Operating system: Windows, Android, macOS

Group of programs: Business automation

Accounting of granted loans

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

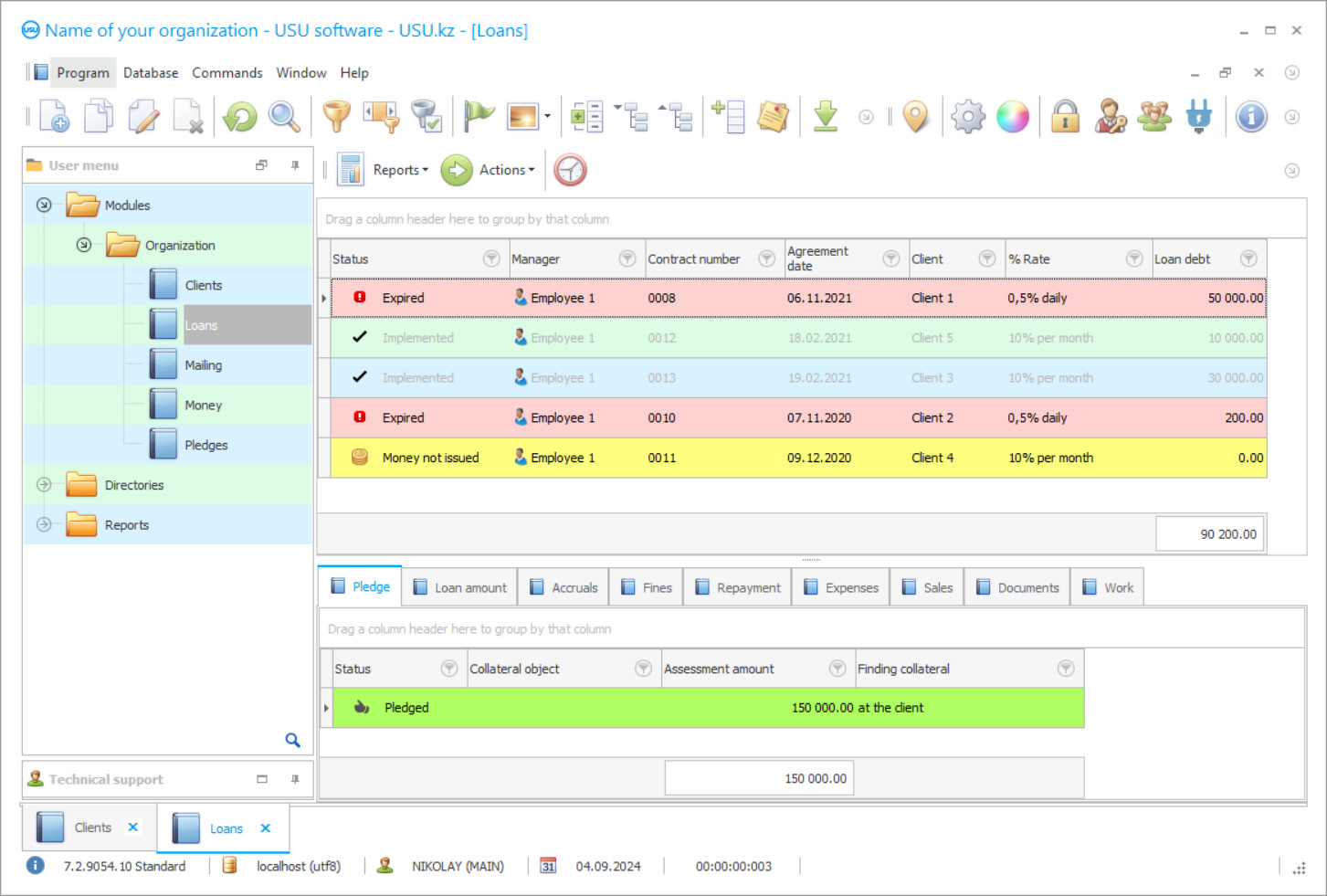

Program screenshot

The accounting of granted loans in the USU Software is in the formed base of loans, which lists all provided loans and indicates the conditions for their provision, including terms of provision, payment schedule, interest rates, and displays all actions on loans granted that were performed in the past, at the current time, and further. Accounting of granted loans can be kept even visually using this database since all granted loans have been assigned their own status and colour, which together characterize its current state - whether the maturity dates have been violated, if so, is there a penalty for late payment, and other implications.

An employee can visually keep a record of the status of loans granted, without spending a lot of time to get acquainted with the information on the accounting of granted loans, which, in fact, is performed automatically, and its results are visualized in status and colour to it. If the client made the payment on time, the status of the loan granted will inform that the conditions of the provision are fully met here. If there is a delay in payment, the status indicates a violation of the repayment period and, therefore, the provision of the loan, the delay is followed by the accrual of a penalty, which will display the next status of the loan provided in the database of loans.

