Operating system: Windows, Android, macOS

Group of programs: Business automation

Accounting of loan costs

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

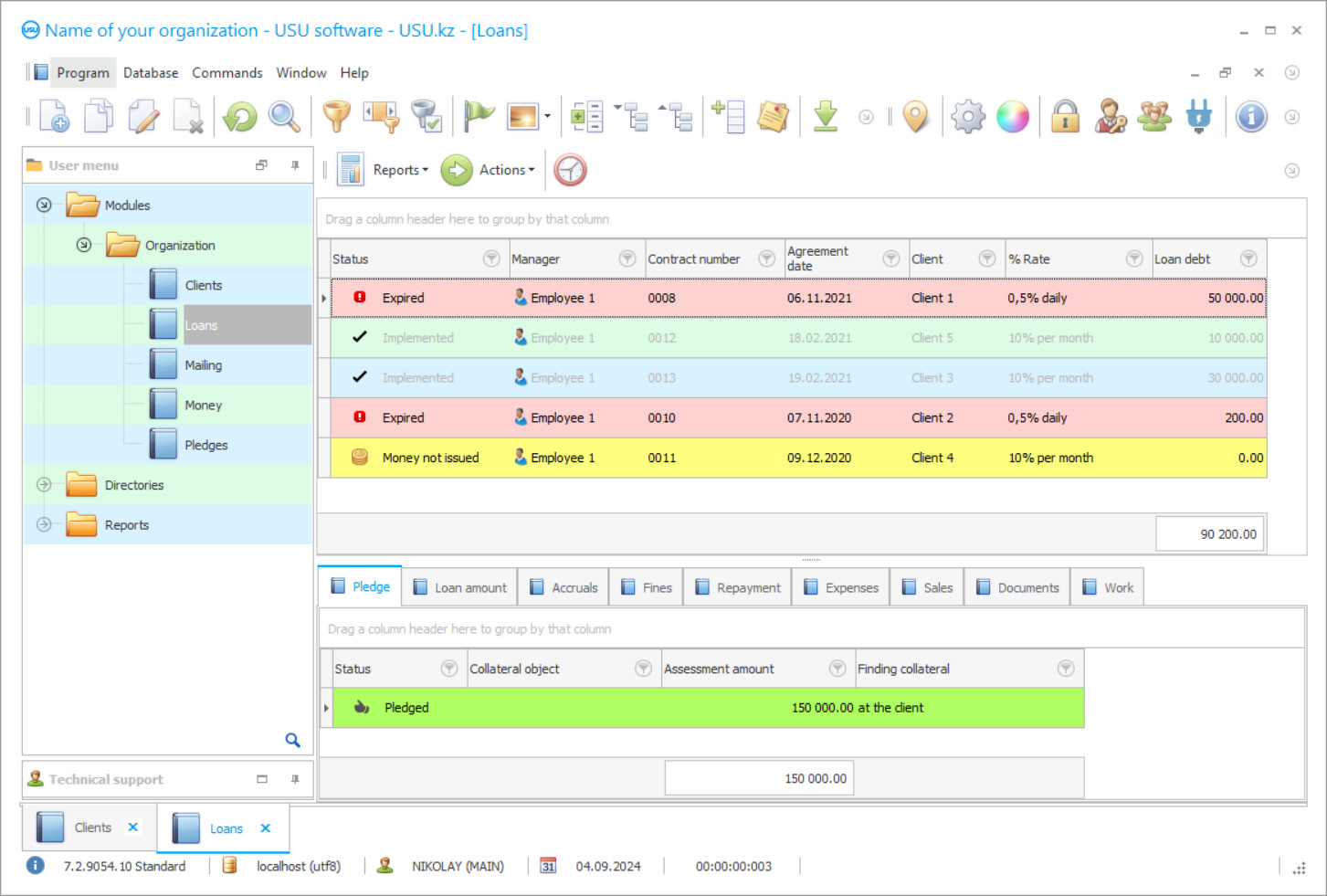

Program screenshot

The current pace of market relations dictates the need to independently resolve the issue of monetary resources, to correctly calculate direct income, dividends from the sale of securities, contributions from shareholders, loan costs, and other forms of receipt of funds, not in contravention of the legislation. But at the same time, it is not reasonable in times of a dynamically developing business environment to form financial assets using only the company's available budget, reserve channels, a certain goal setting of funds, often, in order to go one step faster than competitors, it is required to attract borrowed resources by contacting banks or MFIs. If you correctly keep track of the costs of the loan within the company, then this method is a profitable measure since the profit from the development of production that the company will receive covers the loan cost and interest, but at the same time, you will not waste time looking for your own cash sources. A thorough display of accounting data in all kinds of documents, accurate and constant control of spending help to understand the current situation on borrowed loans, but this process is quite laborious and not always effective if carried out by means of a staff of specialists because no one is immune from errors due to the human factor.

