Operating system: Windows, Android, macOS

Group of programs: Business automation

Accounting of microfinance

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

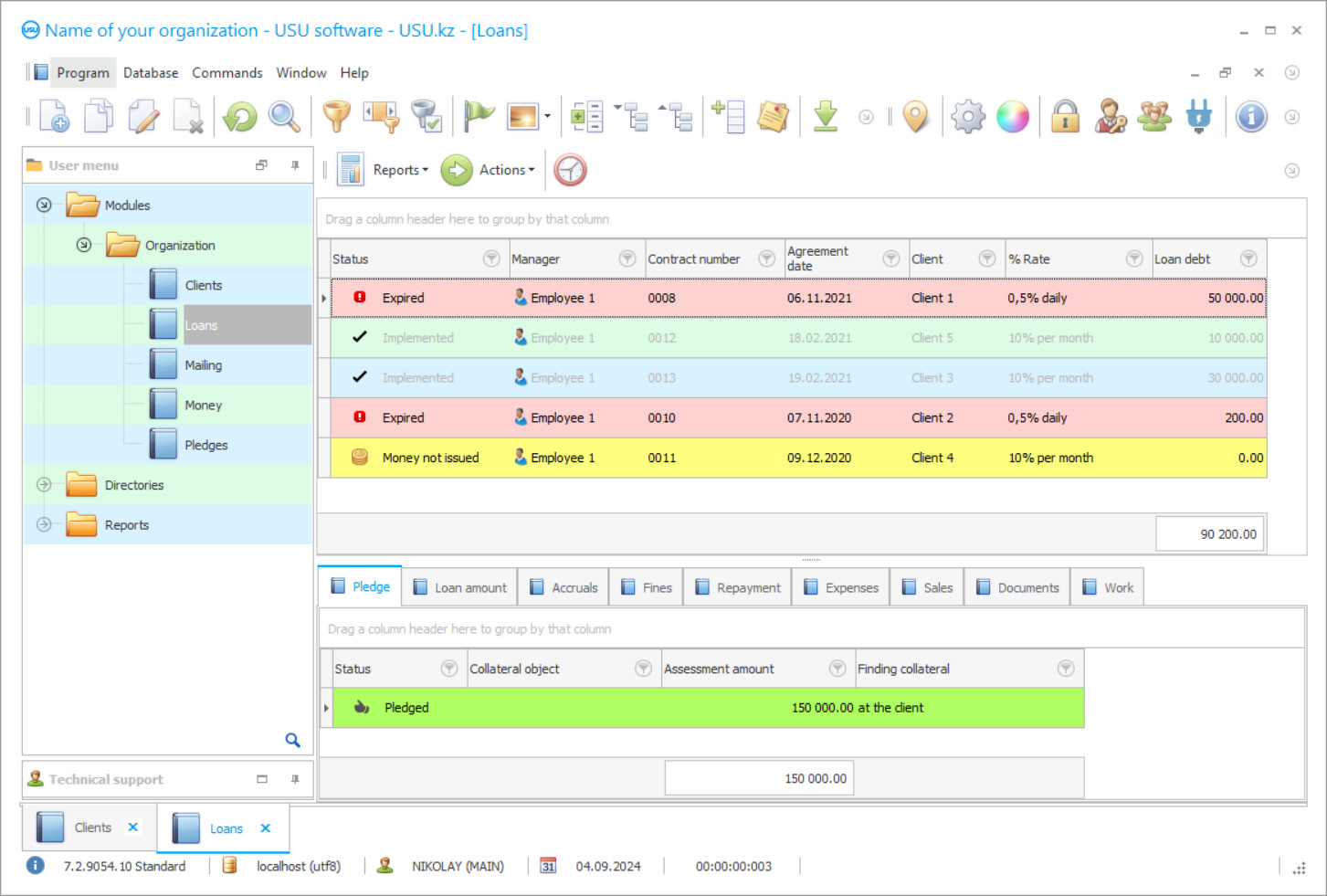

Program screenshot

Modern microfinance companies prefer to use the latest developments in the field of automation in order to quickly put in order the regulatory workflow, correctly allocate resources, and build clear mechanisms for relationships with the client base. Digital accounting of microfinance is designed to streamline the internal processes of loan management and a financial organization, to establish an operational flow of analytics, and to provide access to information support. At the same time, the control parameters are easy to customize on an individual basis.

