Operating system: Windows, Android, macOS

Group of programs: Business automation

App for accounting of loans

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

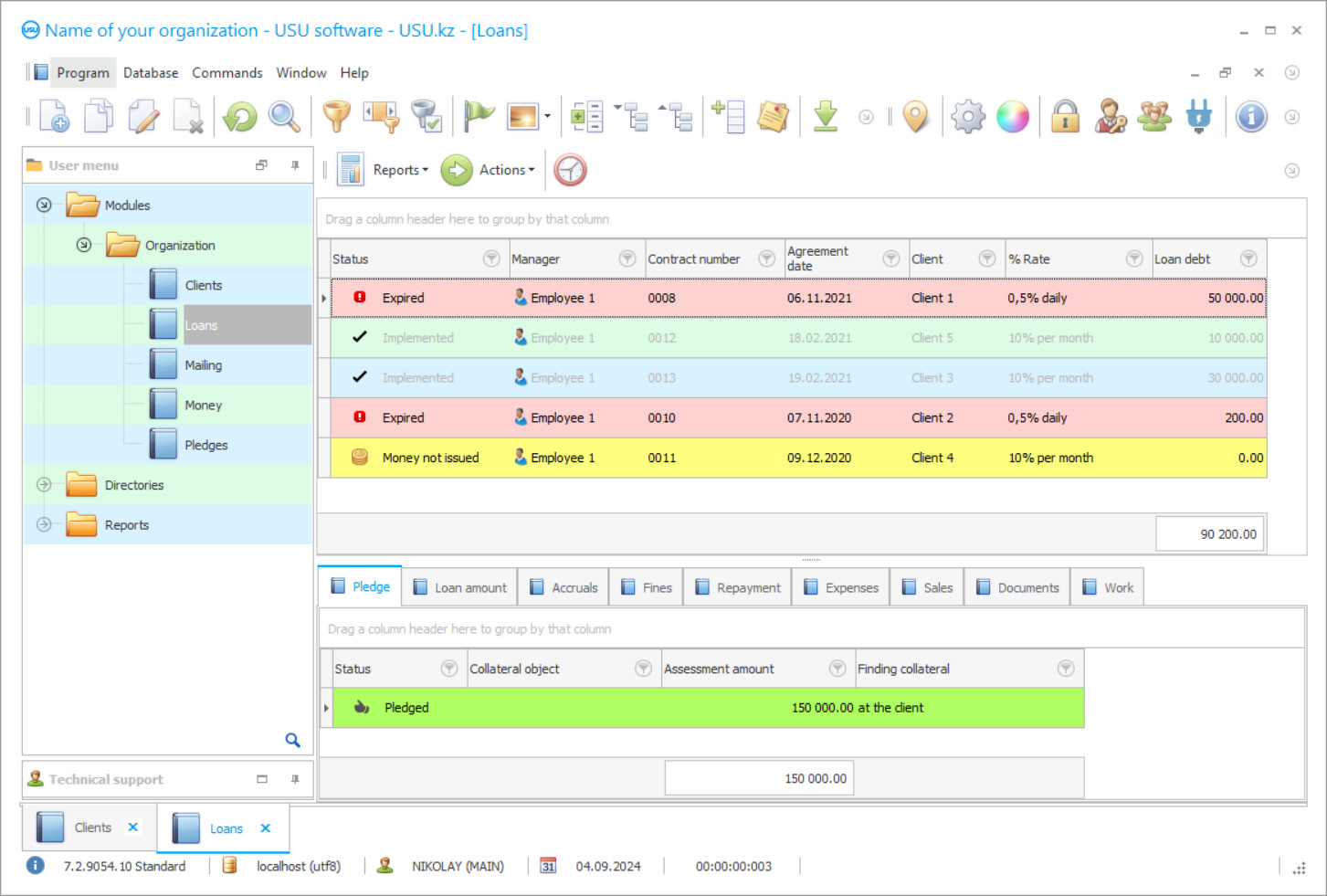

Program screenshot

Credit organizations use modern technologies for their work, which help to monitor all business processes in a real-time mode. A quality loan accounting app serves as a good basis to build a stable position among competitors. It is necessary not only to properly conduct its activities but also to use the latest technological progress. It is required as nowadays the number of requests for loans is just rising and clients need more proper and accurate services, which are difficult to establish due to the specific feature of the loan accounting and other processes related to credit accompany. Therefore, to minimize the possibility of errors and save labour effort and time, it is necessary to facilitate the loan accounting with the aid of the new automated app.

