Operating system: Windows, Android, macOS

Group of programs: Business automation

Accounting for credit brokers

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

During business hours we usually respond within 1 minute

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

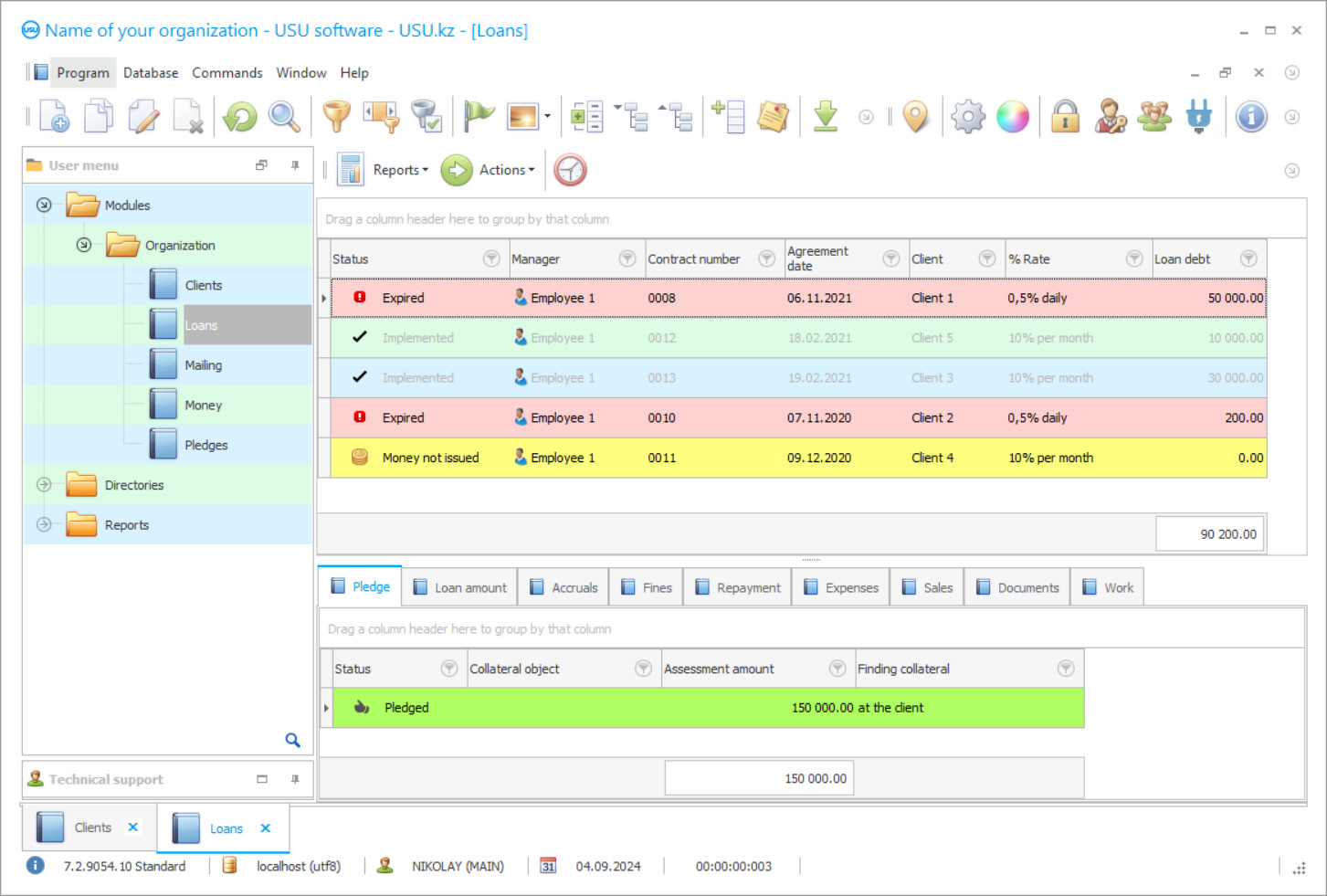

Program screenshot

A screenshot is a photo of the software running. From it you can immediately understand what a CRM system looks like. We have implemented a window interface with support for UX/UI design. This means that the user interface is based on years of user experience. Each action is located exactly where it is most convenient to perform it. Thanks to such a competent approach, your work productivity will be maximum. Click on the small image to open the screenshot in full size.

If you buy a USU CRM system with a configuration of at least “Standard”, you will have a choice of designs from more than fifty templates. Each user of the software will have the opportunity to choose the design of the program to suit their taste. Every day of work should bring joy!

Credit organizations provide various services related to collateral transactions. They work on direct and intermediary services. With the help of modern software, you can set up any business activity. Credit brokers are accounted for according to certain rules, which are specified in the regulations of state bodies, as well as in the company's internal documentation.

