Operating system: Windows, Android, macOS

Group of programs: Business automation

Accounting of expenses of a credit institution

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

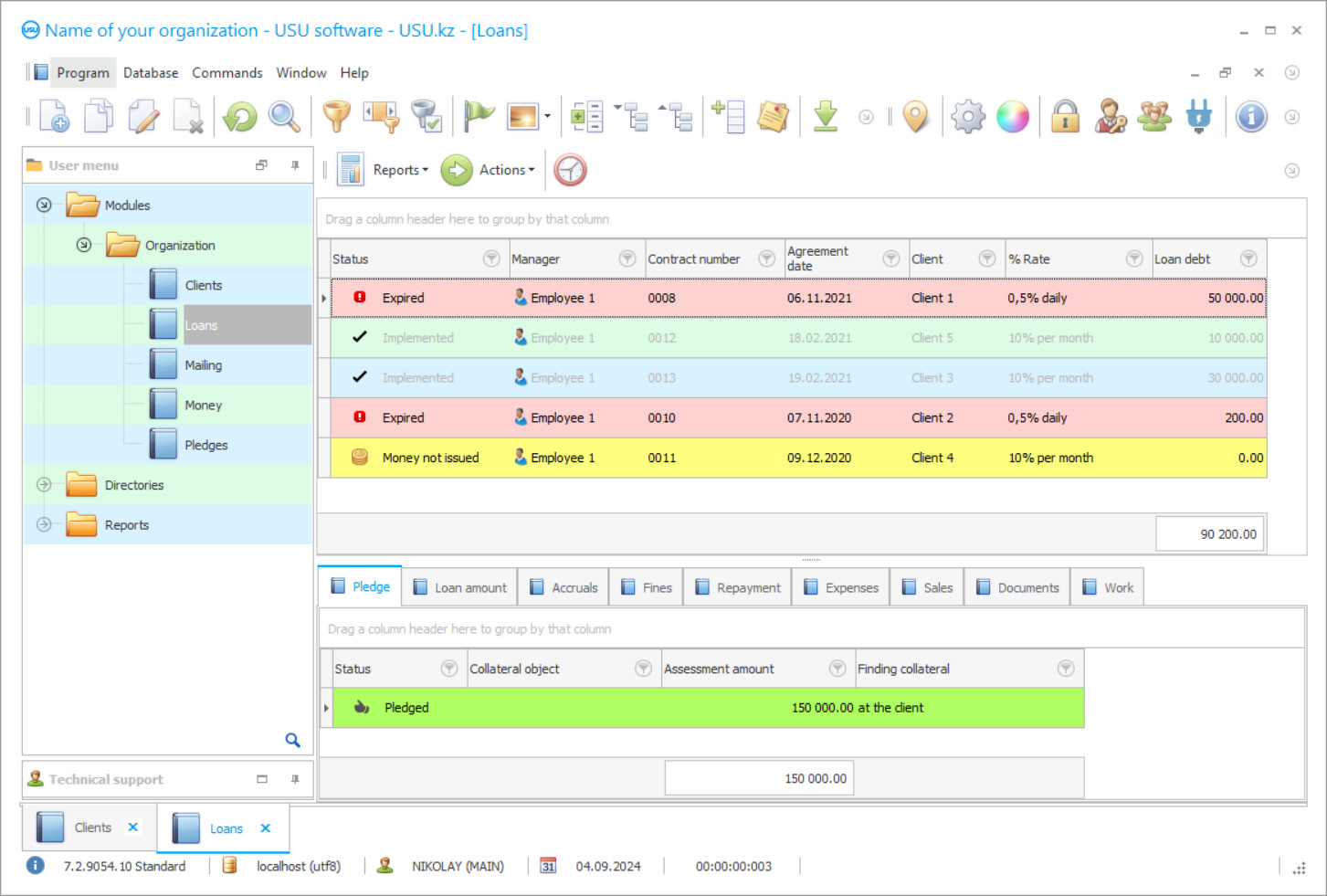

Program screenshot

Credit institutions improve their systems every year. They introduce new modern technologies to automate and optimize production processes. The expenses of the credit institution require continuous accounting. It is necessary to determine the level of profit and identify the cost factors of the firm.

