Operating system: Windows, Android, macOS

Group of programs: Business automation

Accounting of expenses on loans and credits

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

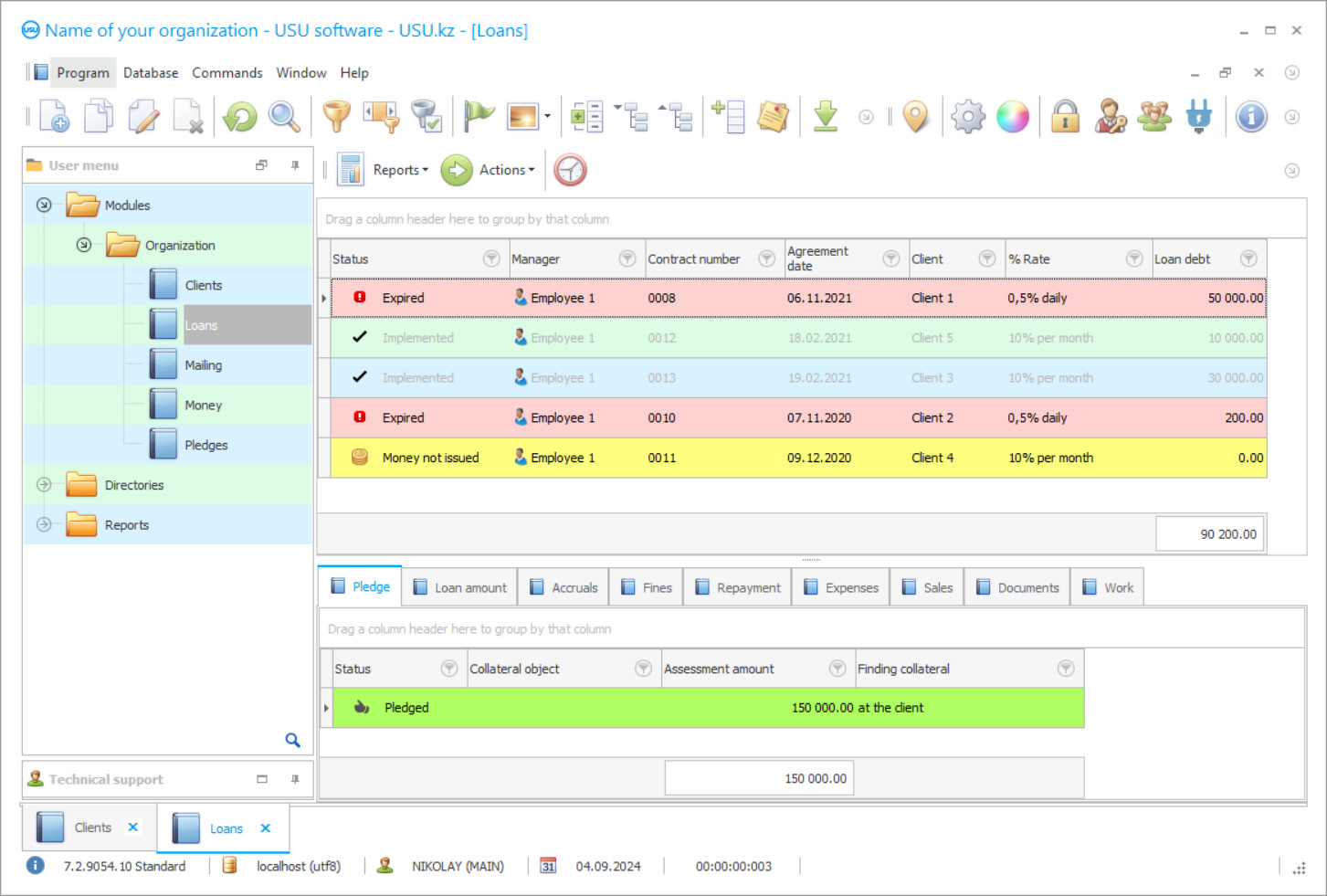

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

Program screenshot

The market system and business these days during their activities are forced to use not only their funds and savings but also turn to lending products. With the use of finances received when applying to banks, MFIs can solve the problem of lack of material resources with the need for business development, raising production volumes. However, to maintain a competent and rational organization of business processes, it is important to keep track of the expenses on loans and credits in a timely manner. It is loans that can ensure the full functioning of the company's economic activities, in the absence of the necessary funds, contributing to their development, expanding the range of products and services. The level of knowledge of the management about the structure, volumes of the financial side depend on the fidelity and accuracy of the accounting of loans and credits, making informed decisions to correct problem indicators, analysing the productivity of the policy pursued in the organization. Based on the selected optimal accounting format, the company will determine the type of receipt and use of cash flows, expenses in all aspects.

