Operating system: Windows, Android, macOS

Group of programs: Business automation

Accounting of long-term loans

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

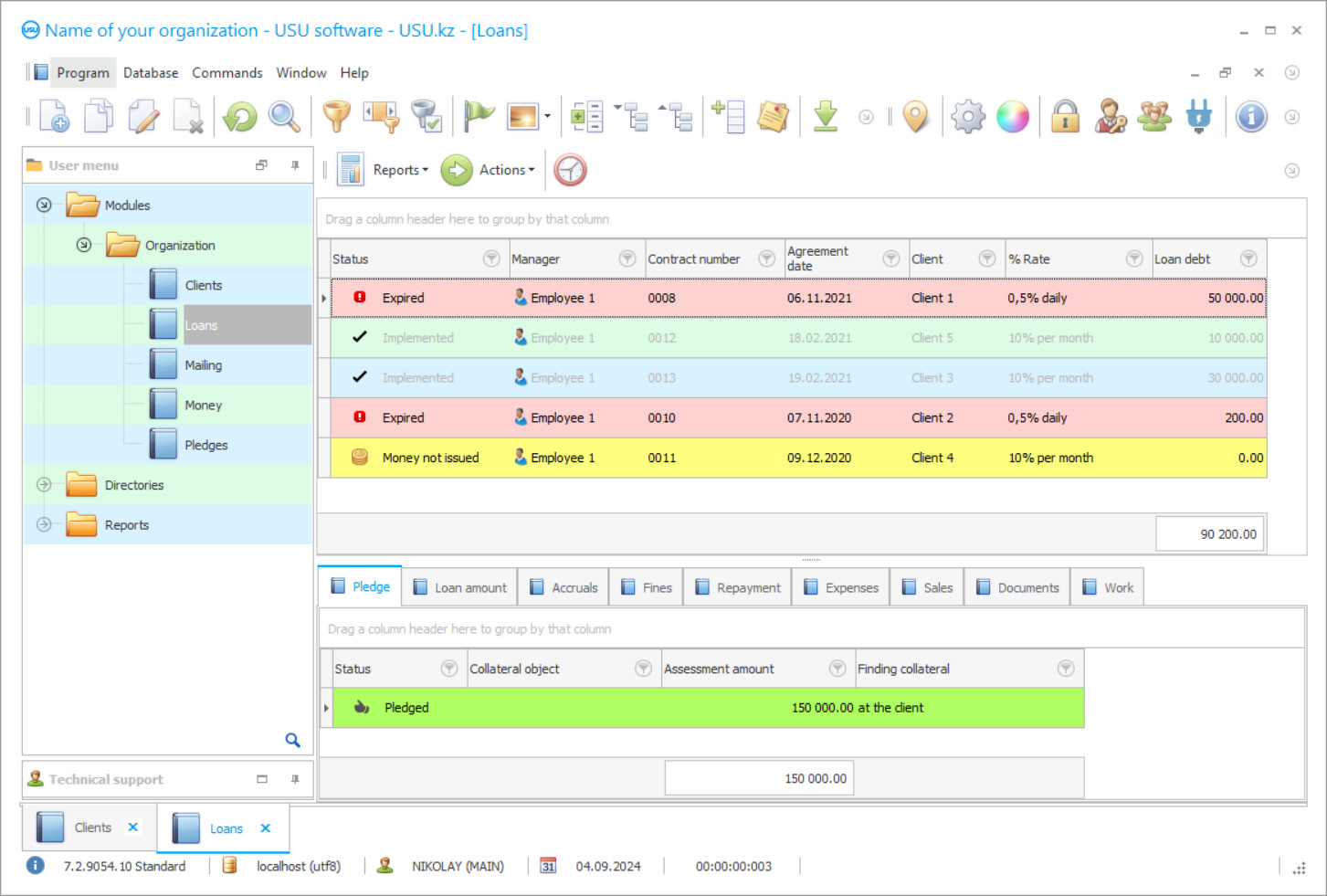

Program screenshot

Long-term loans are accounted for in the USU Software according to the generally accepted accounting rules posted in the industry reference database along with other provisions and regulations on long-term lending to individuals and legal entities. The presence of such a base allows to ensure an automatic accounting in full compliance with the established norms and the recommendations given in it when the configuration of accounting of a long-term loan independently determines whether there are any deviations from the procedure of distributing funds established in the accounting. The presence of such a base allows us to normalize the activities of personnel following approved quality standards and automatically charge them a piece-rate monthly remuneration, considering the volume of performance, which is recorded in electronic forms of users.

