Operating system: Windows, Android, macOS

Group of programs: Business automation

Management of credit institutions

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

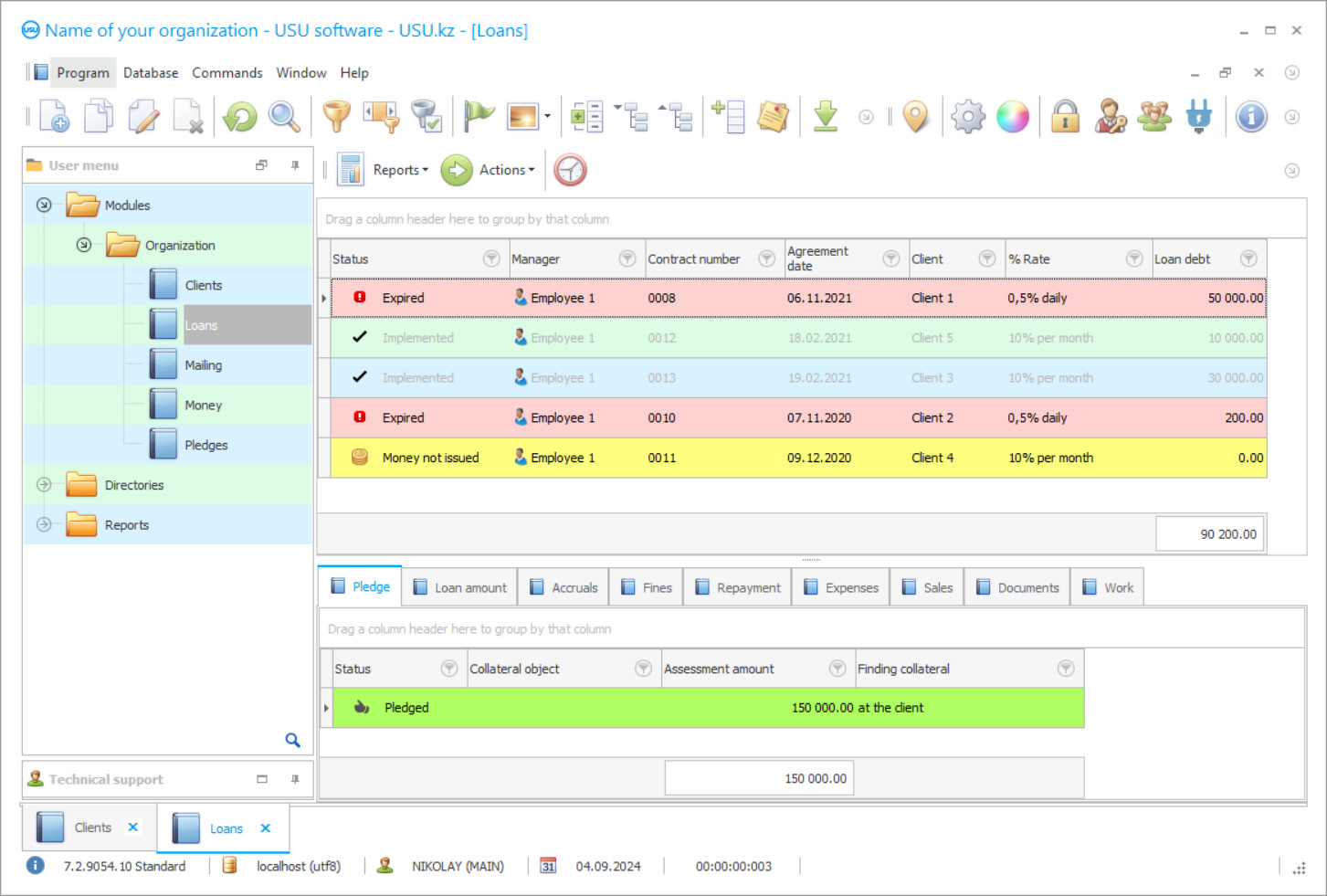

Program screenshot

Nowadays, it is difficult to imagine the activities of banks and other financial institutions without the use of automated control systems. The management of credit institutions by means of computer programs helps to increase the efficiency of all processes related to financial transactions. The software can ensure the reliability of the processed documents, thanks to the use of several methods of automatic and visual monitoring, as well as the ability to always have an up-to-date picture of current affairs and the state of the business. Usually, the management prefers not to look for new forms of automation and turns to the general accounting platforms, it undoubtedly does a good job with its responsibilities, but at the same time, it requires certain training and skills that only specialists can have, and the cost of the application is not all companies on a budget. But technologies do not stand still, every year many configurations are created, which further simplify the management process and create comfortable conditions for the development of a credit firm.