On the website of the USU Software, the internal control of microfinance is presented by several software solutions at once, which were initially developed with an eye to the operating environment, industry standards, and regulations. The project is not considered difficult. For ordinary users, a couple of full-fledged practical sessions are enough to thoroughly understand digital accounting, learn how to prepare supporting documents, manage microfinance rationally, and contact borrowers.

Who is the developer?

2024-04-18

Video of accounting of microfinance

This video can be viewed with subtitles in your own language.

It is no secret that successful microfinance largely relies on the accuracy and correctness of program calculations when you can quickly calculate interest on loan agreements or split payments over a given period. The quality of the computations of the digital accounting system is beyond doubt. It will become easier to work with outgoing and internal documents. The control program contains all the necessary templates, including accounting sheets, acts of acceptance and transfer of pledge, sample contracts, cash orders, and other arrays of regulated documentation.

Keep in mind that the microfinance structure will be able to take control of key communication channels with clients, including e-mail, voice messages, Viber, and SMS. The choice of the appropriate communication method remains the prerogative of the microfinance organization. Among the tools for dialogue with debtors is the method of prompt information notifications about the formation of debt, but also the automatic application of penalties, the accrual of penalties and fines according to the letter of the loan agreement. Also, the configuration regulates internal relationships with staff.

Download demo version

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

Programmatic control of the current exchange allows you to instantly display the latest exchange rate changes in the internal electronic registers of the accounting system and even regulations of the microfinance structure. If the credits are linked to the current rate, then the function becomes key. As a result, the change in dynamics, fluctuations in the foreign exchange market will not result in financial losses. As for the processes of loan repayment, addition and recalculation, they are also under the supervision of an automated assistant. Moreover, each of these processes is displayed extremely informatively.

In the microfinance industry, many companies prefer to have automated controls at their fingertips that align quite well with optimization trends. With the help of the accounting program, you can organize outgoing and internal documents, establish the flow of analytics, and organize the work of personnel. At the same time, the most important element should be recognized as a high-quality dialogue with borrowers, which allows attracting new customers, advertising services, improving the quality of service, effectively influencing debtors, working for the future, and achieving the goals and indicators.

Order an accounting of microfinance

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Accounting of microfinance

The software support tracks key microfinance levels, handles documentation, collects up-to-date analytics on current loans and borrowings. It independently adjusts the control parameters in order to comfortably work with the information base, monitor the performance of personnel. For each of the credit transactions, you can request a comprehensive amount of statistical or analytical information. Internal documents are strictly ordered, including templates of accounting documents, cash orders, acts of acceptance and transfer of pledge, contracts, and other arrays.

Control over external communication channels applies to sending by e-mail, voice messages, Viber, and SMS. They can be used to inform customers in a timely manner. Completed microfinance operations can be easily transferred to a digital archive so that you can access statistics at any time. The detailed internal analysis takes seconds. At the same time, the monitoring results are available in a visual form, which reduces the time of processing of accounting data and making management decisions. Calculations are fully automated. Users will not have a problem calculating interest on loans or breaking down payments in detail for a certain period.

On request, it is proposed to acquire functional extensions of the accounting program that are not represented in the basic spectrum. Control over the current exchange rate allows you to instantly display the latest exchange rate changes in digital registers and regulations of the microfinance organization. If the current microfinance indicators do not meet the plans of the management, there has been an outflow of financial profit, then software intelligence will rush to notify about this. In general, it is now easier to work on credit transactions when each step is regulated by an automated accounting system. The internal processes of loan repayment, addition, and recalculation are also controlled by the application. Moreover, each of the named processes is presented in maximum detail. The release of a unique turnkey project requires additional investment, which implies changes in functional equipment and design. For a trial period, you should try the demo version. It is available for free.