Operating system: Windows, Android, macOS

Group of programs: Business automation

Software for credit institutions

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

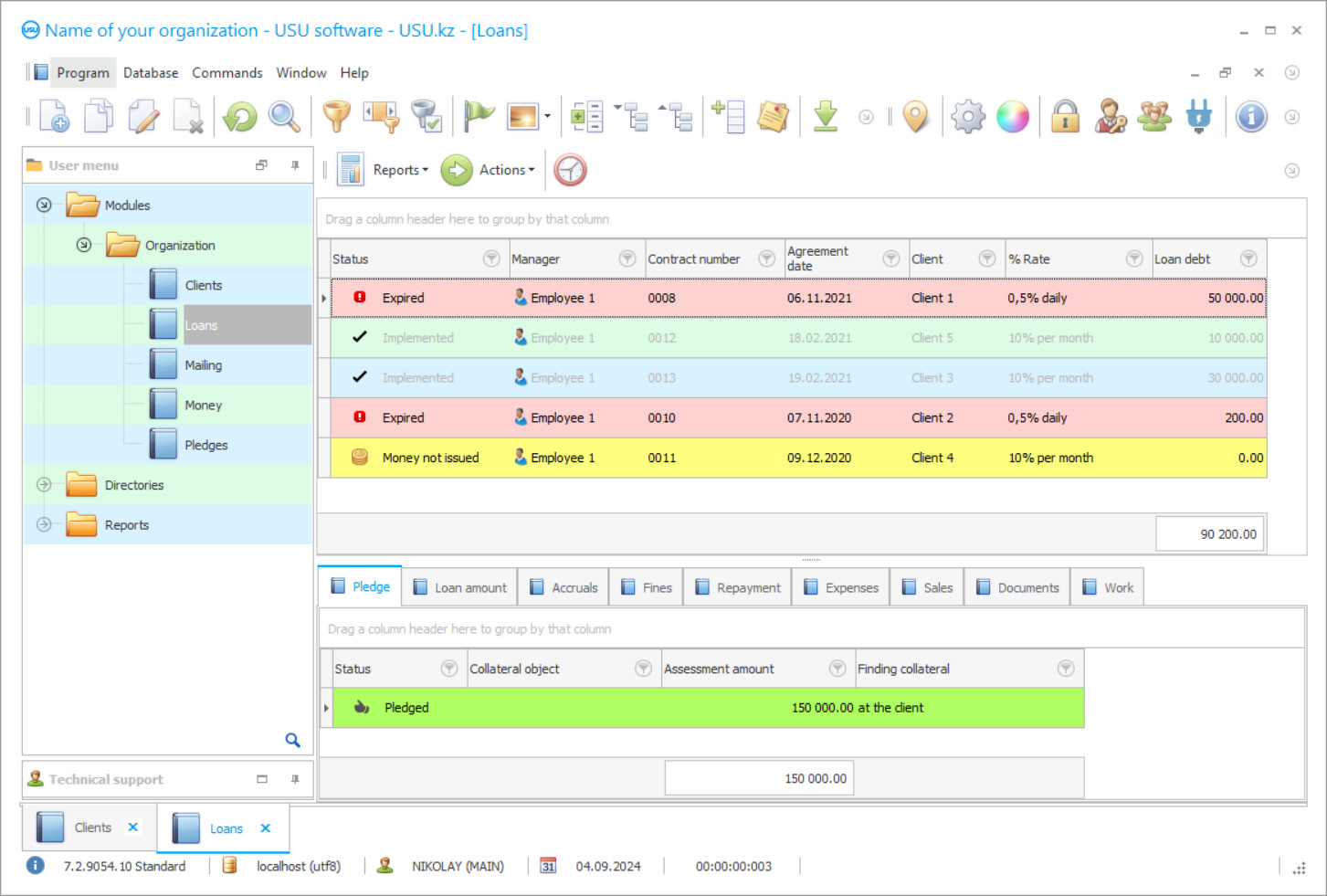

Program screenshot

Leading credit institutions plays an important role in professional activities. This is done by special people who have the appropriate education. It is worth noting that the introduction of automated systems expands the possibilities of any activity. Therefore, modern technologies are very often used when creating a new organization. This increases the chances of a stable position in the market among competitors. The USU-Soft software manages the affairs of credit institutions in real time. Its settings imply full automation of management and cost optimization. This is also important for the staff, since the configuration includes built-in templates. Automatic generation of transactions in a credit institution reduces the workload of the operating system and increases data conversion. In conducting such activities, it is necessary to clearly monitor the level of workload and production.

