Operating system: Windows, Android, macOS

Group of programs: Business automation

System for credit cooperative

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

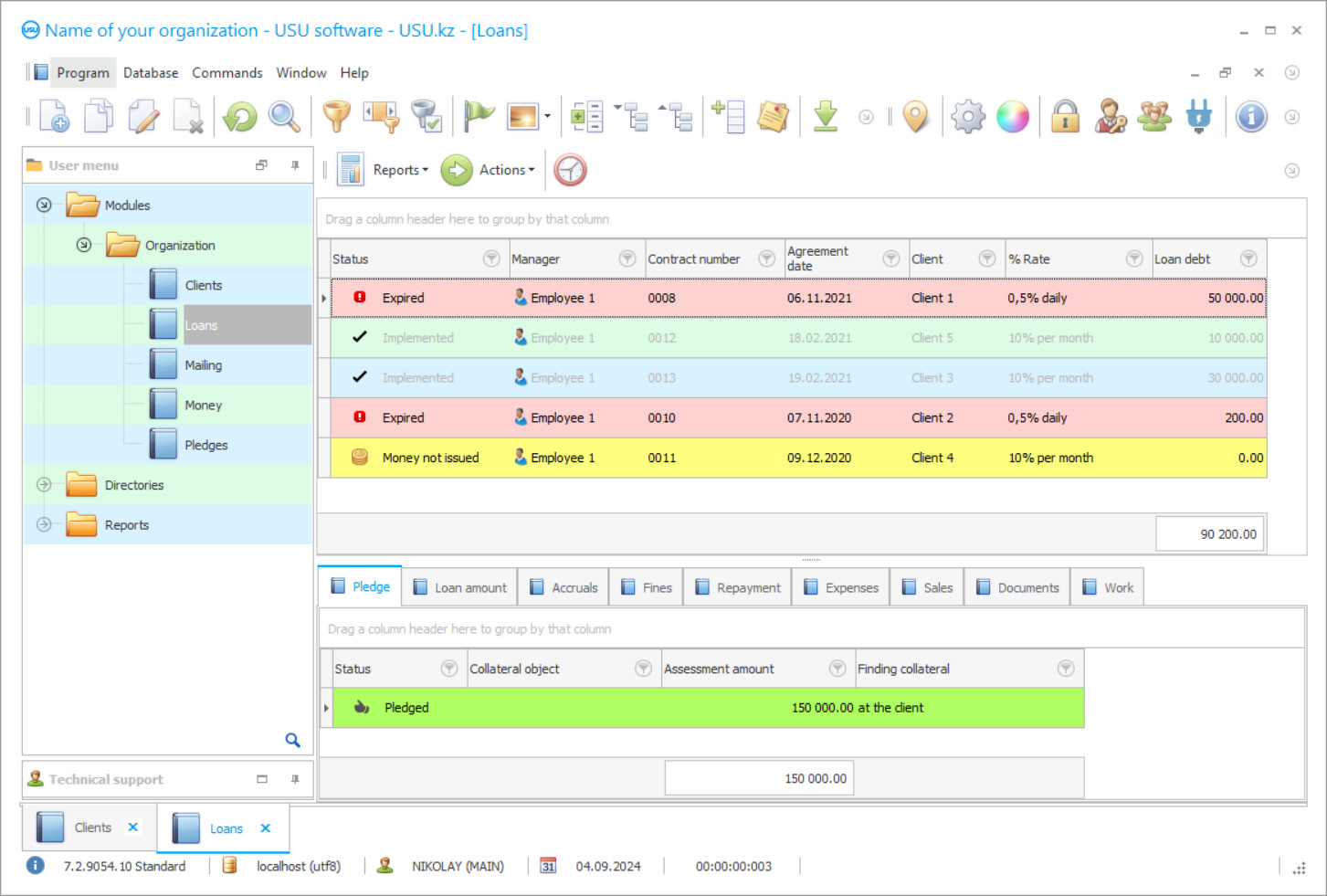

Program screenshot

The system for the credit cooperative of the USU-Soft is fully automated - it performs many functions independently, carries out accounting of all types of activities, and makes automatic calculations. The participation of personnel in the work of the system of the credit cooperative consists only in entering the working information obtained in the performance of work, according to their duties. The automated system of a credit cooperative, like any automation, increases the efficiency of its activities - it reduces personnel costs and speeds up the production process. The credit cooperative provides financial services and is a community of shareholders who lend money at interest to each other. The credit refers to a credit product and is repayable on the terms agreed with the credit cooperative. When it is drawn up by the system of a credit cooperative, an agreement is automatically formed between the parties, a repayment schedule is drawn up, according to the selected conditions - annuity or differentiated payments, the calculation of which is also made automatically.