Accounting of their activities is the only responsibility of personnel in the configuration of long-term loan accounting and enables them, using this information, to correctly describe the current state of work processes in the institution. If something was not noted in the user's log, being completed, then it is no longer subject to payment, therefore, each employee is interested in promptly entering of readings as soon as the work is ready, providing the program with a stable flow of primary and current information. Long-term loan accounting configuration helps management make the right decisions by providing the necessary information, objectively assessing the real situation before making changes to the workflow. At the same time, control over the current situation can be carried out remotely if there is an Internet connection. The program visualizes all indicators, shows deadlines and performers, so it is not difficult to form an opinion about the work of each employee.

Who is the developer?

2024-04-19

Video of accounting of long-term loans

This video can be viewed with subtitles in your own language.

The configuration of accounting of a long-term loan introduces two approaches to organizing work. This is the unification of the workspace, including electronic forms, information management tools, entry rules and the principle of data placement, and the personification of the information space, when it is known who owns a particular value, who performed that or another operation when issuing a long-term loan to a client. In short, all tools are unified, while information, on the contrary, is personalized. It is convenient as it is easy to work in the program since its mastering comes down to memorizing several simple algorithms, so everyone has time to do everything necessary within the framework of their duties, regardless of the existing computer skills, and the control apparatus is always aware of who did what and what is doing now.

The configuration of accounting of a long-term loan offers users to plan their activities, which allows the management staff to know about the current employment of personnel, monitor the timing and quality of execution, be able to evaluate the effectiveness of each user, including the difference between the actual volume of execution and the planned one. The configuration of accounting of a long-term loan forms several databases for the convenient work of personnel, which, due to unification, are the same, and establishes control over long-term loans, employees who supervise them, customers directly related to long-term loans, and customers who want to get a long-term loan.

Download demo version

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

To account for a long-term loan, a loan base has been formed, for a customer account - a client base in CRM format. The first lists all applications of long-term loans, including those already completed or refused. To separate them, statuses are provided that show the current state of applications at the present time. A colour is attached to the statuses, by which you can visually determine the status of an application without detailing the content. This is also convenient because it saves time on monitoring the position of long-term loans and requires intervention only when problem areas arise, about which the automated accounting system will notify, using red to colour the application that has ceased to meet the established order of execution, which happens when the payment deadline is not met.

CRM contains all clients - former, existing, potential. They are also divided into categories according to their qualities, which allows you to form point proposals of individual target groups and, thereby, increase the effectiveness of contacts due to their scale. In this database, over time, the ‘personal files’ of all borrowers are formed, which contains their personal data and contacts, the history of relations by the chronology of calls, including e-mails and mailing texts. To ‘personal affairs’ photographs of clients, taken by a web camera, concluded contracts, and payment schedules are attached. If a client has a debt and is marked in red in the loan database, it is highlighted in red in CRM too as information between databases has internal subordination, which allows you to identify inaccuracies and false information when entered the accounting system. The configuration of accounting of a long-term loan guarantees the reliability of the data placed in it and excludes the facts of postscripts.

Order an accounting of long-term loans

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Accounting of long-term loans

The program automatically informs the borrower about the imminent payment date and non-compliance with its term, and, if this happens, the accrual of a penalty that will be added to the debt. Penalty interest is calculated automatically. The program has a built-in calculator that calculates according to the officially approved formula, which is indicated in the reference base. The accounting of the long-term loans program performs all calculations automatically, including the calculation of payments considering the crediting period and rate, the calculation of the cost of the loan, and the profit from it. In addition to calculations, reporting and current documentation are automatically drawn up, it is distinguished by the absence of errors, exact compliance with the format, and mandatory readiness on time.

At the end of the period, automatic analysis of the institution's activities is performed for all types of work, including an analysis of the profitability of long-term loans and the demand for them. Informing clients is carried out using electronic communication, which has the form of Viber, SMS, e-mail, voice announcements, by contacts in CRM that were provided. The duty of electronic communication also includes advertising and information mailing in any format - selective or personal. There is a set of ready-made text templates to ensure it. The list of subscribers is formed automatically, considering the specified selection criteria, the sending itself goes directly from the CRM, then a report is prepared with an assessment of efficiency. The program measures the effectiveness of any work by the profit received, in relation to mailings - received from new clients or due to an increase in the loan of existing ones.

A marketing code is formed for the mailing report, which evaluates the effectiveness of marketing platforms of promoting services - by the difference between costs and profits. At the end of the period, an employee performance rating is compiled based on the amount of work recorded in the system, the time spent on them, and each profit earned. All reports, analytical and statistical, have an easy-to-read form - these are tables, graphs, diagrams with visualization of the participation of indicators in making a profit. The accounting of the long-term loans program integrates with electronic equipment, which radically changes the format of many operations, improves the quality of customer service, and speeds up work. The cashier uses a fiscal registrar, a receipt printer, a barcode scanner to read it on a cash order, in the hall, electronic displays notify the client about the queue number. The program offers an automated cashier's place, notifies about cash balances in each cash register and in bank accounts, allows you to set video control over all cash desks.