Operating system: Windows, Android, macOS

Group of programs: Business automation

Accounting of bank loans

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

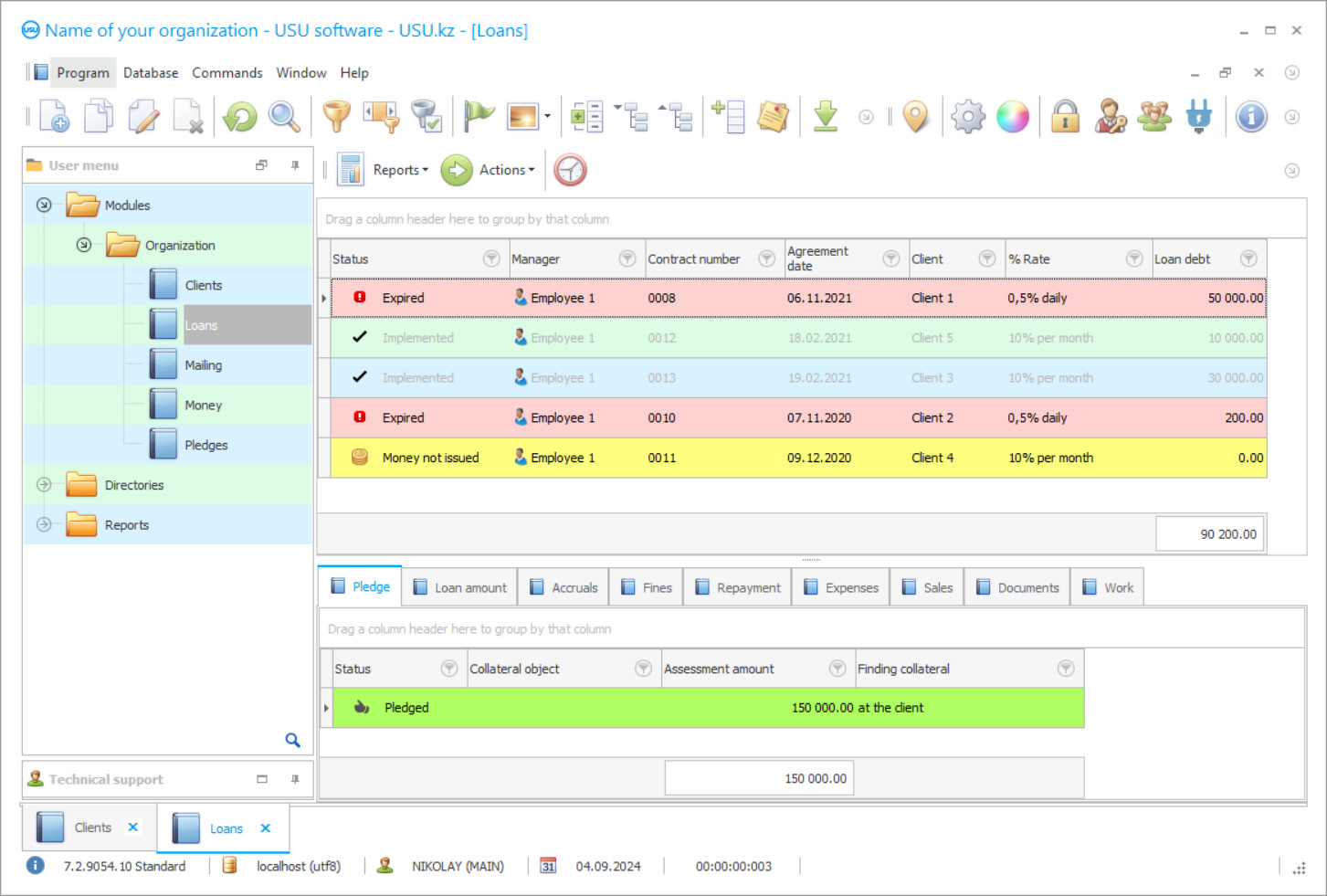

Program screenshot

Accounting of bank loans in the USU Software is carried out without the participation of personnel since all types of accounting are automated from the moment when the automation program is introduced. The installation is carried out by our specialists using remote access via an Internet connection, so the location of the customer's enterprise can be anywhere. Bank loans are both short-term, provided, as a rule, for a period of up to 12 months, and long-term, therefore, two different accounts are opened in the accounting service for settlements on two types of bank loans. A bank loan is considered a cash loan from a banking institution, subject to repayment and payment of interest.

