Operating system: Windows, Android, macOS

Group of programs: Business automation

App for credit institutions

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

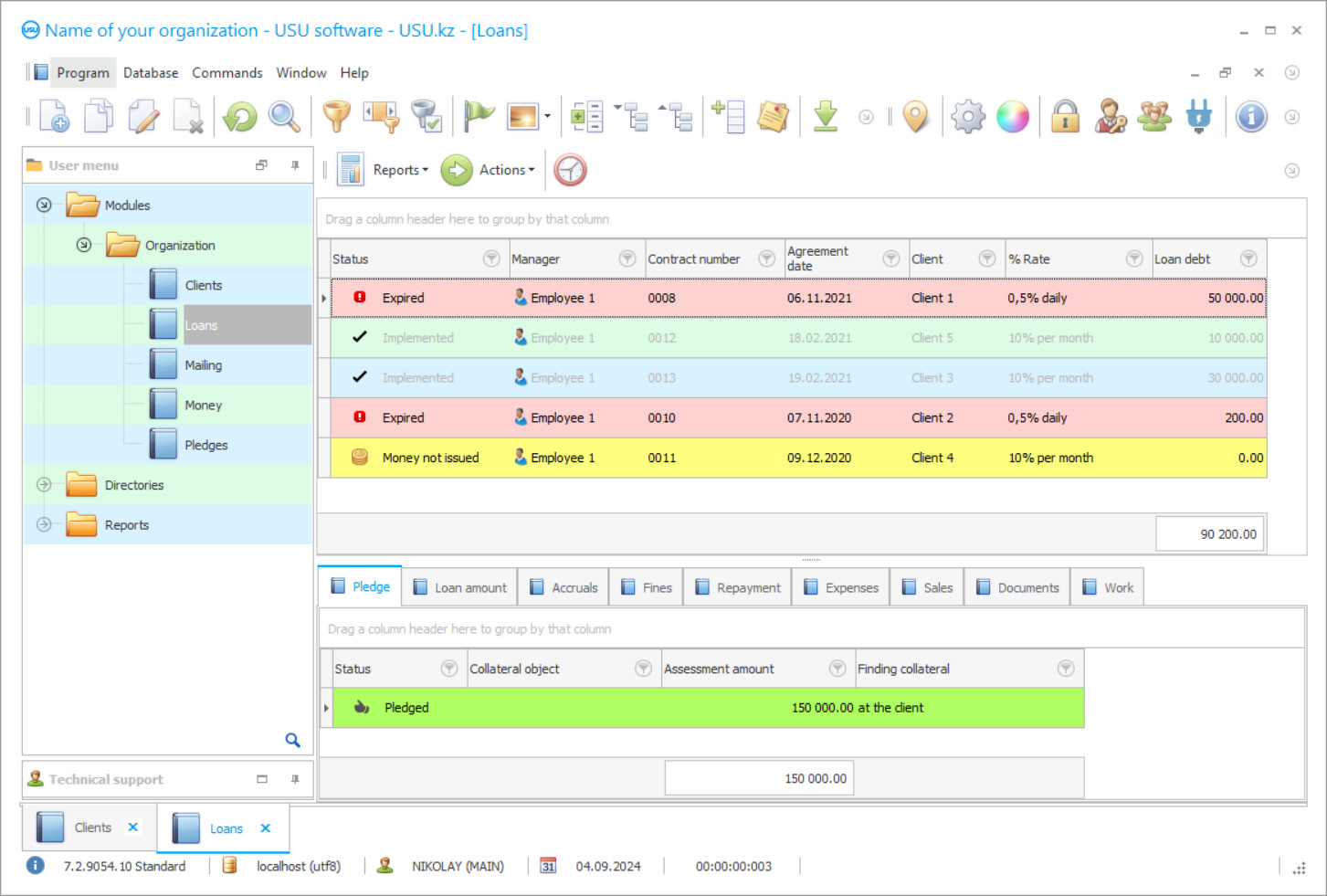

Program screenshot

The app for credit institutions in the USU Software provides credit institutions with the ability to automate their activities, including accounting. Credit institutions belong to financial institutions, whose work is strictly regulated by legislative acts, is subject to accounting by state bodies, and is accompanied by the provision of mandatory reporting on their activities in a certain period. Due to the installed app, all these functions will now be performed by this application itself to ensure the accounting of credit institutions. To ration all work considering the officially approved regulations, keep automated records of all types of activities, including credit, generate reports of inspections that control credit institutions.

This app of credit institution has a very simple interface and easy navigation, so all employees can work in it, regardless of the profile of their activities, status in a credit institution, without considering their work experience on the computer where the app of accounting of credit institutions is installed. The only requirement to install the app is the presence of the Windows operating system. Other characteristics are unimportant. The app without regard to technical qualities and user skills has high performance, dealing with all work operations in a split second without considering the amount of information that may be processed. Therefore, when they talk about automation, they use the expression ‘in real-time’ since the result of any operation appears instantly and without any time expenditure.

