Operating system: Windows, Android, macOS

Group of programs: Business automation

MFIs automation

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

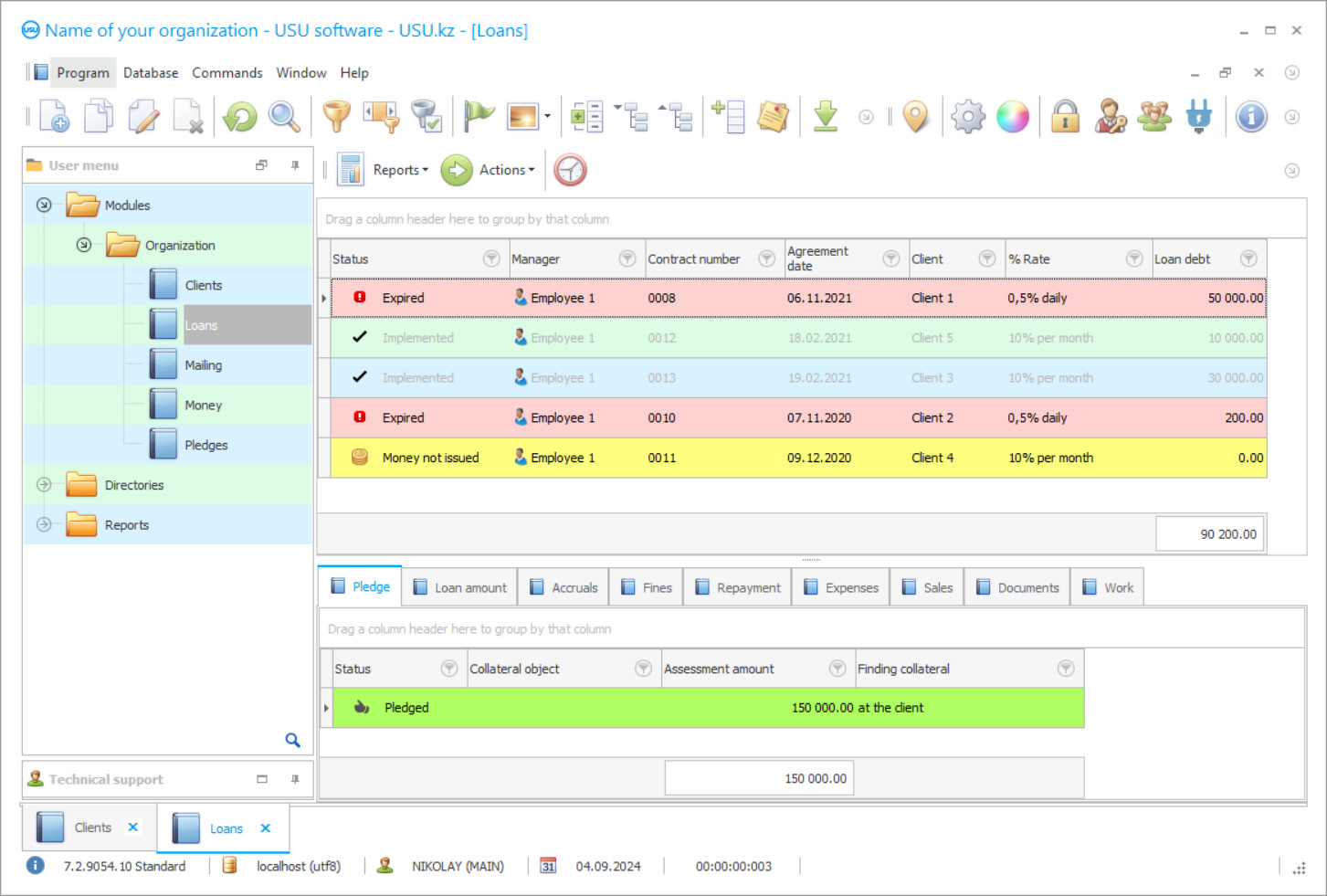

Program screenshot

Automation of MFIs is represented in the USU Software, where all accounting and calculation procedures, systematization of information according to specified criteria, and it is structuring by work processes are subject to automation. Optimization of MFIs involves accelerating the procedure for applying for a microloan, convenient storage of documents according to their purpose, reliability in checking the client's solvency, quick construction of a repayment schedule, prompt calculation of contributions, etc. Here, under the optimization of MFIs, we can consider minimizing the working time of staff for obtaining a loan in order to accept as many clients as possible during a work shift, but at the same time preserve the quality of decisions made on granting a loan or refusing it. Automation of MFIs involves the automation of internal activities, when the input of some data gives a ready-made solution, which the manager can only confirm to the client, the rest of the work will be done by automation, in case of a positive decision, it will prepare all the required calculations, generate the necessary documents, after which MFIs employee will send them to print to present to the client for signature. Considering that the speed of all operations in automation is a fraction of a second. And, of course, the MFIs employee spends the minimum possible time on the entire procedure.

Who is the developer?