Bank loan accounting differentiates accounts to reflect bank loans according to the purposes for which they were taken. When an enterprise is established, long-term bank loans are taken to invest in production resources, while short-term bank loans help maintain working capital and reduce the turnover of funds. To gain access to bank loans, the company prepares a package of accompanying documents - copies of constituent documents and current financial statements at the time of submission in order to confirm its solvency as an economic entity, the presence of an independent balance sheet, and own funds in circulation.

Who is the developer?

Akulov Nikolay

Expert and chief programmer who participated in the design and development of this software.

2024-04-27

Video of accounting of bank loans

This video can be viewed with subtitles in your own language.

The program of accounting of bank loans automatically distributes the amounts of the loan provided by the bank and the interest for using it to the accounts. This is if it is on the computers of a company that has received a bank loan. If it is installed on digital devices of a banking institution or any other that specializes in lending, the configuration of accounting of bank loans will control the issued bank loans, their maturities, interest accrual, the calculation of penalties for the formation of debt, also automatically distributing the funds received on the corresponding accounts, thereby optimizing the accounting.

It is necessary to describe this program in more detail in order to evaluate all its capabilities, which are very many and which are advantages over the traditional form of accounting. The configuration has a simple interface and easy navigation, which makes it possible for personnel of different status and profile to take part in its work, despite their user experience since the program will be quickly mastered at any level of experience and, as a result, various information about all processes, operations, quantity, and availability - parameters that change their state during the implementation of activities and are important for the accounting configuration, so that it can describe the actual state of accounting as a whole and separately for each of its types as holistically as possible.

Download demo version

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

Such accessibility allows you to get everything you need and at the right time since the automated system itself motivates users to add information in a timely manner during work since it automatically charges them a monthly piece-rate remuneration for labour, but only according to the volumes performed that are recorded in the accounting configuration, otherwise, no payment will be made. Therefore, the staff is interested in the prompt input of information, which has a positive effect on the relevance of indicators calculated automatically based on their readings.

The accounting configuration attracts as many users as possible but shares their access to official information according to their competencies in order to limit the amount of information in the public domain and, thereby, protect its confidentiality. Each user owns only the information that is the subject of his activities within the framework of assigned duties, for which a system of individual logins and passwords is introduced, which form separate work areas for personnel with personal journals to enter their readings and registering completed tasks and operations. In this way, our accounting configuration determines the scope of work and the area of responsibility.

Order an accounting of bank loans

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Accounting of bank loans

Above, it was mentioned about the documentation to obtain borrowed funds. The accounting configuration automatically generates all documents of the enterprise and financial institution, regardless of the field of activity, including financial workflow, different types of invoices, declarations, specifications, receipts, route lists, applications to suppliers. When issuing borrowed funds, a full package of documents required to confirm a drawn up - a loan agreement, a schedule for repayment of payments indicating the amounts and terms, according to the selected interest rate and loan payment terms, cash flow order, and others. Moreover, the accounting program generates internal reporting with an analysis of financial activities.

The only requirement for digital devices to install the program is the presence of the Windows operating system. In local access, work goes without the Internet. To ensure the inclusion in the general activity of remote offices and branches, a single information network with remote control functions is needed, which requires an Internet connection. During the functioning of the unified information network, the division of rights to access service information is maintained. Only their own information is open to branches. The staff can work together at any time. The multi-user interface eliminates the conflict of saving information even when working in one document. Electronic forms in the program are unified. They have the same structure in the presentation of data, have the same principle of data entry, and the same management.

The user's workplace can be personalized. More than 50 interface design options are prepared with a choice in the scroll wheel on the screen. The software is the only one in this price range with an analysis of the activities of a financial institution. This is its distinctive competence among analogues. Among the prepared databases, there is a nomenclature range, a customer base in the form of a CRM, a loan database to monitor loan applications, an invoice database, a personnel database. All bases have the same structure - a mandatory list of all positions with basic parameters, a tab bar with a detailed description of the selected position in each of them. The program menu is made up of three information blocks – ‘Reference books’, ‘Modules’, ‘Reports’, each of them has its unique tasks, but all have the same internal structure and headings.

Users' personal work logs are subject to regular review by management, which uses the audit function to expedite this control procedure. The cost of the program determines the set of functions and services, it is fixed in the contract and does not charge any additional fees, including a regular subscription fee. The program easily communicates with digital equipment, improving the quality of operations, accelerating customer service - bill counters, electronic displays, video surveillance. The program promptly notifies about cash balances on all current accounts, at any cash register, shows the total turnover at each point, forms a list of payment transactions. Regular analysis of the institution's activities allows you to identify factors of positive and negative impact on profit, work on mistakes, and evaluate the results.