Operating system: Windows, Android, macOS

Group of programs: Business automation

Accounting of payments on loans

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

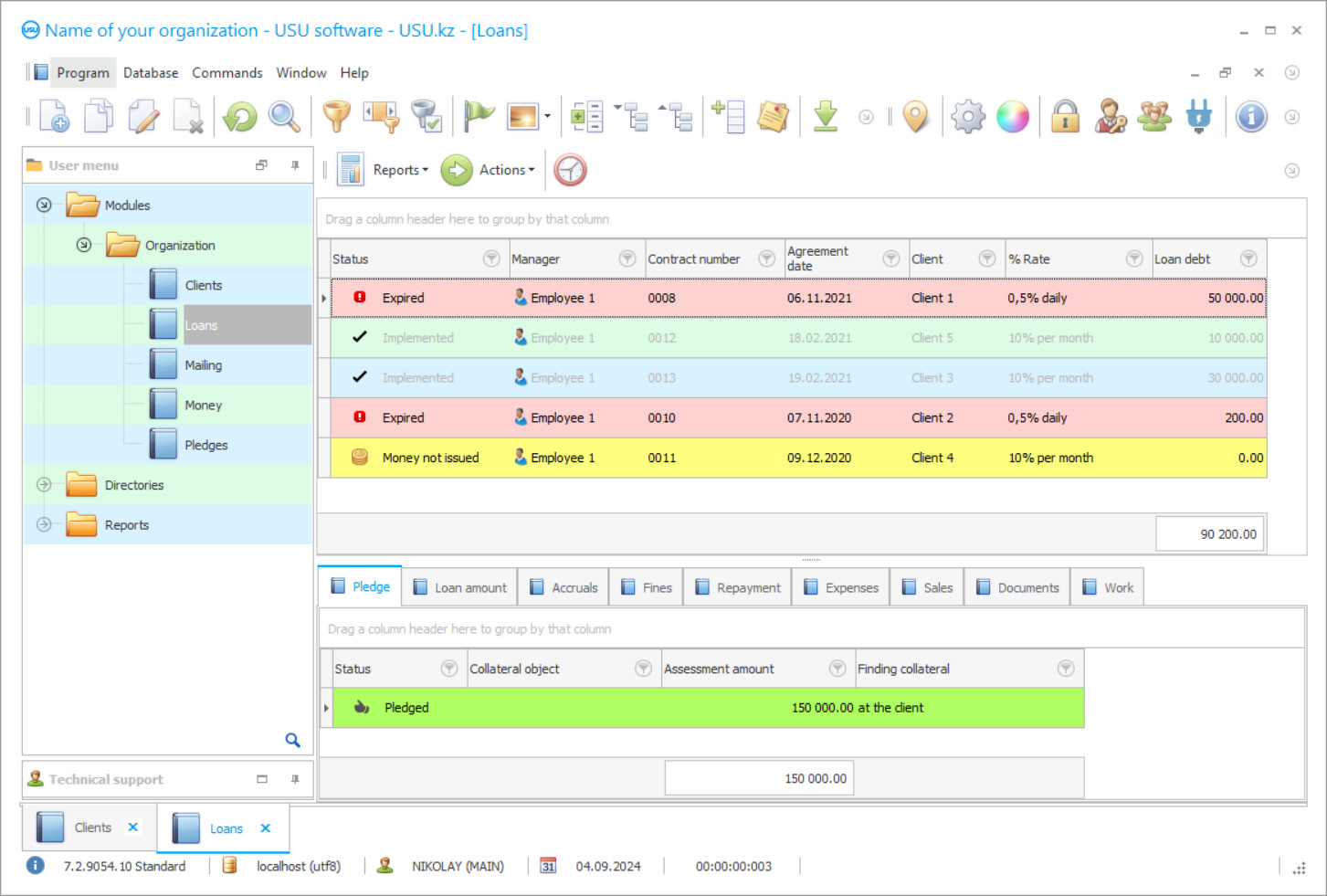

Program screenshot

In banks, MFIs, and other organizations, the main activity in which they are specialize is the issuance of loans. The provision of loans is becoming the main sphere of profit and allowing to finance investment and consumer projects of private individuals, legal entities, and state companies. Debt payments allow you to earn on the difference between the debt and the interest rate at which the loan was issued. The process itself is a mutual, mutually beneficial agreement, where the conditions, amount, interest, the method of its provision, and the deadline for completion are prescribed. But before agreeing to issue a loan, it is necessary to make sure of the client's solvency, and for this, it is important to have a unified verification mechanism, strict regulations for conducting internal operations, a debt collection procedure, an established control scheme based on the industry and the object of credit. An improperly thought-out structure can lead to bankruptcy since incorrectly assessed risks when preparing a decision to issue funds can affect many debts and non-payments, therefore, it is important to correctly keep track of loan payments and perform accounting.

