Operating system: Windows, Android, macOS

Group of programs: Business automation

Organization of work of MFIs

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

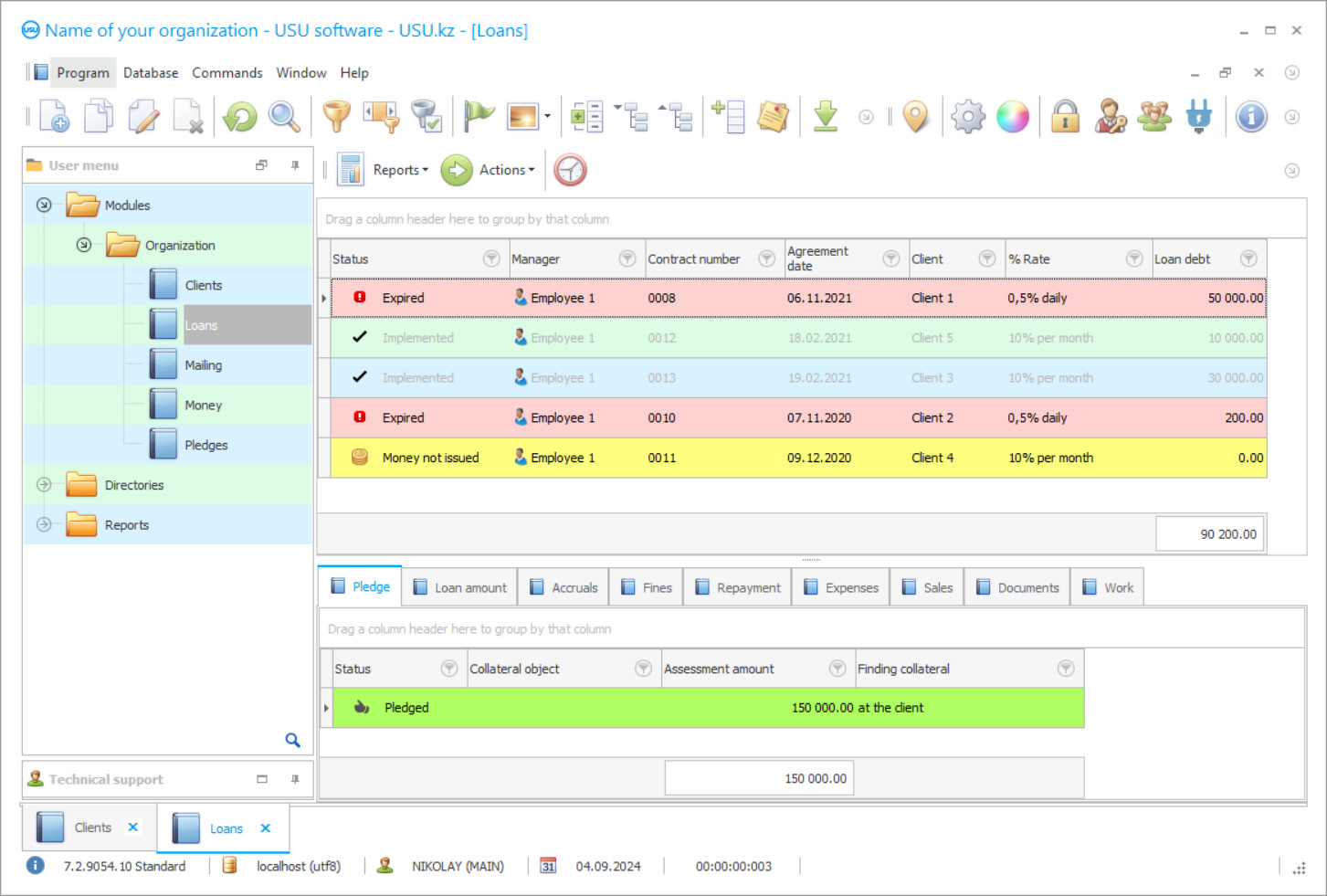

Program screenshot

In microfinance, automation projects are increasingly used to delegate key management functions, including the customer database, lending operations, regulatory workflow, staff and resources. In general, the organization of the microfinance institutions' (MFIs) work is built on high-quality information support, where users can personally work with each client, listen to complaints and wishes, issue new optimization applications, monitor the financial activities of the organization, and plan operations for the future. Several innovative projects have been developed on the website of the USU-Soft under the industry standards of the MFIs. As a result, painstaking work with claims in MFIs becomes more productive, reliable and efficient. The project is not complex. Several people are able to work on the organization of key levels of management simultaneously. At the same time, personal admission rights are easy to regulate. Full rights are reserved exclusively for the program’s administrators. It is no secret that the activities of MFIs presuppose impeccable accuracy of calculations, when documents and lending agreements are drawn up correctly, without claims from both the parties of the borrowers and regulatory organizations. The software calculations are made promptly and accurately.

Who is the developer?

Akulov Nikolay

Expert and chief programmer who participated in the design and development of this software.

2024-04-25

Video of the organization of work of MFIs

This video can be viewed with subtitles in your own language.

The system of MFIs work organization is not afraid of computational work, when it is necessary to urgently calculate interest on loans, automatically charge a penalty, or apply other penalties to the organization's debtors. Any payment can be detailed by month or day, as you like. Do not forget that the MFIs digital assistant of organization’s work and order establishment controls the main communication channels of the microfinance organization with the client database - voice messages, Viber, SMS and E-mail. It is not difficult for users to master the methods and tools of targeted mailing. Working with clients becomes more productive. By means of mailing, you can not only warn the borrower about the need to make the next loan payment, but also collect reviews, complaints and claims, offer to evaluate the quality of service, and determine a promising direction for development. The application monitors of organizations’ work exchange rate fluctuations in real time, which is especially important to MFIs whose activities are tied to the dynamics of the exchange rate. Current changes are instantly displayed in the registers of the program of MFIs work organization and entered into regulatory documents. There is no easier way to avoid claims from borrowers against MFIs to popularly spell out currency changes and refer to the letter of the loan agreement. In general, working with loans and related documentation packages becomes easier.

Download demo version

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