The accounting of granted loans is organized in a similar way if the bank uses the automation program, which independently keeps records of loans provided. The procedure of granting borrowed funds by the bank includes several stages from the moment when the application is received, which will be consistently displayed in this loan database since the bank registers all loan applications in it, including those that are still pending and provided loans. At the same time, several different services are related to the provision process, including credit, legal, and others, although such a long approval procedure is characteristic only of the traditional provision format. Automation gives its solution within a second since its processing speed of any amount of information is the fractions of a second.

Who is the developer?

2024-04-18

Video of accounting of granted loans

This video can be viewed with subtitles in your own language.

In any case, the credit department in the bank or the accounting system, all evaluate the evidence of their solvency provided by the client so that their decision to grant a loan is justified. When a positive decision is made on the provision of a loan by the bank, the accounting department is informed about the opening of accounts for the client, and a loan agreement is formed with the corresponding annexes to it, including a payment schedule. It should be noted that during automation, internal interaction between services is supported by a notification system that allows employees to exchange instant pop-up messages, including on the topic of granted loans.

In the bank, the provision of a loan is made by transferring a non-cash amount to a current account opened for the client if the client is a legal entity. If an individual, the bank can issue the granted loan either by bank transfer or in cash at the cash desk. In any case, the bank accounts are being opened, the documentation accompanying the loan is being formed. The accounting system compiles all the necessary documents automatically as their list and forms are pre-inserted into the automated accounting system. The client's details added by the bank employee are inserted into the required fields and are automatically transferred to the document body.

All information about the client and finished documents are reliably stored by the accounting system in several prepared databases, including the client base presented in CRM format, to which, by the way, you can attach any documents and photographs of the client captured from the webcam mentioned above the base of loans for the accounting of granted loans and control over them, in the electronic registers of the bank, which are also compiled by an automated accounting system.

Download demo version

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

The accounting system maintains the entire document flow in the bank, while its functions include both the registration of documents with continuous numbering and the current date, as well as the distribution of finished documentation, according to the purpose and archives with the appropriate heading, control over the return of copies signed by the second party. Moreover, the accounting system easily differentiates copies and originals of the documents provided. It should be added that the automated accounting system prepares absolutely all documents, including accounting reports of counterparties, mandatory reporting for the regulator, and other current documentation - both in electronic form and in printed format if the provision involves paper media. The requirements for such documents are all met - a regulatory framework is built into the accounting system, which regularly monitors industry changes. This allows us to assert that the format of documents and their information is always up to date since this database contains, in addition to provisions and resolutions on the bank's activities, recommendations on the accounting of loans, and calculation methods, including the accrual of penalties.

The program provides an opportunity to plan work with each client, regularly reminding about the deadlines, records calls, e-mails, mailings, meetings. When making a request, it is easy to display the entire history of interaction with each client from the moment of the registration in CRM, which allows you to evaluate the history of relations, and draw up a portrait of the client. The granted loan database contains a similar history of financial transactions of each loan. It can also be shown with a display of each action by date and purpose.

All databases formed in the program have the same structure of placing information and the same tools to manage it. The unification of electronic forms speeds up the work of users, minimizes the time spent on performing various procedures, which leads to an increase in employee productivity. There is only one way of personification in the program against unification - personal design of the workplace by choice from more than 50 design options. The presentation of information in databases consists of two sectors: in the upper half - a general list of items, in the lower half - a panel of tabs with a detailed description of their parameters.

Order an accounting of granted loans

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Accounting of granted loans

The program independently conducts all calculations, including the calculation of payments for repayment of a loan, considering the interest rate, the calculation of piecework wages, commissions, and penalties. The calculation of piecework wages to users is according to the volume of work that is registered in their electronic work forms, so work outside the system is not paid. This rule encourages users to increase their activity, which contributes to the timely data entry and, accordingly, the operational display of processes. The accounting of the granted loans program keeps a continuous statistical record of all performance indicators, which allows to ensure effective planning of future activities and forecasting the results. Based on statistical accounting, automatic analysis of the institution's activities is carried out, which makes it possible to improve the quality of interaction with borrowers, to increase its profits.

Regular performance analysis, provided at the end of each reporting period, includes an assessment of employees, borrowers, loan portfolio, and financial performance. The provided analytical reports have a convenient format with full visualization of the significance of each indicator in the formation of profit, showing the dynamics of changes. Integration of the program with modern equipment improves the quality of customer service, accelerates warehouse operations, including the search and release of goods, inventory.