Who is the developer?

Akulov Nikolay

Expert and chief programmer who participated in the design and development of this software.

2024-04-27

Video of the software for credit institutions

This video can be viewed with subtitles in your own language.

The software of maintaining credit institutions invites new users to familiarize themselves with the help information that will explain the process of working on this platform. The built-in assistant answers the most frequently asked questions. Special reports help to form the totals for management to determine the development policy of the organization. The lending company systematically makes an inventory of its facilities to identify unclaimed ones. They can be implemented on the side or used in the future. When shaping strategy and tactics, the administration department monitors industry data among competitors and determines the most profitable areas for work. Then the institution determines its capabilities and draws up a planned task for the next period. Cases in the credit institution are formed for each client so that there is a complete database in the software. When submitting an application, the service history is checked. This can give certain benefits if this is included in the accounting policy. Each case contains passport data, credit history from other companies and the services of this organization that were provided earlier. If there were controversial situations or late payments, then the credit institution may refuse to further interact with the client.

Download demo version

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

The USU-Soft monitors various economic activities. It is used by manufacturing, construction, transport, insurance and other companies. It is also applicable in highly specialized firms such as pawnshop, beauty salons, and rest homes. The functionality of the software has been expanded, so it is considered universal. Built-in reference books and classifiers help company’s employees in the continuous conduct of business operations. Delegation of typical cases occurs between departments. All information goes to a single server, so the information is always up to date. Management monitors work progress in real time. Credit firms are growing and developing at a rapid pace thanks to the use of modern technologies. Keeping bookkeeping in spreadsheets helps to optimize various costs and propel a company into a good position in the industry.

Order the software for credit institutions

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Software for credit institutions

Each step is adjusted, which increases the productivity of service, the effectiveness of risk assessment for issuing loans. Improvements to the USU-Soft software of credit institutions’ management can be made during its operation, which guarantees the comfort of daily work and compliance with all the requirements of the legislation of the country where it is implemented. Any employee can master the USU-Soft without additional skills. The software of credit institutions management combines the best functions. Thus you can purchase a ready-made, debugged computer system for successful business development in microcredit institutions (numerous reviews and experience of other companies will help you to decide on the final choice of the list of options). The system establishes full control over cash flows, being responsible for registering the necessary data and preparing documentation, following the prepared forecasts. The registration software of credit institutions management switches to automatic mode the paperwork for issued loans, sending the entire complex to print by pressing a few keys. Integration with the company's website is possible as an additional option, which allows you to upload online applications directly to the database and register new customers. The methods of repayment of loans in the USU-Soft software of credit institutions can be regulated by choosing annuities or differentiated forms of payments, the period can also be adjusted.

The computer software of credit institutions accounting allows you to automatically send applicants via SMS, e-mails, online voice calls, which, judging by the reviews, turned out to be a popular option. In the software, you can set up a mechanism for credit holidays, loan restructuring, acceptance of additional agreements and changes in ready-made schedules. For greater motivation of employees, payroll will be based on the indicators of completed transactions and the percentage of non-refunds. The USU-Soft software has a very simple external design, which does not distract from the main work and does not overload the computer system. Each module takes its place in the menu, and any action is carried out directly from the main interface. Among the many advantages of our software, the automation of posting through accounting registers, using built accounts. With the help of the software, a database of analytical and management reports is formed. They can be displayed in the form of a table, graph or diagram. Our program processes a large amount of information at a high speed of processes. Installation, implementation and configuration within the company structure take place remotely by the USU-Soft specialists.