The responsibility of the employee of the credit cooperative includes only indicating the client and the credit amount, interest rate and maturity, if there is a choice. The system of the credit cooperative does the rest by itself, issuing almost instantly the entire package of documents for signing with a ready-made schedule and amounts to be paid. The most important thing in this operation is the indication of the client, since a lot of information has been accumulated on him or her in the system of the credit cooperative, which can affect the condition of the new lending. In order to visually and conveniently systematize all the information, the system of a credit cooperative uses the CRM format when forming a client database. In our case - a database of shareholders, where the full amount of data about each is stored, including personal and contact, the size of entrance and membership fees transferred to the credit cooperative , history of credits and their repayment, copies of various documents, including those confirming identity, photographs. The CRM system is a reliable place for storing any information in any format and, besides this, has other advantages over other formats.

Who is the developer?

Akulov Nikolay

Expert and chief programmer who participated in the design and development of this software.

2024-04-25

Video of the system for credit cooperative

This video can be viewed with subtitles in your own language.

The CRM system of a credit cooperative control is the best format and the best solution of structuring its activities and control over clients, which the CRM system maintains automatically. The program of a credit cooperative management carries out regular monitoring of all its members in order to find among them those to whom to make a quick payment on credits, make a membership fee, and perform other cooperative duties. At the same time, the system compiles lists of shareholders of each financial transaction, without confusing either shareholders or transactions, and provides a daily work plan formed in this way for employees so that they can quickly contact the client and discuss an urgent problem or, conversely, make him or her an interesting financial proposal. We should pay tribute to the system monitors the execution of the plan, sending regular reminders to employees about the need to make the appropriate call until a report on the conversation with the client appears in the system. Moreover, the program invites its users to draw up a work plan for a period, tracking the effectiveness of each at the end of the period - according to the volume of the planned implementation.

Such plans are convenient, first of all, to the management, as they allow them to maintain operational control over the activities of their employees and add new tasks to the plans. Even if a new employee turns to the application, he or she can easily and quickly restore the picture of interaction with each client, draw up his or her portrait and determine the range of his or her financial preferences and needs. It should be said that in the automated system there are other databases, including the credit database, nomenclature and others, and they all have the same information distribution structure: at the top there is a numbered list of positions with general information visible in line by line. At the bottom of the window a bookmark panel is formed, where each bookmark is a description of a parameter that is significant for a given database. This is reflected in the name of the bookmark itself. Transitions between bookmarks are carried out in one click, so the manager's awareness is always at its best.

Download demo version

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

It should also be noted that all customers are divided into different categories, according to their working or behavioral qualities, status, - the classification is determined by the credit cooperative itself. The catalog of categories is stored in the setting block of the Directory system, from where the regulation of operating activities comes. There is a separate block Modules. The third block Reports evaluates this operational activity and offers its full analysis in the format of visual reporting - these are spreadsheets, graphs, diagrams with full visualization of indicators. The credit database formed with each new loan contains all applications received by the credit cooperative; they have a status and color to it to reflect the current state. Each change in the credit - payment, delay, interest - is accompanied by a change in status and color, so the manager visually monitors the entire database, saving time. When entering new readings, the system automatically recalculates all indicators directly or indirectly associated with new values. This causes a change in status and color.

In addition to documents for a credit, the program automatically generates other documents - financial document flow, mandatory reporting, route sheets and applications. All documents comply with the requirements for them, which is provided by a database of regulatory documents, which is regularly updated, so the information is always up-to-date. The presence of a database of regulatory documents allows you to make a calculation of work operations and carry out automatic calculations for all types of activities. The system is compatible with digital equipment - fiscal registrar, bill counter, video surveillance, barcode scanner, receipt printer and electronic scoreboard. Users have separate access to service information - it is provided by individual logins, security passwords to them, issued to everyone according to their duties. Individual logins provide you with personal responsibility for the accuracy of the information. The management exercises control over their compliance with real processes. The automated system itself controls the reliability of the data, linking them with internal relationships through forms designed of manual data entry.

Order the system for credit cooperative

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

System for credit cooperative

These forms have a special cell format to speed up the entry procedure and form an internal link between values, which ensures that there are no false data in the system. All electronic forms have the same filling principle. All databases have one information distribution structure, in the management of which the same tools are involved. The unification of electronic documents helps to save working time, allows staff to quickly master the program. It is distinguished by a simple interface and convenient navigation. With general unification, the personification of workplaces is provided - the user is offered a choice of more than 50 color interface design options. Activity analysis reports allow you to get effective planning taking into account the statistics presented in them.