Operating system: Windows, Android, macOS

Group of programs: Business automation

Accounting of funds in credit institutions

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

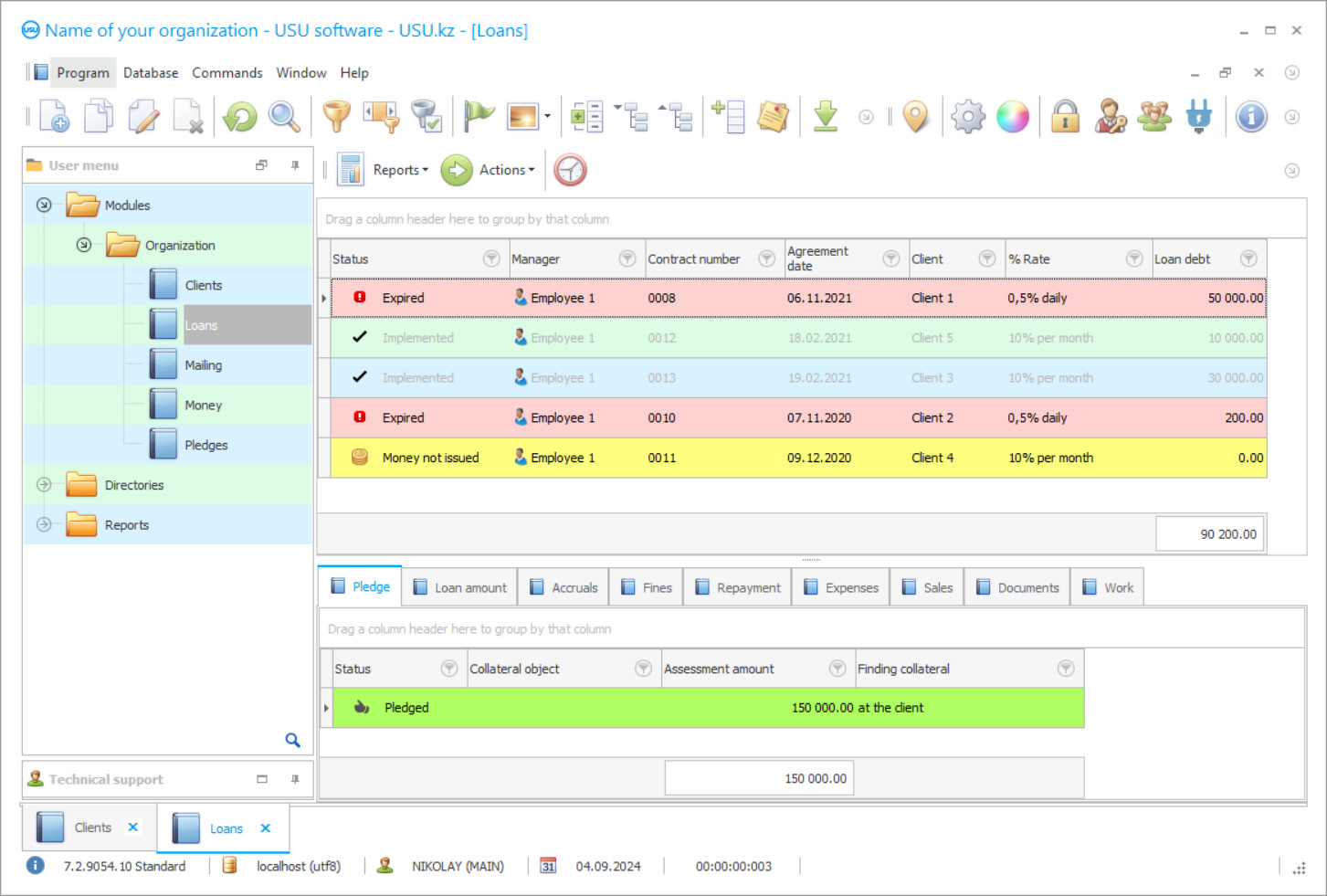

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

Program screenshot

Automation trends are more and more noticeable in the field of MFIs, where industry representatives need to work efficiently with regulated documents, build clear and understandable mechanisms of interaction with clients, and receive fresh analytical calculations on current processes. Digital accounting of funds in credit institutions is based on multifunctional information support, where you can get comprehensive information on any accounting position, automatically prepare accounting reports, transfer data to higher authorities or management.