The availability of the accounting app of the credit institution allows all personnel to be involved in its work since the more diverse information enters the application, the more visible and, therefore, the more efficiently the current state of work processes is displayed, the faster decision can be made if discrepancy suddenly appears or dissonance at work. Based on the information provided, monitor the behaviour of borrowers, the status of loans issued, cash balances in each cash register and the bank account, establish control over the activities of employees, inventory, and much more.

Who is the developer?

2024-04-18

Video of app for credit institutions

This video can be viewed with subtitles in your own language.

In the accounting app of the credit institutions, there can be enough users to provide each with a scope of work and to divide areas of responsibility. A system of security codes is used to enter the application. These are individual logins and passwords, which divide the common information space into separate work zones of each employee allowed to work in the application. In a word, everyone owns only the amount of data that they need to perform their job well. This helps to protect the confidentiality of service and commercial information, and their safety is ensured by the task scheduler built into the app, which starts the automatic execution of tasks according to the schedule set for each type, including regular backups of service information in the list.

The credit institution app does not provide for the participation of personnel in the maintenance of accounting and counting procedures, which increases their speed and accuracy. The user's responsibilities include only adding working values to electronic documents that employees have registered. The information is marked with login from the moment it was entered, while the ‘label’ does not disappear anywhere when correcting and even deleting data, so you can always determine whose hand was involved in a particular event in the application.

The app of credit institutions offers a function of control over user information. On the one hand, control is exercised by the management, which regularly checks the content of electronic forms of users for compliance with the current situation in the credit institution, to ensure which a special audit function is used that speeds up the procedure by highlighting updates received in the application after the last check. On the other hand, the app itself exercises control, establishing subordination between different information categories, using the usual forms of data entry, which are offered to each database: client registration, loan registration, purchase of new goods for economic activity, assessing the collateral, if such an operation is required.

Download demo version

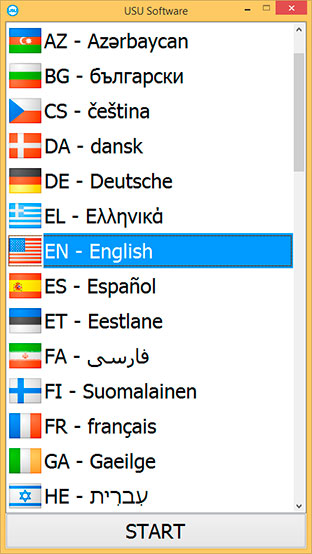

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

In the app of credit institutions, these usual data entry forms have an unusual format, due to which their internal subordination to each other is formed. Therefore, all the calculated indicators in the application have a mutually balanced state, and when false information comes in, this balance is violated, which is impossible not to see how and find the culprit due to the labelling of the values. This is important, as the app guarantees error-free credit transactions and maintains their privacy.

The credit institution needs clients - the application does everything possible to attract them to get a loan, offering its effective tools of promoting services. The app offers CRM as a client base, which is one of the most effective formats of working with clients and a convenient place to store their information. The competence of CRM includes personal information and contacts of the client, documentation, and photographs proving the identity, an archive of interaction from the moment of registration. When a client contacts a credit institution for the first time, they first register through the above form, the client's window, specify the source of information about loans.

The app monitors information sources, generates a report on the effectiveness of the sites used for promotion, comparing costs, and profits from their clients. CRM participates in the organization of advertising mailings, forming a list of subscribers according to exact criteria, in any format - massively, personally, or sends messages directly from the database. To support mailings, a large set of texts has been prepared for any occasion and purpose, which are saved in the client's personal file to save the history of relationships. At the end of the reporting period, a mailing report will also be presented with an assessment of the effectiveness of each - by feedback parameters, including new credits and requests.

Order an app for credit institutions

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

App for credit institutions

At the end of the reporting period, the application generates several reports with an analysis of all types of activities of the credit institution, which improves the quality of management accounting. Analytical reports optimize financial accounting and the financial activity itself, determine the factors influencing the formation of profit, positive and negative. The analysis of the activities of the credit institution is based on statistical data, which is carried out continuously for all indicators, making it possible to plan its work.

Control over loans is important in the credit institution. The app forms a database of loans and makes it possible to visually monitor their current state in it. Each loan has a status and colour that change automatically when the information about it, which comes from different users, changes, thereby informing the manager about it. The multi-user interface offers users to work simultaneously without the conflict of saving information, even if the changes were made in the same document. The app promptly reports on cash balances at any cash desk or on a bank account, indicates the total turnover of each point, and makes reports on credit debt.