Operating system: Windows, Android, macOS

Group of programs: Business automation

Accounting for credits debt

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

During business hours we usually respond within 1 minute

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

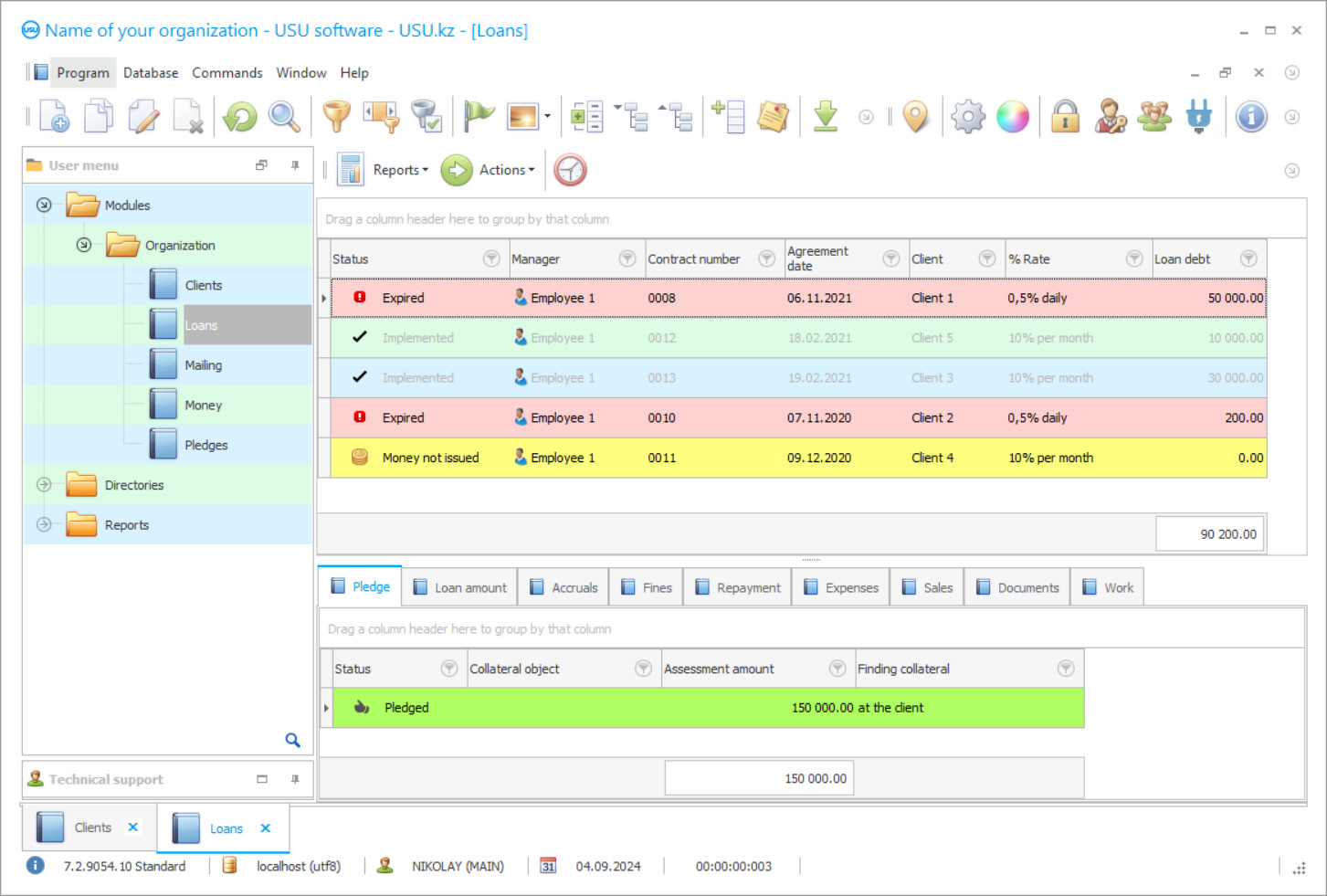

Program screenshot

A screenshot is a photo of the software running. From it you can immediately understand what a CRM system looks like. We have implemented a window interface with support for UX/UI design. This means that the user interface is based on years of user experience. Each action is located exactly where it is most convenient to perform it. Thanks to such a competent approach, your work productivity will be maximum. Click on the small image to open the screenshot in full size.

