Operating system: Windows, Android, macOS

Group of programs: Business automation

Program for loan brokers

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

Program screenshot

The USU-Soft program for loan brokers is an automation program prepared by loan organizations, to which loan brokers are directly related. The services provided by loan brokers include the selection of the most optimal conditions for obtaining a loan, which the client can use, as well as the preparation of documentation for processing a loan application and sending it to the bank. By and large, a loan broker includes intermediaries who issue bank loans and receive a certain percentage of them as a reward, since the bank reduces rates and application requirements for such loans. The program for a loan broker performs many functions independently, thereby reducing its labor costs and saving time, but most importantly, it simplifies accounting and control over the entire volume of issued loans, since it automatically controls the repayment schedule in accordance with the conditions established for each borrower. The software of credit brokers’ management automates the acceptance of incoming applications and distributes them to credit brokers with a lower load than the rest - the program automatically evaluates by the number of applications assigned to them or being processed.

The application of credit brokers’ management collects all applications into one database - this is a database of loans, where applications that have come even just for calculation are saved - they are saved as a reason to contact a potential borrower. To place an application, a loan broker opens a special form in the software, which is called a loan window and contains pre-built fields of filling out, having a special format to speed up the data entry procedure. This is either a menu with multiple answers built into the cells, or a link to go to another database such as a customer database. But this format of cells in the program of loan brokers’ management is more important for the current data, since the primary information is loaded into the program by traditional typing from the keyboard.

Who is the developer?

Akulov Nikolay

Expert and chief programmer who participated in the design and development of this software.

2024-04-24

Video of the program for loan brokers

This video can be viewed with subtitles in your own language.

If a client turns to a credit broker for the first time, he or she first registers the customer in the client database. The first software requirement, which is present in any USU-Soft system, is a CRM format - one of the best in working with clients. To begin with, the CRM system notes the personal data and contacts of the future borrower, and also indicates the source of information from where he or she learned about the loan broker organization. This information is needed by the software to further monitor the advertising sites that the organization uses to promote financial services. After registering the customer, the program of loans management returns to the loan window, although the borrower's registration can be carried out directly from it, since the link to the client database in the program of broker accounting is activated - you need to go to the appropriate cell. Following it, the credit broker organization selects a client in the CRM system with a mouse click and immediately returns back to the form.

