Operating system: Windows, Android, macOS

Group of programs: Business automation

Software for microfinance organization

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

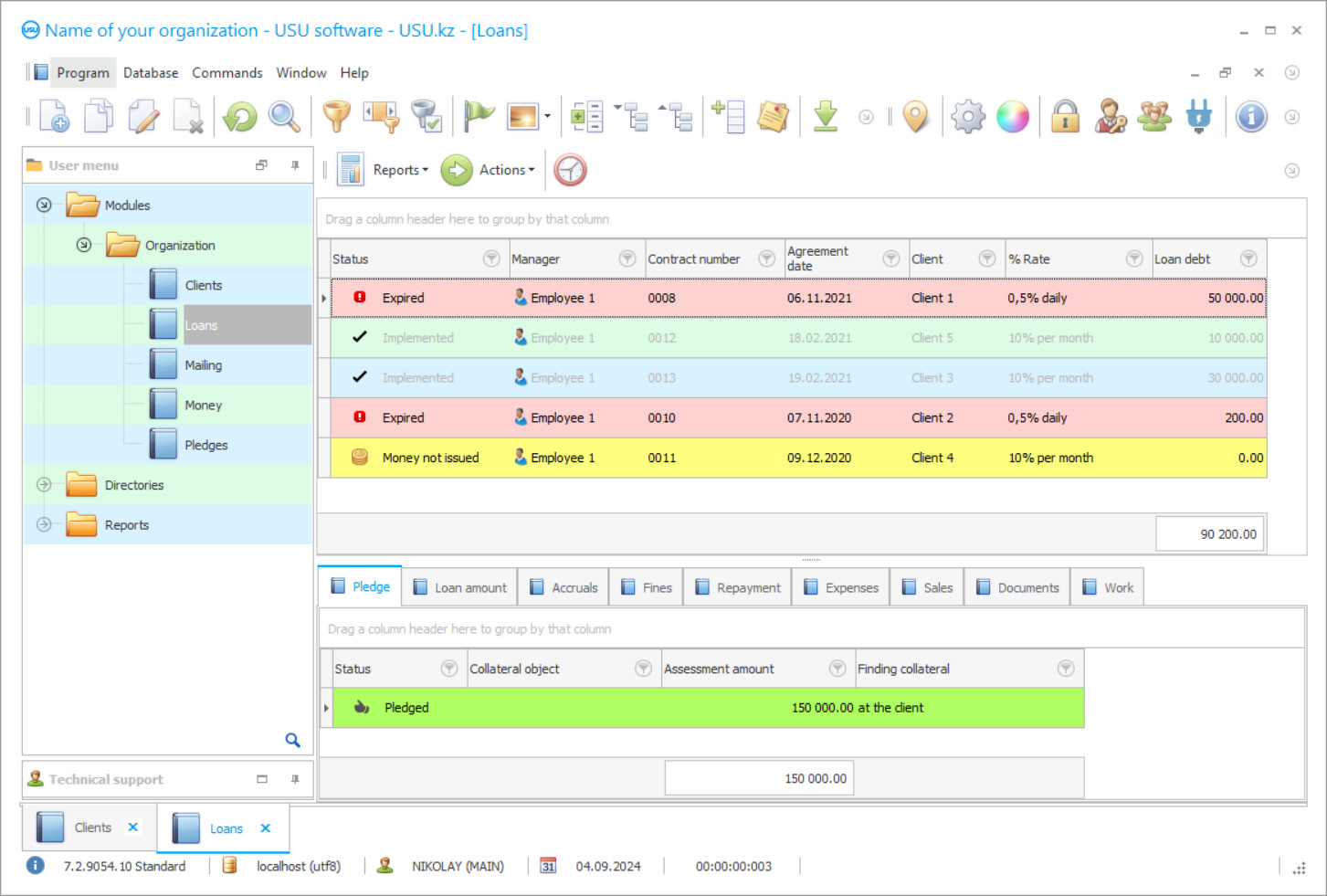

Program screenshot

In modern business conditions, the most effective way to optimize processes is software of a microfinance organization management, which will improve management and increase the profitability of lending services. Automated software contributes to minimizing manual operations, freeing up working time, rigorous management analysis and real-time control. The choice of the most suitable software has a certain complexity, since the activities of microfinance organizations have their own specifics, which must be taken into account in the used computer system. One of the most important criteria when looking for a program is information capacity, as well as flexibility and the ability to customize working mechanisms in accordance with changes in market conditions and the specifics of running a microfinance business.