Our institution is engaged in the development of various forms of automation for various types of entrepreneurship, we use only advanced technologies and strive to individualize the project for a specific customer. High-class specialists from the USU Software development team have created a unique project with the same name, which, as soon as possible after implementation, will lead to automation of control over loans, and credits, as well as monitor the timeliness of their repayment. The structure of the management structure of most credit applications is similar to the USU Software, but we have provided the opportunity for any user to work, without requiring any special skills.

Who is the developer?

2024-04-19

Video of management of credit institutions

This video can be viewed with subtitles in your own language.

The application will equally effectively handle the management of small-scale credit institutions, and with those that have a wide network of branches, geographically scattered. For multi-branch companies, we will create a common information space with a centralized base for accounting, using the Internet connection. The platform is being implemented on working PCs, without any requirements for technical characteristics. The interface is designed in such a way that all activities take place in a comfortable environment, which is facilitated by convenient navigation and a clear structure of functions.

Any employees of the credit institution, such as managers, operators, accountants, will be able to carry out the workflow in the USU Software. We will give each user an individual login, password, and role to log in to their account, according to the position, the scope of authority, and access to various information will be determined. The main work begins with setting up internal processes, algorithms for calculating and calculating a credit, which may differ depending on the department. The reference database is transferred either manually or using the import option, which is much easier and faster. Employees only need to enter the initial information into electronic forms, the rest of the calculations will be done automatically by the application. We have provided a function for determining the status of the credit, the color of which will indicate the current position. And the ability to receive notifications and reminders will become a convenient tool for completing all things on time.

Download demo version

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

The management of credit institutions using the USU Software platform means the ability to conduct payments in various currencies. In the case of using one form of the monetary unit for credit, this does not cause difficulties, then when issuing in national currency, and receiving contributions in foreign currency, problems arise. But sometimes this mechanism is necessary, so we took this moment into account when developing our program so that the current exchange rate was taken into account. The configuration can increase the amount of an already open credit agreement, in parallel making a recalculation based on the new conditions, adding new agreements, automatically drawing them out. The USU Software is responsible for the formation and maintenance of a customer base, data entry, tools for promoting new advertising products, such as mailing via SMS, e-mail, or a voice call. All samples of documentation, templates, forms are entered at the very beginning of the operation of the program, which will subsequently facilitate the work of personnel, eliminating the need to manually fill in papers.

In the category of credit accounting, the program manages the operations performed, monitors the availability of the required documents. The management will be able to regulate the business in real-time, having the most relevant data, identify weak points associated with the institution of work moments that require intervention or additional financial injections. The function of creating reports of a management nature will also be useful for the directorate.

Order a management of credit institutions

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Management of credit institutions

We operate in such a way as to develop automation systems for the needs of each customer and specific business. Due to constant monitoring of new technologies and studying the specifics of management in institutions for issuing credit credits, we offer only technological solutions that are easy to maintain. The management team will quickly establish the management of the institution thanks to a wide range of tools and analytical reporting.

The program will lead to a single standard for all the nuances of managing firms specializing in the issuance of cash credits. In the program, you can make adjustments to the credit conditions, draw up additional agreements, keeping the history of changes. The USU Software can manage simultaneously for several institutions, forming a single space for the received data. Credit repayment monitoring in the system occurs according to the previously drawn up schedule, in case of a delay, it displays a notification to the employee responsible for this contract. For each available subsystem, the application will prepare any required reporting, both for each working day and for a certain period. Our application also regulates taxation issues using various accounting systems.

The entire package of documentation required after the approval of the credit will be generated automatically, according to the templates that are available in the database. Interest, penalties, and commissions on credits are calculated automatically, according to the configured algorithms. When receiving funds to repay the credit, the system breaks down the entire amount by type of payment, preparing supporting documentation. After analyzing the credit, the program will create a report that reflects the principal debt, interest rate, maturity date, and completion date.

The help database has the ability to attach any number of documents and various files, including images. Your management has the ability to restrict the user from adjusting the conditions when creating the credit documentation package. Contextual search, grouping, and sorting are implemented as comfortably as possible, by several characters, finding the required information in a few seconds. Each stage of the operation is accompanied by technical support from our specialists. In order for you to be able to study our software platform in practice, we suggest downloading a demo version and exploring all the above advantages yourself!