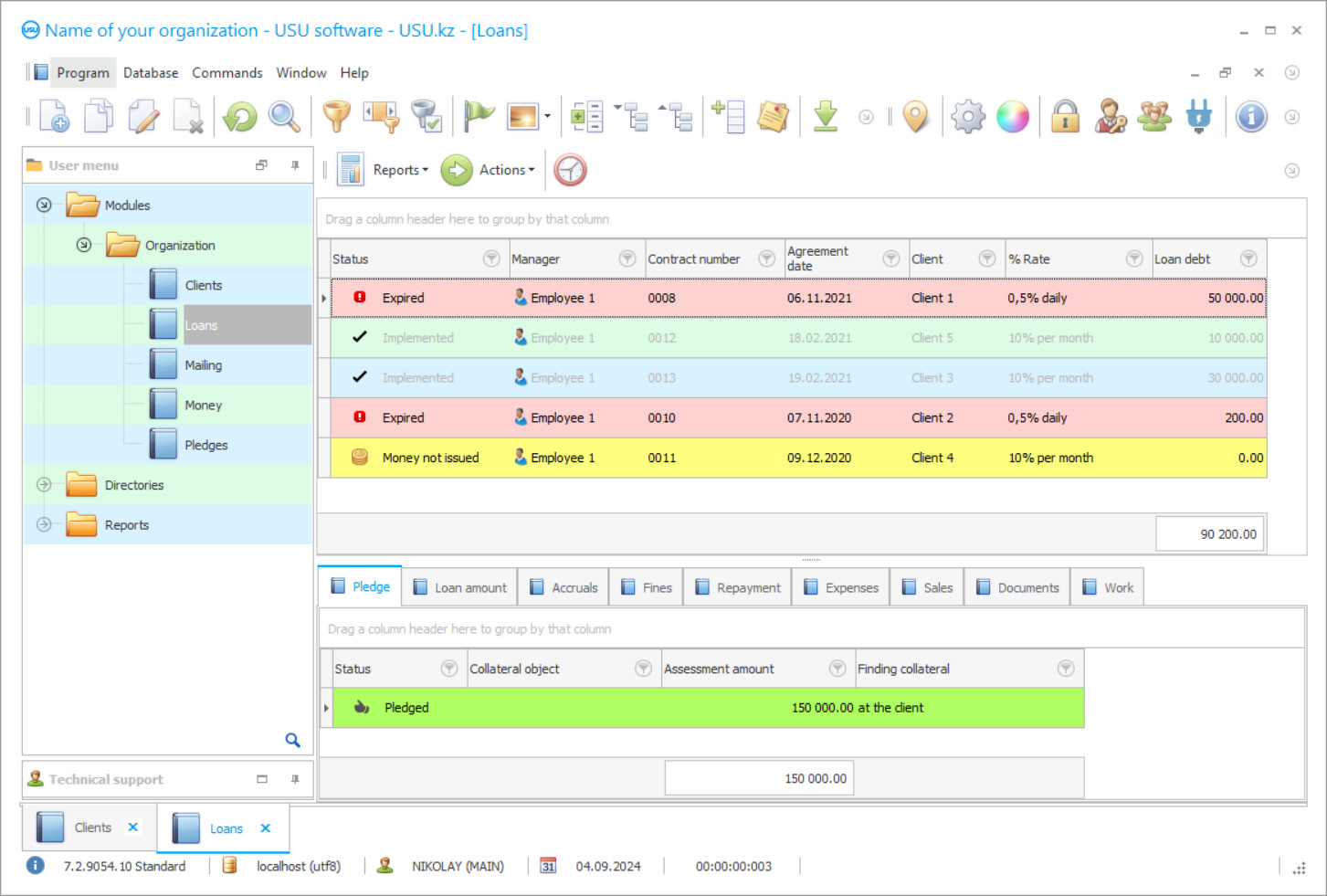

Next, information on the loan is added to the program: the loan amount, payment terms - in equal installments or interest first, and the full amount at the end. Based on this decision, the software automatically draws up a repayment schedule taking into account the selected conditions and generates the documents necessary for signing, while simultaneously sending a notification to the cashier about the need to prepare the required amount for issuance. The borrower signs the contract prepared by the program of broker management and, at the direction of the manager, who received a response from the cashier about the readiness of the funds, goes to the cashier. All stages of registration are recorded by the software step by step by assigning a specific status and color to each stage, which allows you to establish visual control over the process, including the time of execution.

Download demo version

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

The application has many different states and, therefore, colors, according to which the credit broker monitors its execution, including the timeliness of payments, repayment, delay, accrual of interest. The program displays each current action in color, thereby, allowing you to visually control the execution of the loan. In this case, the change of statuses and colors is made in the software automatically based on information that comes to the program from other users. A cashier issued money and noted this fact in his or her electronic journal, confirming it with an expense and cash order generated by the program itself, which is also saved in its own database. Based on the cashier's mark, the program broadcasts the information further, changing the associated indicators, including the status in the loan database and its color. When a payment is received from the borrower, the program generates a new receipt and cash order to confirm it, on the basis of which the status and color in the loan database changes again. The manager can simultaneously accept and issue new loans, monitoring the current activities of the past. The software has the task of speeding up work processes, increasing labor productivity and, accordingly, profit.

The program provides separate access to everyone who works in it, presenting to everyone the amount of official information that he or she needs to perform his or her duties. To do this, users are assigned personal logins and security passwords. They form separate work areas and personal electronic forms. Confidentiality of service information is protected by a reliable login system, and its safety is ensured by regular backups carried out on a schedule. The software provides a multi-user interface, so all users can work simultaneously without the conflict of saving their information. All electronic forms are unified - they have the same filling method and the same data presentation. This speeds up the work of staff when working in different documents. Each employee can design his or her workplace with any of more than 50 options for the proposed interface design. Any of them can be easily selected in the scroll wheel. The software forms several databases, all have the same structure of information distribution: at the top there is general data, at the bottom there is a panel of tabs with details. The CRM system is a reliable repository of information about each borrower. It contains their personal information and contacts, copies of documents, photographs and loan agreements.

Order the program for loan brokers

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Program for loan brokers

The CRM program monitors clients, identifying among them those with whom the manager should contact first of all, and draws up a daily work plan for him or her with execution control. The software provides the option of photographing the borrower with a webcam capture, saves the resulting image in the system for its subsequent identification. To interact with customers, electronic communication functions. This is used both for prompt information and for mailings - a voice call, Viber, e-mail and SMS. By the end of the reporting period, the software generates vaults with analysis of loans, customers, personnel, cash flows, maturities and arrears. All summaries and reports have a convenient form for studying indicators - tables, graphs and diagrams in color, which clearly shows the participation of each in the formation of profits. In addition to summaries with analysis, current reports are also generated on the availability of funds in cash desks, on bank accounts, indicating the turnover for each point and a list of operations. If an organization has several branches and geographically remote offices, then a single information space will function for conducting common activities.