Who is the developer?

2024-04-19

Video of the software for microfinance organization

This video can be viewed with subtitles in your own language.

The USU Software is an optimal solution to the full range of current and strategic tasks. The management of microfinance organizations has its own individual requirements for the software used in each individual case. Therefore, the USU Software of microfinance organizations is presented in various configurations that can be configured taking into account the specifics of a particular organization. Thanks to this, the software developed by our specialists can be used by microfinance and credit organizations, private banking enterprises, pawnshops and any other companies that provide credit services. You will have at your disposal the tools necessary to fully maintain an information database, control cash flows and monitor the timely repayment of payments both from borrowers and to suppliers, ample opportunities to improve financial and management analysis.

Download demo version

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

A special advantage of the USU Software of microfinance organizations, which is sure to be appreciated by every user after the first minutes of use, is the automation of calculations, operations, analytics and document flow. All monetary amounts of credit are calculated automatically, and when using foreign currency, you do not have to update the rate manually. Interest and principal amounts are recalculated taking into account the current exchange rate both upon extension and repayment of the loan. This allows you to receive additional income from exchange rate differences. Registration of contacts of borrowers and filling out agreements takes a minimum of working time, since managers only need to select a few parameters, and the system generates a ready-made document. This increases the speed of service and the number of transactions. You do not have to spend time with complex analytical calculations: the software of microfinance organizations presents the dynamics of income, expenses and profit indicators in visual charts and diagrams. You don’t need additional applications for electronic document management, because in our software of microfinance organizations you only need to select the required document for uploading. This is drawn up on the official letterhead of the company in a pre-configured sample.

Order the software for microfinance organization

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Software for microfinance organization

In addition, the software of microfinance organizations has an intuitive interface and a simple, concise structure, which makes the program understandable to a user with any level of computer literacy. The list of operations that are available in the USU Software of microfinance organizations is not limited: you can control financial movements in bank accounts and cash desks, regulate the activities of each branch and employees, monitor loan payments, inform borrowers about discounts and arising debts, assess the current state of the business etc. In our software of microfinance organizations, accounting is available in various languages and in any currencies, which makes the USU Software universal in use. The purchase of our software of microfinance organizations is sure to be a profitable investment to you, which brings great results in the very near future! The organization of all work processes is performed in the most convenient way for you, so that solving problems is always prompt and simple. In the microfinance business, the thoroughness and quality of management analysis is important, so our program has a wide variety of tools to improve efficiency and optimize accounting. You can assess the current financial condition of the company and make a forecast of future changes, taking into account the identified trends.

In addition, you are able to develop relevant projects for further development in accordance with the most profitable areas and monitor their implementation. You have access to data on balances and cash flows for the rational use of resources and control over cash flows. Information transparency allows you to see how, with what result and in what time frame employees completed the assigned tasks. This significantly improves the organization of work. In order to motivate and reward staff, you can determine the amount of remuneration and piecework wages, using the income statement for calculations. You can provide microfinance services in any currencies - you don't have to worry about constantly updating exchange rates, as the software of microfinance organizations does it automatically. The monetary amounts of borrowed funds are recalculated automatically when repaying or extending the loan at the current exchange rate. You also have access to a multi-currency regime, which allows you to use national monetary units for issuing loans and making payments.

Users of the program create convenient and visual reference books, information from which is used in the future when working. The internal electronic document management system provides users with the ability to generate and download documents such as contracts, notifications, cash orders, acts, etc. Automation of the preparation of financial statements and documentation makes it possible to staff the staff and optimizes the costs of the credit institution. Structure the debt of your borrowers in order to better manage your finances: you have access to information on repayable and overdue loans in terms of interest and loans. You have at your disposal a CRM (Customer Relationship Management) module, maintaining and replenishing a client database, as well as developing discounts for the active promotion of services.