Operating system: Windows, Android, macOS

Group of programs: Business automation

Accounting for money loans

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

During business hours we usually respond within 1 minute

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

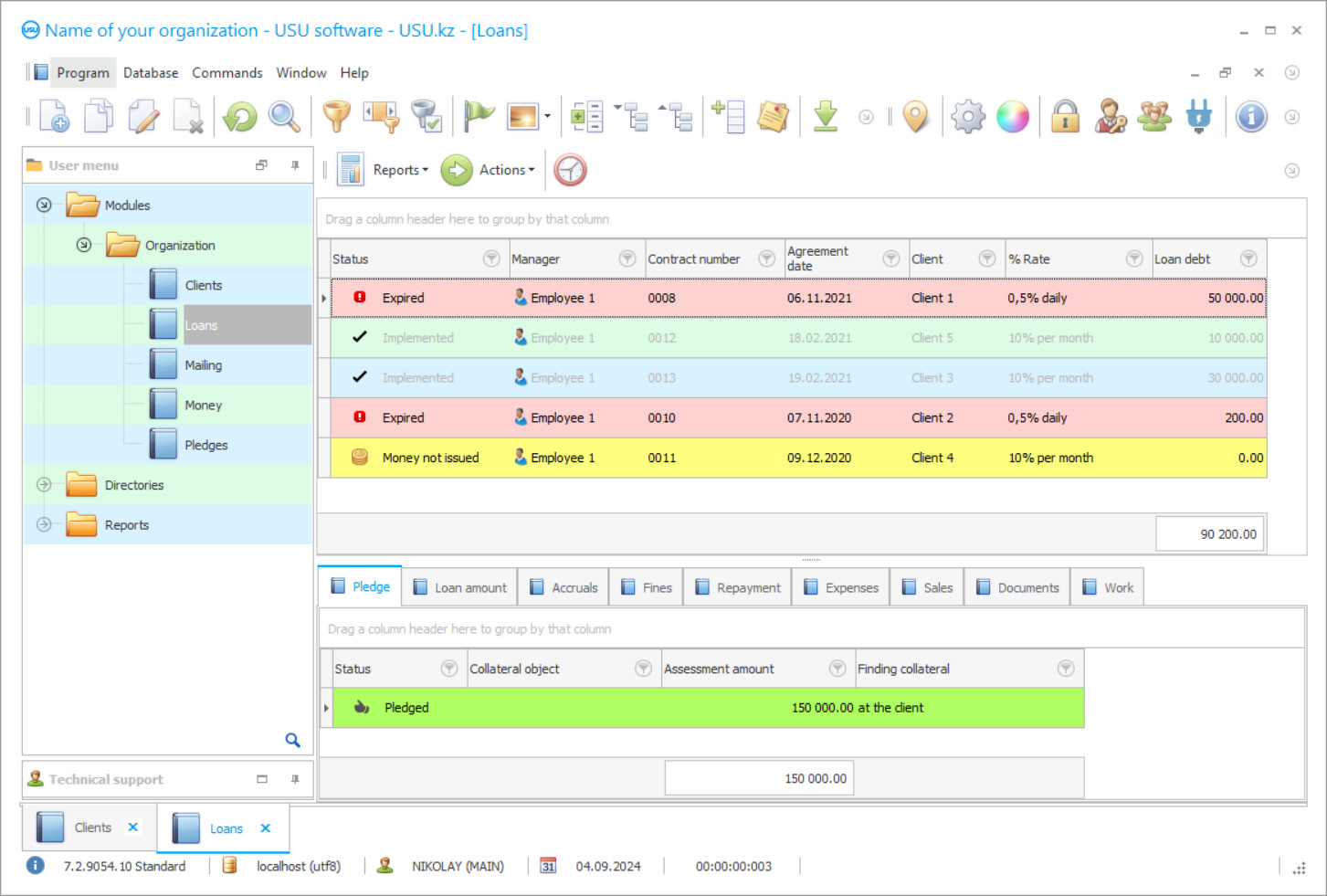

Program screenshot

A screenshot is a photo of the software running. From it you can immediately understand what a CRM system looks like. We have implemented a window interface with support for UX/UI design. This means that the user interface is based on years of user experience. Each action is located exactly where it is most convenient to perform it. Thanks to such a competent approach, your work productivity will be maximum. Click on the small image to open the screenshot in full size.

If you buy a USU CRM system with a configuration of at least “Standard”, you will have a choice of designs from more than fifty templates. Each user of the software will have the opportunity to choose the design of the program to suit their taste. Every day of work should bring joy!

The accounting of money loans in the USU Software is carried out in the current time mode. When there are changes in monetary credits subject to accounting, all indicators associated with such changes immediately change, and the time for the implementation of related changes is fractions of a second. Money loans have changes in their state of the following order: timely repayment, delay in payment, the formation of debt, accrual of interest, repayment of debt and interest, and others. As soon as one of the above occurs, the existing indicators are automatically recalculated, which correspond to the previous state of money loans, before their new match.

Keeping records of loans, being an automated process, does not take much time and effort for personnel servicing and maintaining cash loans since the program itself performs most of the operations for maintaining cash loans, relieving personnel from them and, thereby, reducing the labour costs of the enterprise and with them its personnel costs. Keeping records of money loans consists of maintaining a database, which is formed as the next monetary loan appears, while the base is functionally itself engaged in maintaining. The duties of the staff include only data entry, specifying parameters for compiling a sample of clients with cash credits, which is used in the preparation of various mailings, practiced both by employees of the enterprise, and automatically sent by the configuration itself for keeping an accounting of money credits.