USU Software is an app created to keep track of loans. It forms applications systematically in chronological order. To increase the production of employees, you need to create good working conditions. The commitment of the staff plays an important role in the activity of the organization. The more requests processed per shift – the higher the company's profit will be. The main goal is to maximize revenue at the lowest cost. It is hard to achieve such results without the implementation of a high-quality loan accounting system as there are many nuances and huge dataflow that should be considered.

Who is the developer?

2024-04-20

Video of app for accounting of loans

This video can be viewed with subtitles in your own language.

In the app for an accounting of loan transactions, it is necessary to have various reference books and classifiers that help to quickly generate transactions. Thus, a good level of financial performance is achieved. At the beginning of the period, the company's management forms a plan task that contains all the values of the main indicators of activity. It is necessary to observe these conditions and try to increase them. Programs serve to optimize activities. In our app, there is a full set of tools and functions, which were chosen by our specialists considering the needs and preferences of the companies interested in loan accounting.

Keeping clients from accepting an application to forming service for a loan is carried out in several stages. Creditworthiness, official sources of income, and credit history are checked first. Next, the purpose of lending is discussed. It is necessary to consider many indicators since the level of loan repayment depends on this. The company derives its main profit from these operations. Credit accounting should be carried out according to modern state standards, which are also dictated by governmental organizations such as the National Bank. It is essential as even a minor violation of regulation can be the cause of inactivity of your business in the future.

Download demo version

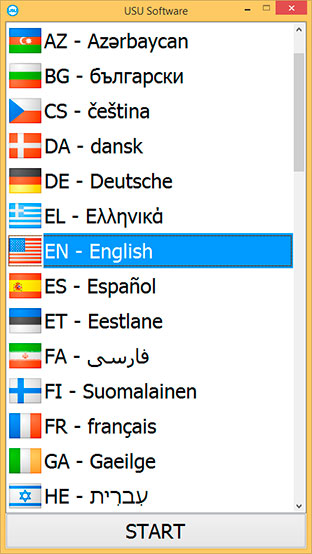

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

Lending automation app assists in running financial companies. It ensures the continuous creation of requests and the transfer of borrower data to the summary sheet. Thus, a single customer base is formed. To ensure the safety of funds, you need to track the level of expenses and income at each stage. The planned assignment contains the main values for all indicators. The main characteristic is profitability. If the value is closer to one, then this indicates a good position in the industry.

The accounting app designed to keep records of loans independently monitors services. It notifies about the tasks in real-time. The planner plays an important role in leadership. In order not to miss the main dates of interaction with customers or partners, it is necessary to fill out an electronic calendar. Built-in templates of standard forms always have a valid revision, so the company does not have to worry when transferring documentation to third parties.

Order an app for accounting of loans

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

App for accounting of loans

USU Software is a new generation app that structures all the actions of employees and directs them towards solving the main problem of the company. The electronic calculation system guarantees the accuracy and reliability of the totals. This plays an important role in determining the current situation.

There are many facilities provided by the accounting of loans app, including the high level of data processing, backups on a set schedule, compliance with legal norms and standards, access by login and password, convenient button layout, operation templates, actual reference information, built-in assistant, online system update, keeping a book of income and expenses, unlimited creation of departments, divisions, and product groups, receipt and expense cash orders, money orders, bank statement, analysis of financial condition and position, business process log, delegation of authority between staff, identifying leaders and innovators, maintaining credits and loans, general customer base with contact details, accounting and tax reporting, specialized reports with company details and logo, implementation in large and small companies, use in various economic activities, templates of forms and contracts, synthetic and analytical accounting, automation of employees' work, consolidation and informatization, optimization of costs, calculation of interest rates, loan repayment schedules, service level assessment, receiving applications via the Internet, taking inventory, salary project in the app, stylish design, feedback, help call, partial and full repayment of debts, identification of late payments in the program, payment using payment terminals, video surveillance on request, SMS mailing and sending letters by e-mail, special classifiers and reference books, waybills.