If you buy a USU CRM system with a configuration of at least “Standard”, you will have a choice of designs from more than fifty templates. Each user of the software will have the opportunity to choose the design of the program to suit their taste. Every day of work should bring joy!

Credit debt accounting in the USU Software is in full compliance with the accounting regulations, which divides the debt, depending on the repayment period of the loans received, according to the agreement, into long-term - the debt repayment period is more than 12 months, and short-term, when the debt must be paid before the expiration of the annual period. Moreover, the accounting of debt on credits received is organized not only by these two categories but also by creditors and borrowers. This is determined by the status of the organization that installed this software, which can be used by either party to the loan agreement, although, if you consider, that the subject of discussion is the received credits, and their accounting, it means that we are talking about the enterprise that keeps records of received loans.

Control over the current debt on received credits is established in the loan database, where the received credits form their history, starting from the date of application submission, its subsequent approval, and transfer of funds to the appropriate account, debt transactions considering the terms and amounts to be paid, payment of commissions, and percent. Each credit received, has its unique ‘dossier’ in this database with an assigned status that characterizes the current state of the debt, and the status, in turn, is determined by the colour, by which the program users visually monitor the fulfilment of obligations to repay this debt. The debt status on the loan received has several statuses, including timely payment on schedule, violation of payment deadlines, delays, accrual of penalties, and others. The user differentiates statuses according to their degree of problem, without spending time opening each document to familiarize themselves with the status of the debt.

Who is the developer?

Akulov Nikolay

Expert and chief programmer who participated in the design and development of this software.

2024-07-27

Video of accounting for credits debt

The configuration of an accounting of debt on received loans successfully fulfils one of its main tasks - it saves staff time and visualizes performance indicators to ensure a quick assessment of work processes, which makes it possible to increase the efficiency of processes and staff productivity, the profitability of the enterprise, while conveniently organizing information on debt on credits received and structuring the procedures of its accounting. The installation of the configuration of an accounting of debt on loans received is carried out by the developer, after which a short presentation of all software capabilities is provided, which are not so few, which makes it possible to free staff from performing many daily duties, primarily from participation in accounting and calculations. So, this is how the automated accounting system will conduct these procedures independently, providing the enterprise with the accuracy and speed of processing the data to be recorded.

Moreover, employees are no longer involved in the formation of any documents. The configuration of accounting for debt on received credits makes them independently, freely operating with the data available in the system and the bank of forms built into it, prepared specially to carry out these works. The automatically generated documentation fully complies with all the requirements, meets the request and purpose, this is monitored by the information and reference base, also built into the accounting system, where all the provisions, regulations, norms, and standards are collected, including the preparation of financial statements. The base conducts regular monitoring of the emergence of new amendments to the existing regulatory documents, which considers and adjusts the settings in the system itself to obtain an up-to-date result in the calculations and preparation of documents. The availability of the information and reference base also provides the setting of the calculation, which allows automatic calculations since each operation receives a value expression considering the standards established in the industry and presented in the base.

Download demo version

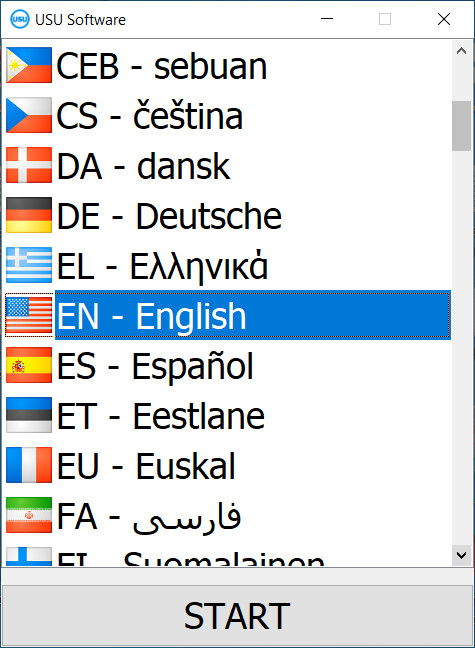

When starting the program, you can select the language.