Several functional projects have been developed on the website of the USU Software to ensure standards of the banking environment and microfinance, including the accounting of funds in credit institutions. The software is characterized by reliability, efficiency, and a wide range of tools. The project is not considered difficult. For ordinary users, a couple of practical sessions are enough to fully learn how to manage monetary assets and loans, operational accounting and regulatory documents, and work productively on organizing a dialogue with borrowers.

Who is the developer?

2024-04-19

Video of accounting of funds in credit institutions

This video can be viewed with subtitles in your own language.

It is no secret that cash loves an account. Each of the microfinance institutions understands this. The accounting application of funds completely takes over automatic calculations in order to most accurately regulate credit transactions, calculate interest, and schedule payment terms step by step. As far as accounting documentation is concerned, it is difficult to find an analogue of the software support offered by us. All templates are organized and catalogued, including acts of acceptance and transfer of pledge, loan agreements, cash orders, and funds. All that remains is to choose a template. Files are easy to print or send by mail.

Do not forget that the accounting of funds program tries to take control of the key communication channels of the credit institution with its customers - voice messages, Viber, SMS, and e-mail. It is not difficult for users to master the targeted mailing technique, sort and group information by the borrower. In general, it is much easier to manage not only accounting documents but also funds. A set of measures with debtors is envisaged. The system will promptly notify the borrower about the need to repay the debt, automatically charge a penalty, and apply other penalties.

Download demo version

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

Built-in accounting of the exchange rate allows you to quickly check your indicators with the data of the National Bank, make changes to the registers of the program and accounting documents. This is extremely important when funds are issued at the current exchange rate. As a result, financial losses can be avoided. The use of the configuration largely determines the quality of credit operations, the general level of management, when it is possible to consider every aspect of credit institution, improve the performance of personnel, substantively work with loans and collateral, and study the latest analytical reports on the funds.

It is not surprising that credit institutions are striving to make the most of cross-functional automation projects. With their help, you can effectively manage money, work on documentation and operational accounting. At the same time, it is worth mentioning separately the quality of work with the client base, where many tools have been implemented to increase the reputation of the structure, attract new customers, share advertising information, contact debtors, and seek opportunities to receive loan payments.

Order an accounting of funds in credit institutions

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Accounting of funds in credit institutions

The software assistant monitors the key parameters of managing the credit institution’s structure, regulates the flow of funds, and is engaged in documenting loan, and loan transactions. Individual accounting characteristics can be configured independently in order to comfortably interact with customers, manage accounting categories, and evaluate staff performance. On any of the credit processes, it is easy to raise exhaustive arrays of analytical information. The maintenance of digital archives is provided.

The credit institution will be able to take control of the main communication channels with borrowers: voice messages, SMS, Viber, and e-mail. Users will not have a problem in mastering the parameters of targeted mailing. The funds accounting application completely takes over automatic calculations when it is necessary to calculate the interest on loans or schedule payments in detail for a certain period. No transaction will be left unaccounted for. Cash flows are strictly regulated by software intelligence. The system conducts online monitoring of the National Bank's exchange rate in order to instantly reflect changes in the program registers and regulatory documents. As a result, the structure does not lose financial resources.

A complete package of accompanying documents is collected for each loan operation of the credit institution. If some files are missing, then the user will notice it first. The option of synchronizing the work of the software with payment terminals is not excluded in order to improve the quality of service and expand the audience. Regulated accounting forms, acts of acceptance and transfer of pledge, contracts, and templates, accounting orders are pre-entered into digital registers. All that remains is to choose the correct format of the document. If the flow of funds decreases, there is a negative trend in the client base, there are other shortcomings, then the software intelligence tries to notify about this.

In general, working on credit relations will become easier when each step is monitored by a specialized accounting program. The system tries to work with debtors as efficiently as possible and seeks to collect cash payments according to the letter of the agreement. Penalty interest is calculated automatically. The release of a unique turnkey project determines the opportunity to introduce some innovations - to change the design to your taste, add additional extensions and options. It is worth trying out the product in practice. Download the demo version from our website.