Therefore, understanding the problematic nature of tax and accounting of loan costs and credits, their servicing at a company, and the complexity of calculating interest, it is more logical to switch to the automation mode by resorting to the introduction of computer programs. Specialized applications reduce the cost of obtaining and using loans, including interest on the principal amount. Modern technologies are able not only to carry out simple calculations but also to consider the additional costs associated with the release and use of obligations obtained during the conclusion of a loan agreement. In the case of foreign currency loans, such software calculates the exchange rate difference, based on data from the central bank on the date of payment, which also simplifies the work of staff. As for the distribution of data according to the required acts and in the specified periods, this moment can also be entrusted to the accounting program. Our USU Software does not only easily cope with the above points but also undertake full accounting of loan costs, in compliance with the conditions laid down at the conclusion of the agreement, on-time accruing, and paying off the debt and interest rate.

Who is the developer?

2024-04-20

Video of accounting of loan costs

This video can be viewed with subtitles in your own language.

The application will become a unique assistant in the accounting of loan costs and department. When the debt is repaid on time, all data is automatically posted to the documentation, indicating that the payment was urgent. If there is a delay, the software indicates that this payment was overdue, and accounting is kept under these indicators until the fact of repayment, with the due penalty interest set in the contract. The program helps to keep an accounting of the company's expenses, forming reliable information on current activities. It is up-to-date information that helps prevent negative moments that may arise if you do not pay attention to the negative dynamics of one of the activities. Automation contributes to the determination of reserves of provision, which will subsequently make it possible to have a stable financial position of the organization. When developing USU Software, we consider the laws of the country where it will be used, customizing templates and calculation algorithms based on them. As a result of the implementation of the system, you will receive full control over the availability, movement of financial flows, and master effective tools of accounting of loan costs.

The software, considering its capabilities, provides information on all the debts of the enterprise, dividing them depending on the availability of interest, a differentiated or annuity calculation formula. If the company is ready to close the loan ahead of schedule, then this is reflected in the accounting entry with the recalculation of payments and terms. Even though almost all operations in the application are carried out automatically, at any time you can perform them manually or adjust existing algorithms, which can be useful in case of changes in rules and regulations. And the reminder function, beloved by our clients, is indispensable not only for the accounting department but also for other employees who will carry out their work using the configuration of accounting of loan costs. This option always reminds you of an upcoming event, unfinished business, or the need to make an important call.

Download demo version

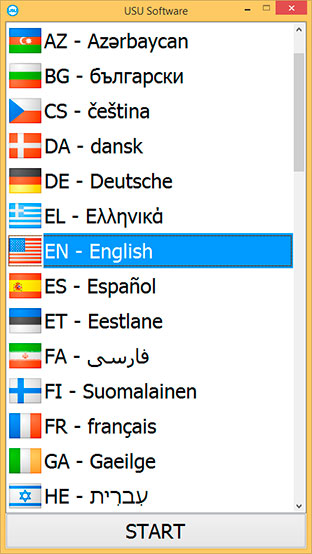

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

It is important to understand that the rational distribution of volumes by available assets and expenses among personal and borrowed funds is a significant indicator by which one can judge the financial stability of an organization. It is the transition to automation and the use of the USU Software that will allow keeping records of debts, which ultimately increases the status of the company of partners and credit companies that can issue loans with greater confidence in their timely return. Do not postpone the purchase of accounting software of loan costs for a long time as while you think competitors are already taking advantage of modern technologies!

USU Software provides an opportunity to conduct automatic control of loans, plan payments, and monitor the movement of financial resources. To ensure a competent accounting of loan costs, preservation and analysis of the history of payments made is carried out. Automatic calculation of interest on loans based on the number of days between transactions. At any time, the user can receive information on the accrued interest on the day the debt is paid. The software of loan costs keeps track of expenses and delays in credit payments made. In the reporting generated by the accounting application, management will be able to see the full amount of payments, the already closed interest rate, the lead level, and the ending balance.

Order an accounting of loan costs

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Accounting of loan costs

Costing in the system is configured both for the annuity form and for the differentiated payment scheme. If it is more rational to use fractional calculation in the company's policy, then the software platform forms a schedule with equal amounts of payments. The costs and revenues of the enterprise are fully controlled by the accounting of loan costs. The simple interface format contributes to easy learning and the transition to the automation mode for all users, so the accounting will become many times easier and more accurate.

Each employee is given a login, password, and role to log into their account. Management imposes limits and restrictions on access to certain information, which depends on the position. The application will prove to be indispensable for firms that need to control the costs of borrowed funds used to purchase or build investment assets. It organizes a full-fledged document flow, filling out forms, acts, contracts, reporting in almost automatic mode so employees only need to enter the primary data. Templates and patterns can be adjusted and customized depending on the purpose. Creating archives and backups helps to preserve the database in case of breakdowns in computer equipment. Forms of accounting documents are drawn up with the details and logo of the organization. Our specialists will undertake installation, implementation, and technical support during the entire period of operation. In order to get acquainted with other functions and capabilities of the system, we recommend that you read the presentation or download a test version of the accounting program of loan costs!