It is not surprising that automated management is increasingly used in the MFIs field. The principles of work become more adaptive when it is easy to change the settings at your own discretion, to put emphasis on one or another level of the organization's management, as well as to manage finances. The system of MFIs work organization successfully adjusts the positions of addition, repayment and recalculation, displays the actual collateral in a separate interface, collects detailed reports on each loan application, assesses the contribution of staff to the overall performance of the structure, and carefully analyzes profit and cost indicators. The optimization software monitors the key processes of lending from MFIs, takes care of the calculation of interest, penalties and other penalties for debtors, and is engaged in documenting. The organization receives a truly effective management tool with adaptive settings. You can change them in accordance with your ideas about productivity and quality service. In general, the principles of work becomes optimized, both at certain levels of management, and in a complex manner. Through the main communication channels - voice messages, Viber, SMS and E-mail, you can directly enter into contacts with the client database, remind about paying the loan and collect reviews and claims.

Order the organization of work of MFIs

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Organization of work of MFIs

The organization is able to check the current exchange rate in real time in order to quickly reflect changes in the registers of the program of MFIs optimization and regulatory documents. The work with loans is displayed quite informative. For any request, you can raise the archives, request analytical and statistical summaries. MFIs regulations are set as templates. Users have to select files, acts of acceptance and transfer, cash orders, loan or pledge agreements, and proceed with registration. Loan refusals can be categorized as a separate category to work efficiently with claims, explain to clients the reasons for refusal, collect collateral information packages, etc. It is not excluded to establish communication between the optimization software and payment terminals, which will significantly improve the quality of service. With the help of digital support, MFIs can comfortably regulate active draw-up, recalculation and redemption positions. Each process is beautifully detailed.

If the current performance of the microfinance structure is far from ideal and costs prevail over profits, then the software intelligence of optimization and control will try to notify about it in a timely manner. The organization is able to collect comprehensive volumes of information on each loan. Several specialists are able to work with borrowers' claims at the same time, which is provided by the factory settings. At the same time, the volumes of actions already performed are easy to note. The release of the original electronic support remains the prerogative of the customer, who is able to obtain a unique design, connect the optimization software with external equipment, and install some functional extensions. It is worth testing the demo version of the project in practice. We strongly recommend purchasing a license after that.