But in order to achieve significant success in the field of credit management, the administration must either form a staff of highly qualified specialists, which is a very costly event or turn to modern technologies and automation systems for help, which will quickly lead to a single standard of organizing the accounting of expenses on loans and credits. Computer programs can also save on manual labour and optimize internal processes. Despite the variety of such applications on the network, making the right choice is not always easy. Ideally, you need a platform that can easily adapt to the specifics of doing credit business, without having to rebuild the work processes already in the organization. And we have created such software that meets all the listed requirements. USU Software is exactly what will become your irreplaceable assistant in the field of expenses management and accounting. Automation of processes greatly facilitates the work of employees responsible for loans, leading them and ensuring the correct display of all necessary documentation. The application takes over a lot of operations related to the control of enterprise loans and credits. Employees only need to enter primary and new data into the database as they appear, and the pre-laid software algorithms will allow tracking the distribution of information by acts, documents, reports.

Who is the developer?

2024-04-18

Video of accounting of expenses on loans and credits

This video can be viewed with subtitles in your own language.

The interest rate is calculated automatically, a payment schedule and an accounting entry are drawn up for cash within the expense items of the company. At the end of the reporting period, the software automatically displays not only the amount of the loan repaid but also the purpose of these funds, so that the management can see how rationally the money received on the loan is used. The display of interest expenses depends on the purpose of their use. They are included in general, operating expenses, if they were not used when making preliminary finances for material, production values, services, and works.

It should also be noted that the system of accounting of expenses on loans and credits of the USU Software has an easy-to-learn interface, with easy navigation and an understandable structure of sections and functions. Reference data is distributed in such a way that it will not be difficult for users to start actively using the application, even if they did not have the skills before. All calculations are carried out automatically, based on built-in formulas. It is important to note that when adjusting for your business, we consider the specifics of the workflow, developing templates and samples of each act, decorating them with a logo, and details of the credit company.

Download demo version

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

USU Software takes care of the security of the information entered. Access control is provided when the management can independently set the framework for each user, especially since each of them has a personal account. An employee's account can be logged in only after entering identification parameters - login, password. The accounting system helps employees to be responsible for their area of responsibility, and the management receives an overall picture of loans, credits, expenses, and profits, to due reporting. For reports, there is a separate section of the same name, which includes all the variety of tools used in analytical work and statistics. As a result of the analysis, the leading link of the organization will receive a whole set of reports, including the accounting of expenses on loans and credits. The shape can be chosen based on the goal: table, chart, or graph.

Installation, implementation, and configuration of the expense accounting application are carried out remotely by our specialists, which allows us to work with any company, regardless of the territorial location. The software menu can be translated into any language, as well as select the main and additional currencies, by which the information on the loan or credit is displayed. The entire organization of accounting of expenses on loans and credits depends on a competent approach, which means that business owners will be able to make only well-thought-out decisions and analyse the productivity of using the received finances!

Order an accounting of expenses on loans and credits

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Accounting of expenses on loans and credits

The software establishes accounting information on the loans available at the enterprise, fixing the amount, interest rate and its type, commissions, repayment periods within the base. It preserves the previous credit history and adjusts the new conditions if any. Interest in the structure of the organization's documents is divided into columns depending on the direction of their use, changes in the time interval, the volume of the principal debt, and the refinancing rate. Part of the accrued interest is included in the amount of investment assets. These processes are carried out automatically. In automatic mode, you can adjust the mechanism of recalculating interest, penalties, and commissions.

The accounting of expenses and credits application provides a uniform procedure of displaying the opening balances for the primary cost estimate of each reporting period. Registration of data based on the company's internal policy and loan agreements, considering the terms of debt repayment, accrued interest, and commissions. The creation of a common information space between all departments, employees, divisions helps to quickly exchange information. The software platform automatically analyses contractual obligations. The accounting organization will become much easier than using outdated methods.

In addition to remote installation and implementation, our experts have provided a short training course for each user, which is quite enough, given the simple interface. By purchasing a license of the software configuration of the USU Software, you will receive two hours of maintenance or training, to choose from. The application automatically generates the necessary documentation on the company's expenses, loans, contracts, orders, acts, and others. User accounts are not only limited when logging in but are also assigned to roles based on the job title. The software is completely undemanding to computer support, you do not need to bear the cost of new equipment. Active work in the program will begin from the first day after implementation, while the process itself runs organically, without disrupting the company's working rhythm. In order to study the basic functions of the USU Software in practice, we recommend that you download the free demo version. The link to it is located a little lower on the current page.