Operating system: Windows, Android, macOS

Group of programs: Business automation

Management of loans and credits

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

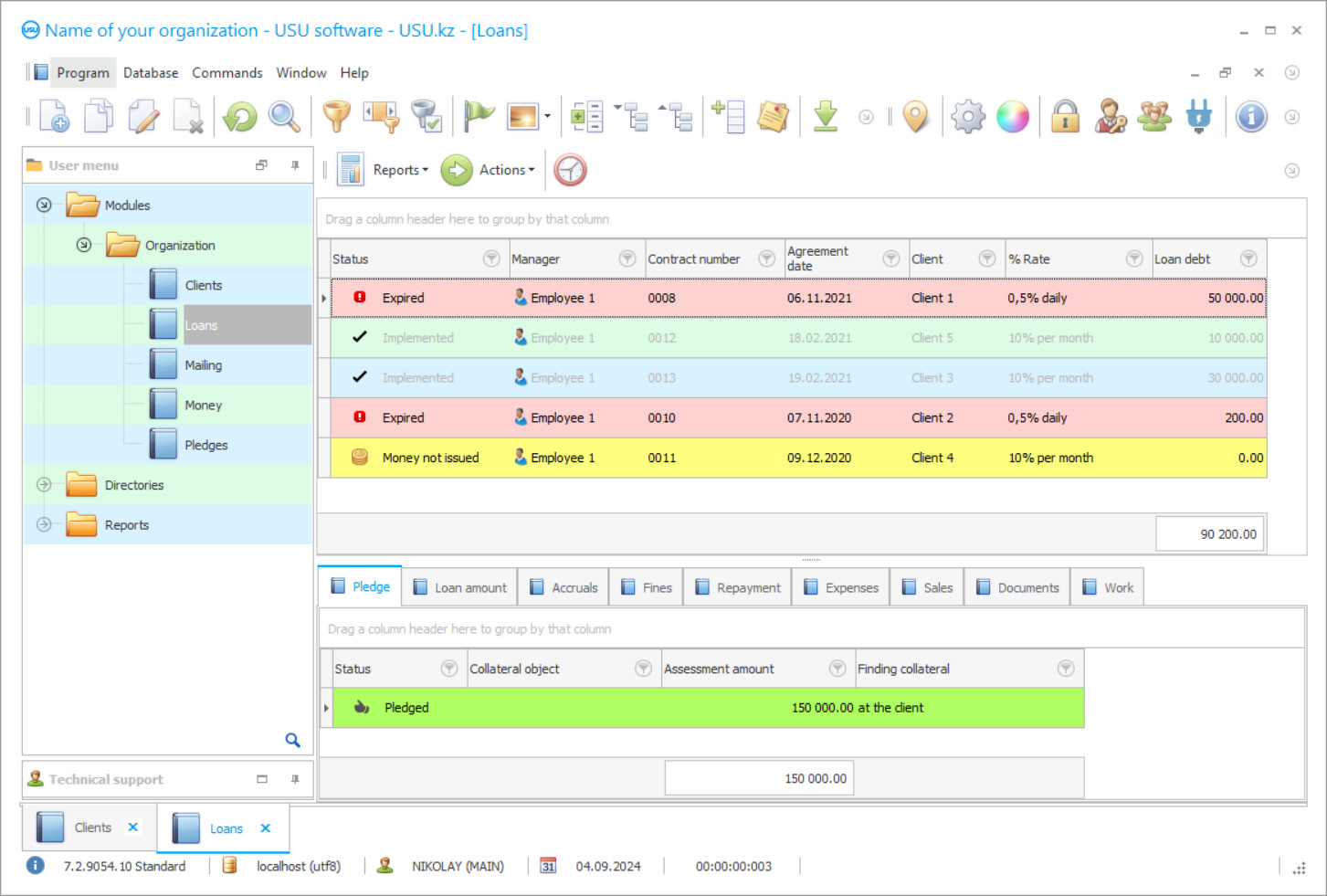

Program screenshot

The business of microfinance organizations that provide loans and credits is dynamic and constantly growing in its profitability, therefore, the management of loans and credits in such organizations requires the use of an effective credit management system that will allow close control over all processes related to finance quickly and simultaneously. Any company associated with loans and credits cannot function at peak of its potential without automation of financial accounting, since the calculation of interest rates, the number of loans, and currency conversion for credits require extreme accuracy in order to maximize the profit.

