all processes will be error-free and done in a matter of seconds.

Order an accounting of credits

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Accounting of credits

Another key feature of the program is its effectiveness. Due to the high-quality functionality and multitasking mode, it can perform several tasks at once without confusion. Moreover, the full set of essential tools allows a fast formation of orders, while keeping the quality of the service, so clients will be pleased by such updates in the activity of credit institutions.

There are many other features, which are useful for accounting of credits such as formation of records in the electronic system, convenient location of functions, built-in assistant, credit calculator, submission of applications via the Internet, calculation of the amount of repayment of loans and deputies, beautiful configuration, modern content of the program, various reports and logs, accounting and tax reporting, access by login and password, compliance with the law, identification of overdue contracts and payments, service level assessment, synthetic and analytical accounting, bank statement, receipt and expense cash orders, implementation in any economic industry, creation of competitive advantages, versatility, continuity, consolidation reporting, control over the features of payment types, taking inventory, formation of a debt repayment schedule, calculation of interest rates, online recalculation of amounts, use of different currencies, accounting for exchange rate differences, distribution of job responsibilities, payment orders and claims, planned task for the short and long term, analytics of indicators, analysis of the financial condition and financial position, determination of the profitability of the current period, business transaction log, book of income and expenses, service level assessment, partial and full debt repayment, personnel accounting, wage, templates of standard forms of documents, specialized reference books and classifiers, feedback, payment through payment terminals, interaction of branches, unlimited creation of item groups.