Operating system: Windows, Android, macOS

Group of programs: Business automation

Write-off of fuels and lubricants in accounting

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

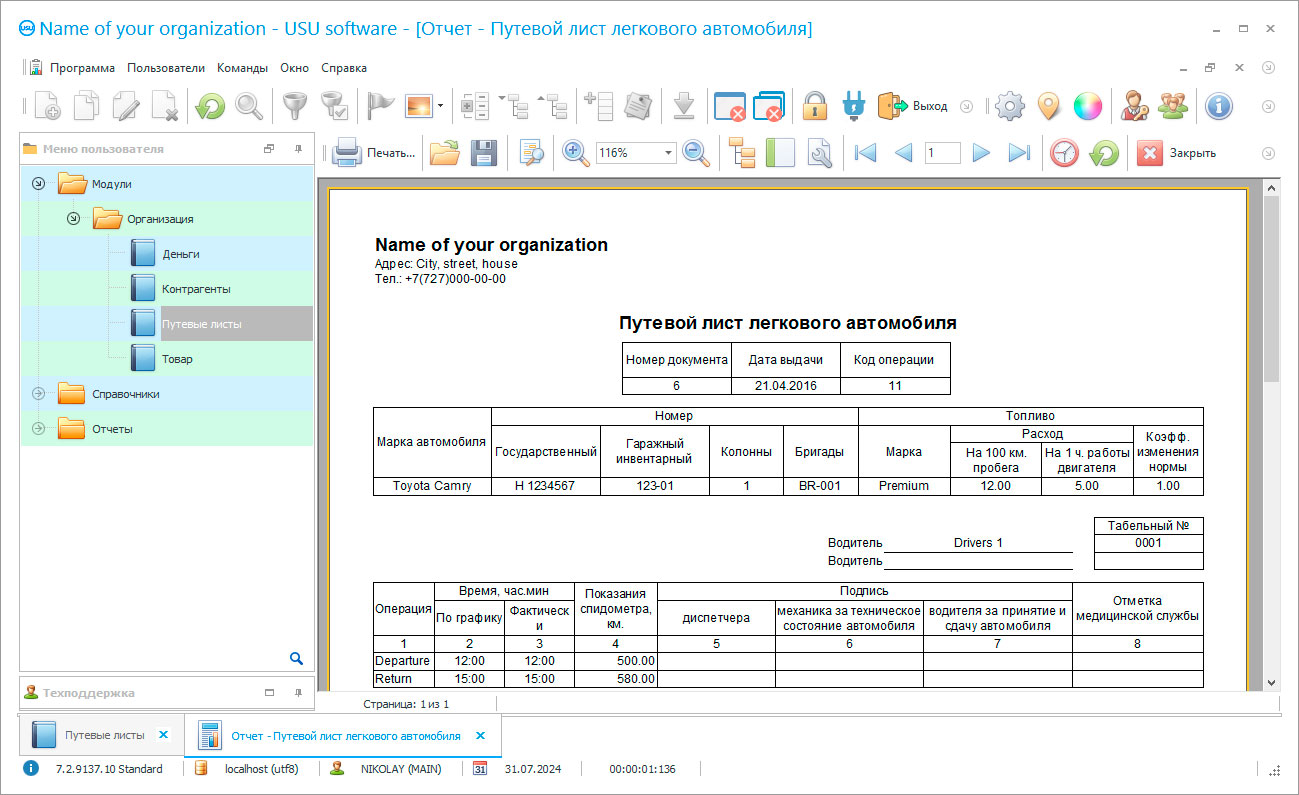

Program screenshot

Organizations engaged in the production of various products need their own, or rented transport to deliver finished products to the point of sale. This also applies to small companies, and even more so, large factories and enterprises, where there is a large fleet of vehicles, from where vehicles are used directly in production, official vehicles for the management and other employees. The presence of vehicles on the balance sheet of the organization bears obligations for accounting, control of the condition, consumption of fuels and lubricants for accounting and tax categories. Write-off of fuels and lubricants in accounting takes up a significant part of the costs, therefore, the correct and competent conduct of the documentation always remains a topical issue.

Fuels and lubricants (fuels and lubricants) include all resources that will be used during operation or during car repairs (fuel, lubricating oils, cooling fluids, brake fluids). The expenses for the purchase of these materials affect the base from which the profit and tax deductions are calculated, therefore it is important to correctly record and write off fuels and lubricants in the accounting department. In order to correctly calculate tax payments, it is necessary to calculate it based on the norms for write-off, not overestimating, but not underestimating either. The write-off rates are determined by each enterprise and their accounting department independently, taking into account the volume of production and the number of vehicles on the balance sheet. There are two ways to calculate the standards, the first option involves the use of technical documents on transport, where the standard costs for this type of vehicle are indicated, and already starting from them, add climatic conditions, season, period and city traffic of road congestion into account. Or, apply the second method, when data is being recorded and measured empirically. Which method will be more convenient, the company also decides independently. But do not forget that vehicles can be used in different conditions, which will also affect the further write-off of fuel residues, even a simple one with the engine on during traffic jams, will affect the actual consumption.

In order not to lose sight of any important circumstance, it is required to create several standards and conduct processes for writing off fuel and lubricants from tax and accounting, adjusting to the situation. Often, incorrect accounting of materials causes problems in the accounting department when writing them off, since it is not always possible to process a large amount of information, arrange it as it should for accounting and calculate. Production volumes are growing, the vehicle fleet is expanding, but automation technologies are also not standing still and are developing. Information technologies now offer many solutions that can help in accounting, write off fuel and lubricants, and create the documentation required by the tax authorities. And of course, it is wiser, having such modern capabilities, to transfer some of the responsibilities associated with accounting to the artificial intelligence of automation programs. Moreover, now such applications are very easy to learn, do not require the purchase of additional equipment, their cost has a wide range and is available to most entrepreneurs who are thinking about optimizing their business processes. We, in turn, would like to present to your attention one of these programs - "Universal Accounting System". It is distinguished by its wide functionality, simple interface, constant technical support, variability of the final version, affordable prices, and adjustment to the characteristics of each organization.