Credit institutions' incomes are recorded for all transactions in chronological order. It is necessary to control the flow of funds at all stages of operation. It is necessary to monitor not only expenses but also income. The stability and profitability of the company depend on a well-developed accounting policy. The main idea of creating any company is to get the maximum profit at the lowest cost.

Who is the developer?

Akulov Nikolay

Expert and chief programmer who participated in the design and development of this software.

2024-04-25

Video of accounting of expenses of a credit institution

This video can be viewed with subtitles in your own language.

USU Software is a special information product that helps to conduct business activities of various organizations, regardless of their size. In the modern world, it is necessary to debug all systems in order to have a competitive advantage among partners. The accounting of income and expenses of a credit institution is made for all indicators in a particular department. There, the corresponding records are formed, and according to the results of the current period, a summary sheet is provided to the management. Extended analytics of values is generated upon request. This affects the adoption of managerial decisions for the future.

Expenses are a very important part of the bill. The higher their level, the lower the profit. The company's employees strive to optimize their work, and automated software helps them in this. Time waste is reduced by using document templates. Thus, time for more important matters increases. Special reference books and classifiers help to distribute items by type of expenses of production and non-production. This division provides more complete information on further actions in the credit institution.

Download demo version

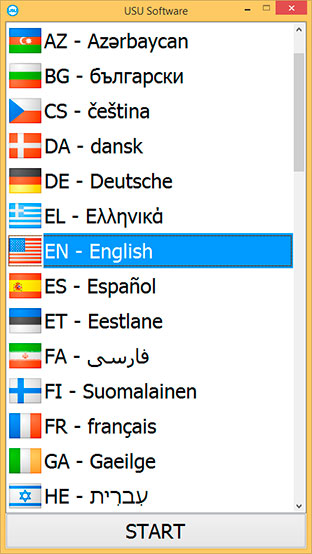

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

The credit institution provides loans and borrowings to the population and enterprises under various conditions. All requests are processed online in an electronic program to quickly weed out incorrect applications. By considering the income and expenses of a firm, one can easily determine its performance. Additional reports help make calculations of related metrics that track changes in the activity. The administrative department of the credit institution needs accurate and reliable data. They influence the formulation of growth and development policies.

USU Software is working on the systematization of transactions related to expenses. Each type is entered in a separate table, and then the total is calculated. If there is a big difference between the categories, then it is worth paying attention to the factors of their occurrence. To ensure stability in the market, you need to monitor competitors and determine industry averages. After these manipulations, the management makes decisions on further work. In case of deviations from the planned target, you need to look for the cause within the organization and only then compare it with changes in the external environment. Most of the costs are for organization and administration.

Order an accounting of expenses of a credit institution

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Accounting of expenses of a credit institution

The accounting of expenses of a credit institution has distinct features so there are not any analogues on the market of computer technologies. Our specialists did their best and used all skills to fully design the application and made it suitable for every credit institution. Due to the high-quality functionality and full range of essential accounting tools, it is possible to significantly develop this sector of business. One of the main advantages is the fast data processing, which is important as there are many financial indicators and all of them should be accounted for. Moreover, all operations are performing without even a minor error, which is beneficial to maintain the profitability of the credit institution. All of these increase the productivity, efficiency, and accuracy of the whole work, facilitating the tasks of employees.

There are many other facilities, which are included in the configuration of accounting of expenses of a credit institution such as the receiving applications via the Internet, convenient location of reports and reference books, access by login and password, interaction of branches in a single system, integration with the site, cash flow control, monitoring expenses, synthetic and analytical accounting, unlimited item creation, client base, backups on a set schedule, accounting and tax reporting, bank statement, inventory accounting, service level assessment, work with legal entities and individuals, implementation in any activity, consolidation and informatization, identification of late payments, templates of standard forms and contracts, compliance with cash discipline, electronic checks, customer accounting, implementation in credit, transport, and other enterprises, money orders, timely update, conducting transactions with different currencies, partial and full debt repayment, accounting of short-term and long-term credits and loans, costing calculation, special lists of books and magazines, maintaining the income and expenses of the company, salary and personnel records, video surveillance service upon request, accounts receivable and payable, reconciliation statements with partners, loan contract templates, mass mailing, telephony automation, feedback, built-in assistant, production calendar, transferring a configuration from another program, prompt introduction of changes, accounting certificates, spreadsheets, calculation of loan rates.