You can download the demo version for free. And work in the program for two weeks. Some information has already been included there for clarity.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

The responsibility of users includes only one operation - the timely addition to the program of their readings obtained while performing work assignments within the competence. On their basis, the automated accounting system conducts an instant recalculation of current indicators related to the received change, rebuilding the description of the current process, therefore, it is interested in the prompt receipt of primary and current information from users, motivating them to actively participate in the data entry procedure by automatically calculating user piece-rate wages, considering the volume of work registered in electronic work logs. At the same time, users work in personal electronic forms, the information posted in them is marked with a login, which everyone receives together with a protective password to enter the program in order to protect the confidentiality of official information, and therefore, bears personal responsibility for the quality of their data and the timeliness of their input into the system.

In addition to the base of credits, CRM is presented as a customer base, where the accounting of interaction with them is organized, a detailed history of contacts is compiled from the moment of registration. Each personal file contains personal data, contacts, an archive of documents, photos, and a detailed list of work performed by date - calls, letters, meetings, and loan issuance. CRM also stores all offers made to the client, the texts of the mailings sent, copies of identity documents, and a photo from the webcam are attached.

Order an accounting for credits debt

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

Send details for the contract

We enter into an agreement with each client. The contract is your guarantee that you will receive exactly what you require. Therefore, first you need to send us the details of a legal entity or individual. This usually takes no more than 5 minutes

Make an advance payment

After sending you scanned copies of the contract and invoice for payment, an advance payment is required. Please note that before installing the CRM system, it is enough to pay not the full amount, but only a part. Various payment methods are supported. Approximately 15 minutes

The program will be installed

After this, a specific installation date and time will be agreed upon with you. This usually happens on the same or the next day after the paperwork is completed. Immediately after installing the CRM system, you can ask for training for your employee. If the program is purchased for 1 user, it will take no more than 1 hour

Enjoy the result

Enjoy the result endlessly :) What is especially pleasing is not only the quality with which the software has been developed to automate everyday work, but also the lack of dependency in the form of a monthly subscription fee. After all, you will only pay once for the program.

Buy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Accounting for credits debt

To ensure external interaction, electronic communication functions in several formats - Viber, SMS, e-mail, voice calls, which are used to support mailing and informing. The client is informed automatically based on the maturity dates specified in the credit debt database. There is a reminder of the date and amount of payment, notification of a penalty. Mailings are organized for advertising purposes to promote services and in different formats, depending on the chosen reason to support contacting - individually, in large quantities, and to the target group.

Automatically generated documentation includes any type of reporting, including financial, accounting, statistical and mandatory, standard contract, and invoices. When making a credit application, the program automatically generates a loan agreement in MS Word with the details of clients included in it and the approved loan conditions. When applying for credit, the program automatically calculates the payment considering the interest rate, changes its amount when the exchange rate fluctuates, if the loan is issued in it. The automated system keeps statistics on all indicators, including the number of approved and rejected applications, which allows effective planning. Based on statistical accounting, internal reporting is being formed with the analysis and assessment of all types of work, which makes it possible to improve their quality and ensure profitable growth.

Analysis of current indicators allows us to assess the activity of clients on certain period, loans demand, staff efficiency, deviation from the repayment schedule, and principal debt. Analytical reporting is presented in a convenient and visual form - tables, diagrams, and graphs that visualize the importance of each indicator in generating profits. Analysis of financial resources allows you to assess the quality of the credit portfolio, determine the appropriateness of individual costs, to identify non-productive costs of processes and debts amount.

The installation of the program is carried out by the staff of the USU Software. The only requirement for digital devices is the Windows operating system. After installation, there is a presentation of the capabilities of the application for an accounting of credit debts.