Our USU platform for accounting and writing off fuels and lubricants in the accounting department will take over all the accounting documentation for fuel, transport, consumption standards, and will form and store them on the basis of forms. At the same time, the calculations can be based on several forms of standards that can be changed, depending on the conditions that have arisen. But before keeping the fuel consumption, it is purchased by drawing up a supply agreement, and the materials already purchased are displayed according to the waybills and invoices that are accepted by the organization. The costs of used fuels and lubricants are written off according to the parameters of the cost of production, which confirms their relationship to production processes. If, when accounting for the write-off of fuels and lubricants, an overrun is found that exceeds the established standards, the system displays a notification, and documents are created in the accounting department that will help substantiate them so that there will be no problems with the tax authorities in the future.

Electronic write-off of fuels and lubricants, tax and accounting, carried out using our USU program, will become a convenient toolkit for the accounting department for operations with fuel and lubricants. But writing off fuels and lubricants, conducting tax and accounting records, is far from a complete list of functions of the USU application. The system creates waybills, makes working schedules for drivers and vehicles, monitors the technical condition of the vehicle fleet, plans inspection, replacement of spare parts. Reporting, which is widely presented in the application, will help the manager track the work of the accounting department, drivers, production departments, and respond to changes in the criteria for writing off fuel and lubricants. Such a powerful mechanism for automating the accounting part of the enterprise will allow you to quickly respond to changing situations, maintaining the working condition at the proper level.

The program for fuel accounting will allow you to collect information on fuel and lubricants spent and analyze costs.

The program for accounting waybills allows you to display up-to-date information on the consumption of fuels and lubricants and fuel by the company's transport.

The program for waybills is available for free on the USU website and is ideal for acquaintance, has a convenient design and many functions.

It is much easier to keep track of fuel consumption with the USU software package, thanks to full accounting for all routes and drivers.

The program for accounting of fuels and lubricants can be customized to the specific requirements of the organization, which will help to increase the accuracy of reports.

Who is the developer?

Akulov Nikolay

Expert and chief programmer who participated in the design and development of this software.

2024-05-12

Video of write-off of fuels and lubricants in accounting

The program for filling out waybills allows you to automate the preparation of documentation in the company, thanks to the automatic loading of information from the database.

Accounting of waybills can be carried out quickly and without problems with modern USU software.

The program for accounting waybills is required in any transport organization, because with its help you can speed up the execution of reporting.

You can keep track of fuel on routes using the program for waybills from the USU company.

Make the accounting of waybills and fuel and lubricants easier with a modern program from the Universal Accounting System, which will allow you to organize the operation of transport and optimize costs.

To account for fuels and lubricants and fuel in any organization, you will need a waybill program with advanced reporting and functionality.

The program for recording waybills will allow you to collect information on costs on the routes of vehicles, receiving information on the spent fuel and other fuels and lubricants.

The program for the formation of waybills allows you to prepare reports within the framework of the general financial plan of the company, as well as track expenses along the routes at the moment.

For registration and accounting of waybills in logistics, the fuel and lubricants program, which has a convenient reporting system, will help.

The program for accounting of fuels and lubricants will allow you to track the consumption of fuel and fuels and lubricants in a courier company, or a delivery service.

Download demo version

Your company can greatly optimize the cost of fuels and lubricants and fuel by conducting electronic accounting of the movement of waybills using the USU program.

Any logistics company needs to account for gasoline and fuels and lubricants using modern computer systems that will provide flexible reporting.

It is easy and simple to register drivers with the help of modern software, and thanks to the reporting system, you can identify both the most effective employees and reward them, as well as the least useful ones.

The basis for writing off fuels and lubricants in accounting are travel papers, which are maintained for each type of vehicle.

The USU system prescribes the accepted standards for accounting control and write-off of fuels and lubricants.

The application monitors residues, the movement of fuel and lubricants, forming documents for issuance and write-off accepted in the accounting department.

Fuel consumption rates are adjusted for each organization separately.

The software creates an act on fuel write-off based on the accepted accounting control standards.

USU takes into account the characteristics of each type of vehicle when creating a waybill.

Correct accounting management of processes for fuel and lubricants costs, including the mileage, operating time in the documentation.

Order a write-off of fuels and lubricants in accounting

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Write-off of fuels and lubricants in accounting

The USU application can control the quality of the drivers' work, displaying the results in the appropriate reports.

The accounting department will be able to automatically calculate and calculate wages, fuel consumption, tax deductions.

All documentation located in the system base can be directly printed, saving time for transferring to text editors.

Each document is automatically drawn up with a logo and company details.

Analysis of the transportation work performed is displayed in special reports that help to assess the current situation.

The USU platform creates a single information space between departments and branches, which helps to write off fuel and fuels and lubricants in the aggregate of all departments.

Importing and exporting data from external applications will become a convenient function, for example, for transferring existing databases on customers, employees, transport fleet.

Our program monitors the timely conduct of technical inspection and replacement of parts, as scheduled.

The configuration has the ability to implement many additional options that can help you manage your organization.

The enterprise can be managed remotely, for this you only need a personal computer and the Internet.

You can try the application in the Demo version by downloading it on our page!