Operating system: Windows, Android, macOS

Group of programs: Business automation

Program for control of MFIs

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

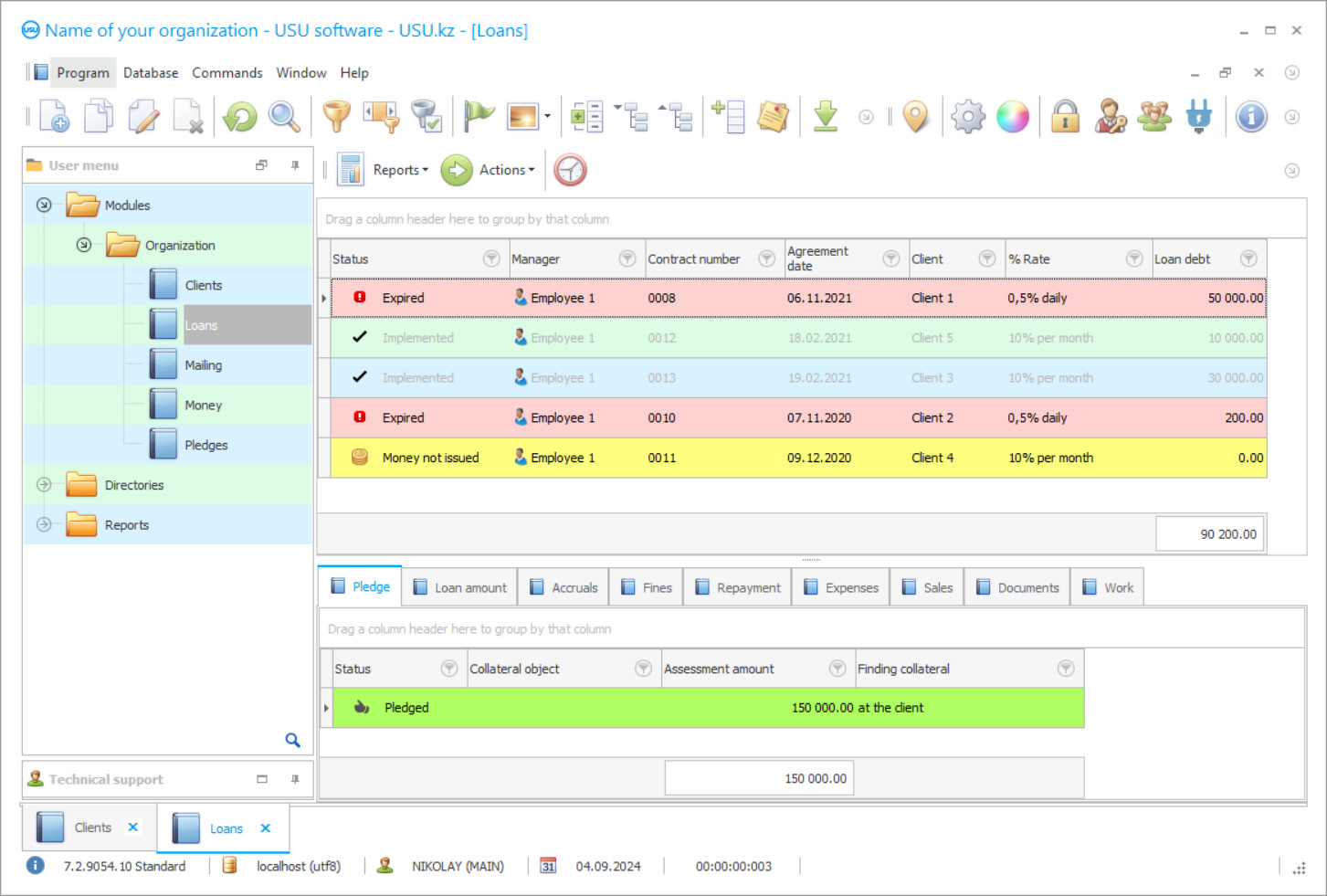

Program screenshot

Control over the activities of microfinance institutions (MFIs) was developed by highly qualified specialists using only optimal, innovative technological processes. This approach to automation underlines our ability to present one of the best and most efficient tools for your business. Employees will be able to carry out their personal direct responsibilities almost immediately by handing over the routine documentation completion for the USU-Soft program of MFIs control. This is important thanks to the well thought out and simple interface. The presence of the need to make the mobile version is allowed at an additional cost. As a result of the implementation of the program of MFIs control, employee mobility will increase, the program’s development period will decrease, and costs will be reduced in all movements without exception. An increase in consumer demand in itself increases various services not only depending on material substances, services, but in accordance with monetary instruments for the purpose of obtaining them. Without exception, various organizations are gaining great popularity, which are inclined to provide the required amount of debt. This service is by no means new in nature. However vigorous activity poses great threats without compensation. In this case, effective modernization of power is necessary.