Akulov Nikolay

Expert and chief programmer who participated in the design and development of this software.

2024-04-27

Video of mFIs automation

This video can be viewed with subtitles in your own language.

In addition to optimizing MFIs, there is the automation of accounting, when all data in an automated system is independently distributed among the relevant items, accounts, databases, folders, forming indicators for accounting for MFIs. Automation of accounting should also be attributed to MFIs optimization, which is also important for an organization where success depends on the accuracy of operations and control over payments, risk assessment, and changes in conditions at the right time. As an example of the benefits obtained by MFIs in the automation of accounting, we can consider an ordinary case of obtaining a credit when a client applies for it. The first thing that requires automation is the registration of the customer in the client base since when applying for a loan, information about him is instantly recorded. It should be noted that thanks to our automation, there is optimization for entering data into the accounting system, for which special forms have been prepared windows for registering new positions, where information is added not by typing from the keyboard, but by choosing the desired option from those offered in this form several variants and following an active link to the database to select an answer in it. In the automation program, only primary information can be entered from the keyboard, the current information should be searched for in the automated accounting system.

Download demo version

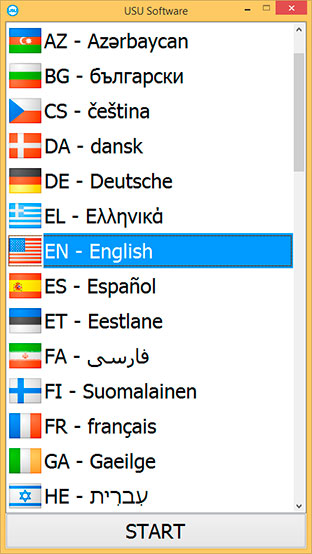

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

Automation in this way solves two fundamental problems. The first is the optimization of data entry since this method of input significantly speeds up the procedure, the second is to establish the relationship between all values from different information categories, which increases the efficiency of accounting due to their completeness of coverage and excludes the possibility of placing false information, and this is very important for MFIs since any inaccuracies are fraught with financial losses. Due to the connection of all the data in the database, all accounting indicators are always connected to each other, meaning when false data gets in, the balance is disturbed, which immediately becomes noticeable, it is not difficult to find the reason and the culprit, since there is also its own optimization — all users have individual logins and security passwords for them, therefore, all input the information is marked with their logins, which are retained for all corrections and deletion of data. Client registration is carried out through the client's window, where data is added manually since they are primary — these are personal information and contacts, copies of identity documents that are attached to the client's personal profile. And this is also optimization — this time, optimization taking into account the interaction with the client, since it allows you to save the archive of work with him, including the applications accumulated over time, schedules, letters, statements — everything that helps to compose a portrait of the client. As soon as the registration of the borrower is completed, through the loan window, a similar form, they fill out an application for a loan and the client is added from the client base, fulfilling the automation. After that, in the window, select the interest rate from the set of proposed ones, the loan amount and indicate the units of measurement — in the national currency or not, since in some cases a link to a foreign currency is applied, in this case, the calculation will take into account its current rate. As soon as the application is completed, the automated system issues the entire package of automatically generated documentation, while simultaneously notifying the cashier about the loan amount that should be prepared for the new borrower. Let’s see some other features of the program.

Order a mFIs automation

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

MFIs automation

The program puts into operation unification, which is also an optimization — all digital forms have the same principle of filling out, distributing data over the system structure. Unified forms save users time because they do not need to rebuild when moving from one document to another when performing different tasks. Databases are also unified — they have a single standard for presenting information, when there is a general listing of items at the top, and their detailing in the lower tab bar. In addition to the client base, the program has a base of loans, each loan has its own status and color, according to which the MFIs employee conducts visual control over its condition. The status and color of the loan change automatically, which saves staff time for monitoring since there is no need to open documents to check the indicators of its status. The credit status and color change automatically based on the data entered into the system from users who have direct access to it.

An assortment of automatically generated MFIs documentation includes a loan agreement, various cash orders, depending on operations, security tickets, and acceptance certificates. This program actively uses informing borrowers about changes in the exchange rate and, therefore, the amount of payment, a reminder of payment, a notice of delay. Sending such messages is carried out directly from the client base, for which they use digital communication in the form of voice calls, messengers, e-mail, SMS, and ready-made text templates. Our MFIs automation program makes an automatic recalculation of payments when the exchange rate changes, if the loan is linked to it, upon repayment of the debt, it charges interest depending on the period. If the borrower wants to increase the loan amount, the system automatically recalculates the amount of principal and interest, forms a repayment schedule with new information.

The system maintains a loyalty program in relation to regular borrowers with a good credit history, offers them a system of discounts, personal service. By the end of the reporting period, statistical, analytical reports are generated for all types of activities, including financial services and economics, and with personnel assessment. The program automatically calculates wages for MFIs workers, taking into account the volume of completed tasks, borrowed loans, and the profit they bring. Programs for automation of MFIs do not have heavy system requirements for hardware, meaning that you can install it on pretty much any device with Windows OS installed!