Operating system: Windows, Android, macOS

Group of programs: Business automation

Accounting of settlements on loans

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

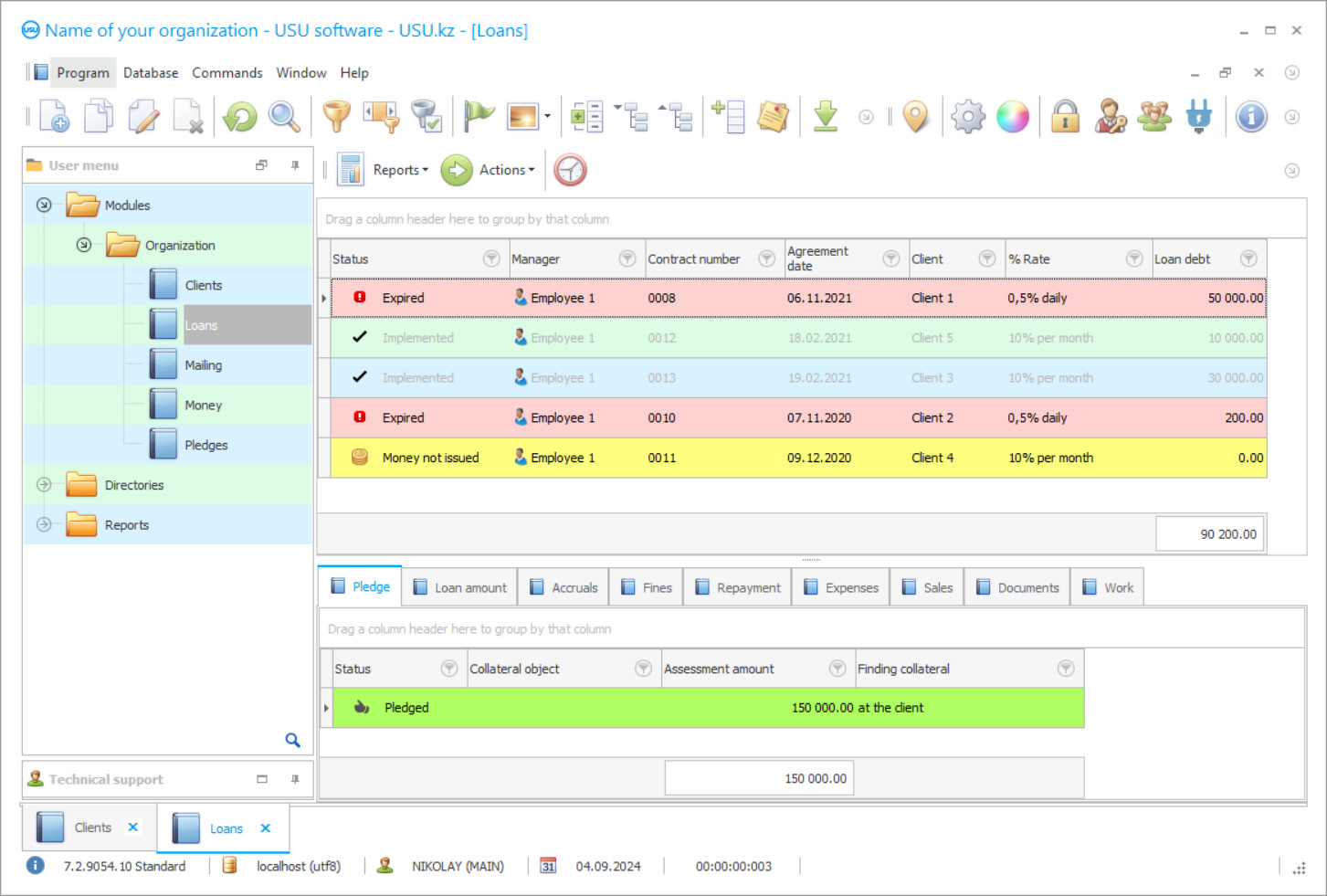

Program screenshot

For business owners, even with a successful business, it is periodically necessary to use borrowed funds in order to prevent downtime in the enterprise development cycle. There may be many reasons for this, including the expansion of production, the fulfilment of obligations to partners, the renewal of industrial equipment. The attraction of money from outside can be of a different nature, it can be loans with interest in banks and MFIs, loans from counterparties or private investors. But depending on the purpose and terms for which the funds are allocated, the accounting and reflection in the accounting documentation of each debt depends. Indeed, from the competent, correct settlement of debt obligations, the further activities of the enterprise are regulated, and the potential for its development is determined. A successful business can be built if we establish comprehensive control of internal processes and accounting of loan settlements. The management pays much attention to creating an effective structure to manage the accounting system of settlements on loans, while it is important to display funds received from different sources in different ways. It is this sector of the enterprise's economy that causes some difficulties associated with entering data in the general composition of the company's expenses and property.