Who is the developer?

Akulov Nikolay

Expert and chief programmer who participated in the design and development of this software.

2024-04-25

Video of the program for control of MFIs

This video can be viewed with subtitles in your own language.

Thus, as is often the case, consumers directly have no way to return money on time, they do not comply with the terms of the first payment, as well as most such contracts that are more difficult to track. The supervision of MFOs should be thought out in such a way that in each period of the period it is possible to see the dynamics, the state of funds, and the level of non-repayable obligations. Equally as a species, it is permissible to expand the use of alleged ideas, to trust their obligations; however, at the end of the paragraphs, this will provide a violation that will lead to significant losses. At the end of the day, the core set of successful entrepreneurs, move to computer technology that will quickly lead the company to automation. A huge number of projects are shown on the horizons of the Internet. You only need to choose the most optimal form with an abundance in general. Philanthropic add-ons have a limited list of abilities. The USU-Soft program of MFIs control perfectly understands, without exception, the needs of MFIs, thanks to which we were able to formulate the USU-Soft program of MFIs control, capturing the interesting current conditions and regulatory framework, the nuances of activities, understanding the features of MFIs.

Download demo version

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

According to the tools of the program of MFIs control, the client can almost simultaneously receive a result with the possibility of loan approval. Filling out the questionnaire and contracts is done mechanically, users just need to select the required operation from the drop-down menu or enter information about the new applicant, adding it to the database. By processing the information in a useful format, keeping the information in line with the finances, there is every chance to help to complete this supervision thanks to active MFIs. The functions in the program of MFIs control are presented in such a way that the management can appear in the direction of operational dealers, traders, and problem loans every time. Overdue contract lists are identified by color status, allowing the clerk to identify problem candidates almost simultaneously. Management can build a strategy for the further development of MFIs. The feature "Control of reports" is designed in such a way that all aspects of the company's activities exist ideally.

Order the program for control of MFIs

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Program for control of MFIs

The concept of the program is in no way considered for the purpose of any changes, extensions, as a result of which it can simply adapt to the company's process. The external situation and design are adjusted by different users next to them. For this purpose more than fifty types of design are shown. However, before that, instead of embarking on multifunctional activities in addition to the control of MFOs, the reference bases of all existing data are filled in, as well as consumer lists, counterparties, standards, samples of documentation are written. Due to official abilities, access to user information and credentials is reduced. Concept functions calculate the implementation of different scenarios according to the workflow. The synthetic emergence of consciousness will adjust the methods in accordance with the search and processing of data. Different functions are able to perform different types of activities independently, in the absence of the significance of the person.

This method simplifies the implementation of actions performed over any period, increasing the rate of reliable and informed decisions. But the fact is that the period, directly connected between the divisions of the company, creates a common information space for the purpose of effective communication. As a result of the transition to the USU-Soft automation program, you will acquire an indispensable assistant for data quality control, as well as to support commercial growth. Adding the USU-Soft program allows you to carry out an inventory in accordance with the calculations with the borrowers, preparing a stock of potential costs in the event of an incident. In the control concept, thanks to the program of MFIs management, it is also permissible to adjust the ranges of possible delay of the share, starting with a certain type of loan.

The program automates all stages of accounting control, as well as the regulation of the company, the presence of minimum investments in foreign currency. All activities are carried out in accordance with established and generally accepted standards and legal requirements. A simple and well thought-out menu contributes to the timely control of personnel. There is no need to take on new employees. Employees, in accordance with the tools of the program, will be able to perform routine tasks of filling out questionnaires and contracts, reflect on their activities, communicate with consumers by sending newsletters and send information via SMS. By handing over the quota of questions, MFIs staff will spend most of their time talking to applicants rather than completing an extremely significant amount of paperwork.