After all the procedures of checking the creditworthiness are completed, the organization concludes an agreement with the borrower, which reflects the moments for which the money will be returned, the form of their transfer, and penalties in case of failure to return on time. But, since these processes require a lot of effort and carry a high degree of responsibility, it is much more rational to use modern information and software technologies that can take over the main preparatory and verification work. At the same time, doing business with the help of payment accounting programs is beneficial both for the companies themselves and for customers, as the quality of service and the speed of decision-making will improve. The automation of the lending industry will lead to the growth and development of business amid competition. The programs can analyse all areas, identifying the most profitable and promising ones, based on indicators and data entering their database. The implementation of the accounting program helps to establish the organization's policy, to expand or reduce investments in specific areas on time, based on demand parameters. On the Internet, there are many software solutions aimed at automating and keeping records of payments on loans in banks and MFIs, but we suggest you not waste time studying them, but immediately pay attention to the USU Software, which can fully cover aspects of the activity.

Our software platform is thought out in such a way that employees, departments, branches are involved in vigorous activity and they can fully interact with each other. It is the common information space that contributes to the creation of a common, well-coordinated mechanism, where everyone fulfils their duties with full dedication. Due to the well-thought-out structure of the USU Software, the issuance of loans and their payment will take place following the rules and regulations established in the organization's policy, reflecting the necessary information in the documentation, automatically transferring payment data to accounting entries and reports. In the system settings, you can differentiate the form of loans by the term of their issuance, dividing accounting according to their display difference in securities. Even though the application has wide functionality, it remains quite simple to learn, due to the user-friendly interface, which has been developed in such a way that the structure is intuitive. Employees will be able to accept clients much faster, consider applications, issue loans, control the receipt of payments, which means that they can perform much more actions in the same period than before. The well-established format of keeping records of payments on loans using the USU Software helps the management to make timely decisions in the field of accounting.

Who is the developer?

2024-04-19

Video of accounting of payments on loans

This video can be viewed with subtitles in your own language.

The service of our software provides the ability to organize accounting for several branches simultaneously, without limiting the number of users. To maintain the speed of loan operations and their payment, we have established a multi-user mode, which allows all employees to conduct high-quality activities at once, while there will be no conflict of saving documents. The accounting program creates conditions for comfortable work when considering the submitted applications, issuing an opinion, and support during the entire transaction. USU Software regulates the issues of late payments, notifying the user in time about the fact of non-payment of funds in time. The reminder function helps to plan a working day, always complete tasks on time. Among other things, the software controls the completeness of the documents provided by the borrower, monitors their validity period, stores scanned copies in the database, attaching them to the card of a particular client, which subsequently facilitates keeping records of the overall history of interaction.

Accounting automation of payments affects every stage of a possible deal, which allows us to guarantee the quality of the service provided to the client, and for the management, this factor will help control the efficiency and effectiveness of the business and make forecasts. Based on the data obtained and the generated reporting, it is much easier to develop a system of incentives for productive employees, raising their motivation for successful activities. The implementation of the USU Software helps not only to significantly reduce the bank's expenses but also improve the quality of accounting of loan payments and the level of service. Our system also unites the management of all business processes in a common structure!

The application automates the accounting scheme of information according to the accepted norms and laws on transactions, preparation of contracts, and other operations inherent in the issuance of a loan and payment. When developing software, we use an individual approach, considering the specifics of a particular company. Starting from installation, continuing with customization, we guarantee full technical and informational support during operation.

Download demo version

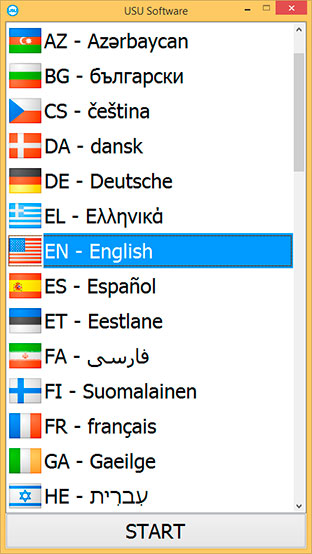

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

The automated USU Software is aimed at bringing to a unified order of processes to monitor credit transactions, regulating payments, creating conditions of full-fledged accounting. If there are many divisions, we will create a common network via the Internet, information from the branches will be fed into a single database, which facilitates the work of the management team.

Users are able to prepare loan plans themselves, make payment calculations, and make adjustments to schedules. The software automatically fills in contracts, applications, and other forms of documentation according to the templates available in the reference database. Accounting also implies the ability to use ready-made calculation algorithms or use a manual method.

Due to the import and export option, you can set up data input or output, while maintaining the existing structure. The accounting application is engaged in maintaining timely compliance with the schedule of repayment of loan, penalties, and others. If necessary, the employee will be able to promptly generate any certificate that the borrower may need. To ensure better differentiation of the status of the transaction, certain categories are highlighted in colour, so the user will be able to identify the problem loan in time. The user can log into the account only after entering the username and password. With prolonged inactivity in the account, an automatic blocking occurs.

Order an accounting of payments on loans

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Accounting of payments on loans

Archiving and creating a backup copy is a mandatory procedure, the frequency of which is configured on an individual basis. Each category of users has an established role, according to which access to information will be delimited. The software does not limit the number of attached files and documents inside the database. With the implementation of our system, you will forget about most of the routine tasks, the endless set of calculations, where inaccuracies often occurred due to the human factor.

If you download a free, demo version, then you can practically study the listed advantages and decide on a list of functions that will be useful for your business and facilitate payment on loans!