USU Software helps to keep records of clients of credit brokers and perform accounting continuously in chronological order. No operation will be missed. All customer indicators are recorded in a single consolidated statement. Thus, a common base is being formed. Credit brokers play an important role in the interaction between the borrower and the firm. They help to carry out operations in the absence of free time or lack of knowledge in the industry.

Who is the developer?

Akulov Nikolay

Expert and chief programmer who participated in the design and development of this software.

2024-07-27

Video of accounting for credit brokers

By accounting operations, you can track the workload of each department and employee. Responsible persons are identified thanks to the logbook. For the leadership of the organization, it is necessary to receive accurate and reliable information before forming a promotion and development policy. Compliance with the principles of the internal instructions gives such a guarantee.

A credit broker is a special person who is able to independently make decisions on behalf of the client. First, an agreement is formed, which specifies general issues of interaction with third parties. Due to the development of information technology, the company can optimize its work in many ways. Reducing time costs and increasing the availability of production facilities help to increase production. The creation of good working conditions for staff affects their interest in the flow of customers.

Download demo version

When starting the program, you can select the language.

You can download the demo version for free. And work in the program for two weeks. Some information has already been included there for clarity.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

USU Software was created for conducting business activities in various sectors of the economy and ensure its accounting. Its structure contains a variety of reference books and classifiers that you can define for yourself. The advanced parameters help to set the assessment and implementation according to the articles of incorporation. High performance guarantees fast wire formation. Each report provides advanced analytics for the totals for clients, brokers, fixed assets, and more.

The account of credit brokers in a specialized program contributes to complete control over all production processes. So, you can track the workload of personnel and the level of production. At the end of the shift, the total is summarized, and the data is transferred to the summary sheet. Spreadsheets are made up of many rows and columns that are populated with the data provided. With built-in templates, you can automatically create a contract and other additional accounting forms.

Order an accounting for credit brokers

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

Send details for the contract

We enter into an agreement with each client. The contract is your guarantee that you will receive exactly what you require. Therefore, first you need to send us the details of a legal entity or individual. This usually takes no more than 5 minutes

Make an advance payment

After sending you scanned copies of the contract and invoice for payment, an advance payment is required. Please note that before installing the CRM system, it is enough to pay not the full amount, but only a part. Various payment methods are supported. Approximately 15 minutes

The program will be installed

After this, a specific installation date and time will be agreed upon with you. This usually happens on the same or the next day after the paperwork is completed. Immediately after installing the CRM system, you can ask for training for your employee. If the program is purchased for 1 user, it will take no more than 1 hour

Enjoy the result

Enjoy the result endlessly :) What is especially pleasing is not only the quality with which the software has been developed to automate everyday work, but also the lack of dependency in the form of a monthly subscription fee. After all, you will only pay once for the program.

Buy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Accounting for credit brokers

USU Software is a good assistant to the manager. It is able to promptly provide reports on all sections, generate accounting and tax reports, track the actions of employees, determine the level of payments and repayment of debts, monitor supply and demand, and also help in optimizing business performance.

In the age of Big Data, there is a huge dataflow, which should be properly analysed and considered during processes that credit broker does. Therefore, it is important to organize the work of credit companies according to the needs of the clients, attracting them and increasing their loyalty level. The only one solution is a modern software – automation computer system, which is able to optimize the activity of the whole credit enterprise, allowing brokers to perform without a single mistake. To ensure it, a high-quality accounting program configuration is needed, which will facilitate every process, increasing the efficiency of the company. USU Software provides such possibilities to support the activity of credit brokers. One of such facilities is a formation of documentation and accounting, including forms and contracts, remotely, online, with the help of an Internet connection.

In every business, the most important thing is accounting, especially in credit companies, as its activity is directly related to financial transactions and even a minor error can cause a huge loss of money. Therefore, the accounting and reporting system should be at a high level, providing error-free reports, which should be used for forecasting and planning of the future development direction for credit brokers. With the help of the accounting system for credit brokers, this will not be an issue as all these processes are performed in the computer program, without human intervention.

There are many other advantages of the program such as entry by login and password, convenient interface, nice menu, changes at any time, electronic database, unlimited creation of item groups, identification of late payments, synthetic and analytical accounting, salary and personnel management, calculation of interest rates, creation of plans and schedules, cash discipline, loading and unloading a bank statement, accounting certificates, forms of strict reporting, waybills, mass mailing by SMS or email, receiving applications via the Internet, special reports, books, and magazines, analysis of income and expenses, determination of supply and demand, tracking staff performance, accounts receivable and payable, use in any economic sector, service level assessment, feedback, built-in assistant, invoices, versatility, process automation, advanced analytics, increased productivity of production facilities, unified customer base, video surveillance service, determination of financial condition and financial position, reconciliation statements with partners, built-in loan calculator, production calendar, costing calculation, Viber communication, creating a backup copy, transferring the database from another program, the hierarchy of departments, and interaction of services and departments.