The credit and loan management program will be beneficial for the microfinance organization if it regularly monitors the timely repayment of loans by borrowers and regularly carries out credit profitability analysis. The most successful solution for these tasks facing the loan management of enterprise will be the use of some top-of-the-line software that is suitable for systematizing financial transactions for loans and credits.

Who is the developer?

2024-04-20

Video of management of loans and credits

This video can be viewed with subtitles in your own language.

USU Software meets all the needs of the management of financial and credit institutions. Data protection, automated mechanisms for performing operations, tools for monitoring the timely repayment of each issued loan and credit, no restrictions in the nomenclature used to form individual and attractive offers to clients. Moreover, you do not have to spend any extra time in order to adapt to the organization of processes in our advanced application; on the contrary, configurations of the USU Software will be customized in accordance with the specifics of doing business in your company. Our program can be used by private banking institutions, pawnshops, microfinance, and credit companies — the flexibility of settings will make the computer system effective for management at any enterprise that works with credits and loans.

Each management program must have a database, which stores all the data necessary for work, and in the USU Software, such a database differs from competitors not only in its capacity but also in the simplicity of data access. Users enter information into systematized catalogs, each of which contains information of a certain category, such as interest rates on loans and credits, customer information, contacts of employees, legal entities, and divisions. So that you always work only with up-to-date data, the software supports the updating of certain information blocks by users.

Download demo version

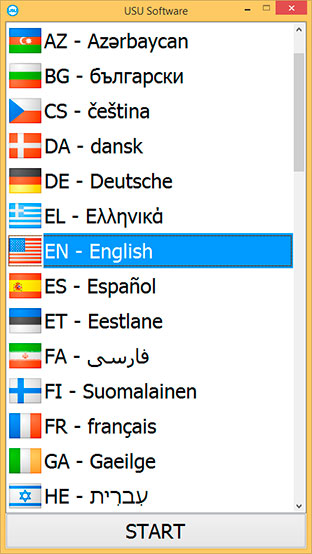

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

Managing your organization's loans and credits will no longer be a time-consuming task for you and your employees, as our software features an intuitive user interface in which each financial transaction has a specific status and color. All concluded contracts contain a detailed list of information, such as the responsible manager, the issuing department, the date of the contract, the repayment schedule and its fulfillment by the creditor, the presence of a delay in the payment of interest, calculated fines in the event of debt, etc. You do not have to maintain several registers to account for certain parameters of the transaction; all data will be concentrated and structured in a single database, which will significantly simplify management in microfinance organizations.

The program pays special attention to financial management; responsible managers and management will be provided with processed analytic information of the company’s income and expenses, information on cash balances in cash offices and bank accounts. Thanks to the analytical tools of the USU Software, you can assess the current state of the business and determine the development prospects.

Order a management of loans and credits

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Management of loans and credits

An important point in our program is the organization of work and the differentiation of user access rights. USU Software has no restrictions on the number of structural units, the activities of which can be organized in the system, so you can keep records for all branches and departments of your credit enterprise. Each department will have access only to its own information, while the manager or company’s owner will be able to evaluate the results of the work as a whole. Employee access rights will be determined by their position in the company, in order to protect sensitive management data. In the USU Software, the work of your company will be organized in the most efficient way, which will optimize the use of time, improve the level of management and improve the business as a whole!

If the loan or credit is issued in a foreign currency, the system will automatically recalculate the monetary amounts taking into account the current exchange rate. Automatic updating of exchange rate will allow you to make money on exchange rate differences without wasting time on manual daily recalculations. You can evaluate the financial performance and check the timeliness of payments to suppliers, you will have access to control over cash transactions on accounts and in cash desks.

With USU Software, you can easily make the work operational, since the activities of all departments will be interconnected in a common workspace. Cashiers will receive notifications that a certain amount of money needs to be prepared for issuance, which will increase the speed of service. By tracking issued loans by status, managers will be able to easily structure debt and identify late payments. Your employees do not have to spend their working time solving organizational issues, which will allow you to focus on the quality of work and achieving effective results.

Your managers will have access to the automatic dialing function in order to inform customers. In addition, our program supports communication methods such as sending emails, SMS messages, and send mail via modern messenger apps. You can generate any necessary documents in digital format, including agreements for the issuance of a loan or the transfer of credits and additional agreements to them. Solving the tasks of optimizing expenses and increasing profitability will not be difficult, since you can view the structure of expenses in the context of loans and credits, which will help to assess the dynamics of monthly profit volumes. Formation of reports in our digital database using the capabilities of automation of calculations will allow you to avoid making even the slightest mistakes in financial accounting.