Who is the developer?

Akulov Nikolay

Expert and chief programmer who participated in the design and development of this software.

2024-07-27

Video of accounting for money loans

Such automatic mailings are carried out according to the list of subscribers compiled by the configuration to keep records independently, following the specified parameters of money credits. For example, those loans that are suitable for the repayment period fall under the automatic distribution. A notification will be sent with a reminder, if there are cash loans pegged to the currency and repaid in national money, then when the exchange rate changes, an automatic notification will be sent about the change in the amount of the next payment. If there is a delay in cash loans, the accounting software will automatically generate and send a message about the presence of debt and the accrual of penalties. In this case, the participation of personnel in accounting is minimized as the software independently copes with such maintenance. Moreover, to organize mailings, a set of text templates has been prepared for all cases of contacting customers, so mailing can also be automated by the accounting program.

Staff involvement is required when sending messages is targeted to solve marketing problems. Here, managers set the selection criteria to compile a list of subscribers who should receive these messages, according to the enterprise. Then the configuration of keeping records of money loans forms a list of target subscribers, excluding from it those who previously refused to receive advertising information, which is necessarily noted in the client base. Such information comes to it when registering a client in the program and further interacting.

Download demo version

When starting the program, you can select the language.

You can download the demo version for free. And work in the program for two weeks. Some information has already been included there for clarity.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

The task of the personnel to ensure accounting of money loans includes registering clients in the database, entering personal and contact information, adding copies of identity documents, photographing the client with a webcam capture, entering information from which information sources the client learned about the company's services, and agreement whether to receive marketing communications. From this data, at the end of the period, a marketing report will be compiled with an analysis of advertising sites involved in the promotion of financial services, and an assessment of their effectiveness by the difference between the costs of the site and the profit received from it due to new customers who came from there. This allows you to save money by denying unproductive sites and supporting those that give the necessary surge of interest.

To organize mailings and automatically inform borrowers, they use electronic communication in several forms, which are a voice automatic call, Viber, e-mail, SMS, while the sending itself is carried out directly from the client base using the contacts presented in it. All texts are saved in the personal files of clients, to avoid duplicate notification. A report is also being prepared on the number of sent mailings, subscribers reached, their categories, and the quality of feedback, which is determined by the number of new money loans, and requests. As follows from the description, accounting is kept for everything - accounting of clients, accounting of money loans, accounting of personnel, accounting of maturities, accounting of the exchange rate, accounting of debts, accounting of funds issued for money loans, accounting of advertising, and many others. And for each type of accounting, the company receives a report drawn up at the end of the period, with an analysis of this type of activity in terms of costs and profit. Such reports are the best tool in conducting financial activities, as they provide an opportunity to find your bottlenecks in working with clients and to identify trends in the dynamics of indicators.

Order an accounting for money loans

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

Send details for the contract

We enter into an agreement with each client. The contract is your guarantee that you will receive exactly what you require. Therefore, first you need to send us the details of a legal entity or individual. This usually takes no more than 5 minutes

Make an advance payment

After sending you scanned copies of the contract and invoice for payment, an advance payment is required. Please note that before installing the CRM system, it is enough to pay not the full amount, but only a part. Various payment methods are supported. Approximately 15 minutes

The program will be installed

After this, a specific installation date and time will be agreed upon with you. This usually happens on the same or the next day after the paperwork is completed. Immediately after installing the CRM system, you can ask for training for your employee. If the program is purchased for 1 user, it will take no more than 1 hour

Enjoy the result

Enjoy the result endlessly :) What is especially pleasing is not only the quality with which the software has been developed to automate everyday work, but also the lack of dependency in the form of a monthly subscription fee. After all, you will only pay once for the program.

Buy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Accounting for money loans

The work of each user in the system is limited by duties and competencies. Access to service information is carried out by personal login and password. Security codes give the user access only to the information needed to perform a high-quality work, so the confidentiality of service information is preserved. The preservation of service information supports their regular backups, which launches the task scheduler, which is responsible for the execution of all scheduled work.

The program does not have a subscription fee, which makes it stand out from the pool of similar systems. The cost is determined by the composition of functions and services and they can be supplemented with new ones. The installation of the program is carried out by the employees of the USU Software using remote access via the Internet connection. After the completion of the work, there is a short master class for users.

If a financial institution has remote branches, offices, their work is included in the overall activity due to the functioning of a single information space. Such an information space functions when there is an Internet connection and has a remote control, whereas with local access the Internet is not required. During the functioning of a single information space, the separation of rights is observed. Each department sees only its information and the parent company sees everything.

Users work in personal electronic forms and register in them their operations performed within the framework of tasks and based on the volume salaries are calculated. The program automatically draws up all the necessary documents when applying to a money loan, including contracts, a security ticket, cash orders, and acceptance certificates. The automatically generated documentation also includes financial statements, all invoices, mandatory reporting of the regulator, and statistical reporting of the industry. If an organization uses marketing tools to promote services, a report at the end of the period will show which of them were most effective and which were not. Regular analysis of activities allows you to identify non-productive costs, assess the appropriateness of individual expense items, clarify the deviation between the plan and the fact. The reports are compiled in a convenient format. These are tables, graphs, diagrams with full visualization of the significance of each indicator and the share of its participation in the formation of profits. The program is easily compatible with modern equipment, including demonstration and warehouse, improving the quality of control over work operations and customer service.