And if before there was no alternative in solving the issue of accounting and calculating borrowed funds, and everyone hoped for the professionalism and responsibility of employees, then modern computer technologies are ready to offer a more technological method. Programs can promptly automate processes and, as a result, provide correct, reliable information on credit control, providing management with information about their volumes and current state, analysing the productivity of the application of received loans and their settlement, and therefore making informed decisions in the field of management.

Who is the developer?

2024-04-18

Video of accounting of settlements on loans

This video can be viewed with subtitles in your own language.

Our specialists have studied all the specifics of this topic and created a unique application of its kind - the USU Software, which will not only take over the accounting of loan settlements but also establish a complete document flow of the company. Calculations are carried out in a fraction of a second and will be accurate, and the created information space between the departments of the organization creates a single area for effective communications. In the course of its work, the USU Software prepares reports that will help you choose the most rational and profitable format of obtaining third-party financial resources.

The system provides an accounting of urgent and overdue payments on debt obligations separately. The settlement of loans software considers the terms set in the loan agreement, and if the payment is made earlier, then all subsequent accounting entries go under the ‘urgent’ category. In case of violation of the specified period, a debt arises and, accordingly, the program automatically transfers the control form to ‘overdue’, with the resulting calculation of penalties. When contacting a settlement on a loan, the company can choose the currency in which further payments will be made, but there are specific features that require special attention to the exchange rate difference. In our application, configure the algorithms when the moment is automatically adjusted. The information obtained when the accounting of settlements on bank loans is entered in the column for current expenses in the current period. Since the expenses associated with loans are directly related to the current expenses of the company, they are automatically included in the financial totals, except for targeted loans of the purchase of material, production stocks.

Download demo version

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

USU Software has a wide functionality of posting all kinds of transactions with cash books, filling out the necessary documentation, acts, and other papers, according to the accepted standards. System settings are flexible and can be changed to suit the needs of the organization. Users of the program are limited to access to certain information, so the staff will not be able to see management or accounting reports, in turn, the management who owns an account with the ‘main’ role has access to all databases, calculations, and any information. Besides, customize the frequency of database backups, change algorithms, and add new samples and templates. The application was created to account for settlements on loans issued in banks or in any other way and is useful for organizations that use borrowed resources in their activities, receiving not only a visual payment schedule but also full control of all aspects related to this. The electronic platform uses data on the loan amount, interest rate, monthly terms, and down payment of calculations. As a result of the application's work, receive a calculation of the payments made, interest accrued to the current moment of the total amount, the remaining debt after making previous payments, and settlement of a loan.

Among the advantages of our program, we would like to note that, despite the presence of the basic version, with many ready-made functional tools, it remains quite flexible and easily adaptable to the specifics of the organization. Depending on the wishes of the customer, we adjust the appearance, a set of options and are ready to make additional integrations with the equipment used in the course of work. The program of accounting of settlements on loans taken from banks, MFIs, or individuals was created after a thorough study of the market situation of automation systems, all the pros, and cons. As a result, the software has combined the experience of other software products, which means that you will get a ready-to-work, streamlined form of business accounting automation!

Order an accounting of settlements on loans

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Accounting of settlements on loans

Our configuration has a simple interface, which makes it easier for users to transition to automation and master all functions. Receive a productive and convenient tool to ensure high-quality loan accounting, automatic generation, and filling out of accounting documents, following internal requirements. We undertake the installation of the application using the remote method over the Internet, and at the end, each user is given a short training course. In the presence of several subdivisions and remote branches, not a local network is formed, but by means of the Internet, while the information is sent to a common base, which the management has access to. The management can differentiate the visibility of certain information about employees, based on their position and powers. Loans received through the funds of a bank or other organizations and their settlement are controlled according to all requirements of the internal policy of the company and the laws of the country.

Accounting of settlements on bank loans and regular analysis help to determine non-rational expenses, assess the justification of the intended purpose of individual items and monitor deviations in actual and planned indicators. Management and accounting reports are presented in the USU Software in a wide variety, their appearance can be customized individually. If the organization needs to obtain a new loan from the bank, provided that the previous one has not been repaid, then the program enters new data and automatically recalculate debt obligations, adjusting the accounting for new indicators. The documents generated by the platform have a standardized form of accounting entries. If necessary, templates can be independently adjusted or added.

A separate work area is prepared for each user, entry into which is possible only after entering a password, login, and choosing a role. The settlements on loans software monitors the reliability of new information, comparing it with the already internal information. By bringing electronic papers to a single unified form, it is much easier for employees to master the interface and navigation of the program. Samples of documents are drawn up with the company logo and requisites automatically, which helps to maintain the corporate spirit. The functionality and the register of settlements accounting options do not have a rigid structure, and the final version depends on your needs and wishes. At any time of operation, you can add new features!