Operating system: Windows, Android, macOS

Group of programs: Business automation

Fuel write-off accounting

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

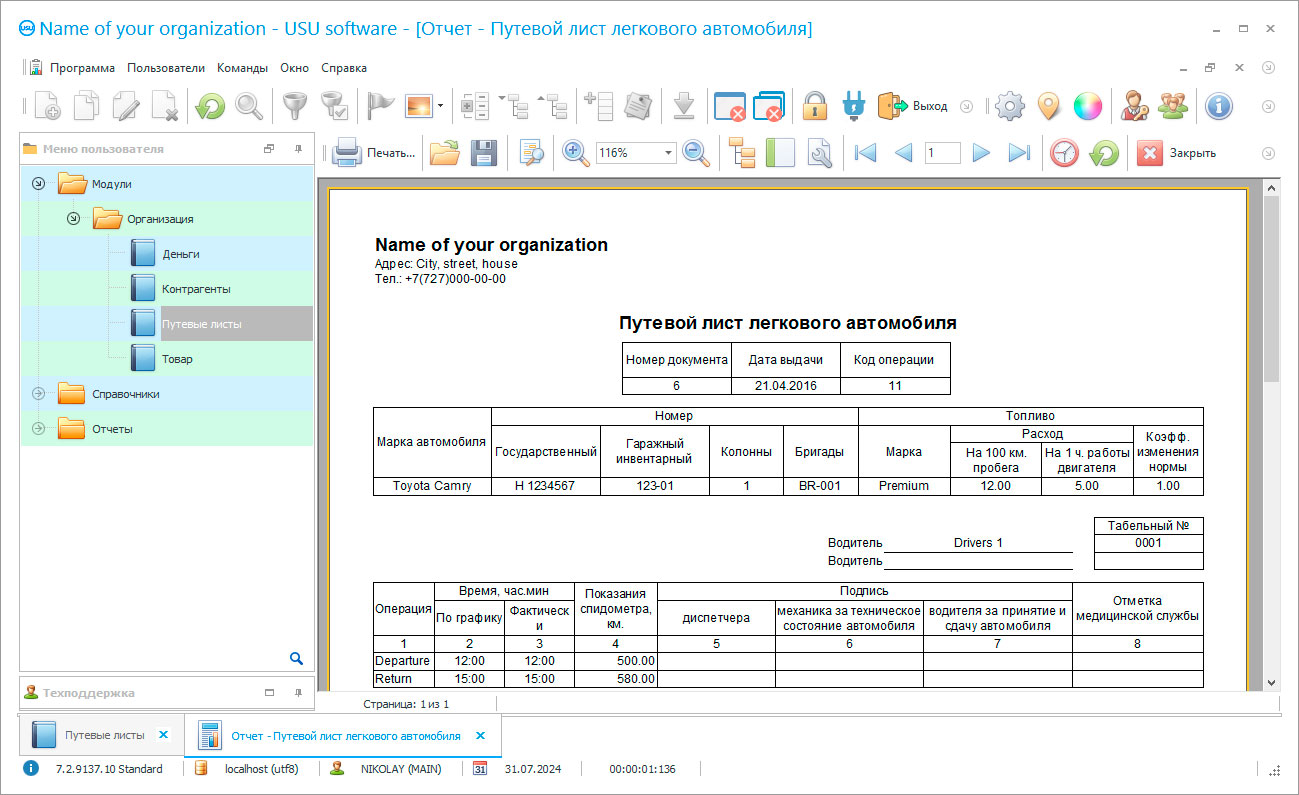

Program screenshot

Fuel write-off is recorded, as a rule, by two methods - at the average cost and at the cost of the first fuel by the date of purchase. At the same time, the most popular method for accounting for fuel write-off is at the average cost, which is the ratio of two amounts: in the numerator the sum of the cost of fuel upon receipt on the balance sheet and the cost of the current balance, in the denominator the sum of the volumes (quantity) of receipts and the balance in natural units. The fuel is written off according to the data from the waybills, where the vehicle mileage, the received fuel and its remainder in the tank are noted. Fuel accounting involves the determination of its consumption, which is calculated according to the indicators in the waybill, using its standard or actual quantity, then multiplied by the selected cost price option (cost per unit), and the resulting value is subject to write-off by posting.

The fuel write-off program is part of the Universal Accounting System software for transport companies, in fact, it is an automation program for them, primarily accounting. The purpose of the fuel write-off program is to automate the fuel write-off accounting to improve accounting efficiency, reduce labor costs, accelerate internal processes for the exchange of information and increase labor productivity. The installation of a fuel write-off program really allows the company to complete this program at least in a fairly quick time, while it provides many other preferences in its work, which contribute to the transport company entering a new level of development in terms of quality and quantity, in terms of quantity, meaning profit.

The fuel write-off program is installed by the USU employees on their own, remotely via the Internet connection. A preliminary discussion of the content of the accounting program and the coordination of its content are also carried out remotely, fortunately, technologies support this format of interaction. In order for future users to quickly master all the capabilities of the accounting program, the same remote master class is organized for them, where the number of students should be equal to the number of licenses purchased by the enterprise.

The master class is for informational purposes only, users can also quickly master the fuel write-off program on their own, since it has a simple interface and easy navigation, to which a single format for filling out work logs, registration forms, current documentation is added, the same way of presenting information is used the databases present in the accounting program use the same data management tools. Regular work in the accounting program can be brought to automatism, so everything is clear in it.

This quality of the fuel write-off program allows line workers to work in it, including drivers, technicians, operators, who may not have experience with a computer, but in the case of this write-off accounting software, the problem is excluded. Since the write-off is organized according to waybills, the formation of which is carried out automatically by filling out a special form for manual data entry, then, accordingly, their own database is compiled from them, while any waybill can be quickly found by any of the known parameters - by the date of formation, driver, route, vehicle registration number, etc.

The write-off accounting software gives drivers the right to enter operational data on the mileage into their reporting electronic journals, recording the speedometer readings before and after the start of the route, for technicians serving transport, to indicate in their working electronic documents the amount of fuel in the tanks of vehicles. At the same time, users can work simultaneously in the same document, without overlapping, each performs its own task within the framework of duties, and the write-off accounting software divides their work zones by entering personal logins and passwords that protect the logins. The multi-user interface eliminates the conflict of saving data, so all employees add their information to the same document, without even knowing about the neighborhood.

In the accounting program, the forms for entering information have a special format that speeds up the input procedure and establishes a certain relationship between the values, thanks to which the accounting software excludes the possibility of placing false information - due to the interconnectedness, all indicators are in equilibrium, when inaccurate information is received, the balance will be violated. and the automated accounting system will be “outraged”, which immediately indicates the reason for its new state. You can find # a lie quickly enough - the accounting system records the time of adding data, which, in turn, is "marked" with the username, finding the reason for "indignation" by these parameters and the culprit is a matter of seconds.

It is a second or less that is the usual speed at which the accounting system performs any operation; the amount of data in an operation does not matter. After monitoring the waybills and calculating the cost, the system will issue the amount to be written off.

To account for fuels and lubricants and fuel in any organization, you will need a waybill program with advanced reporting and functionality.

The program for waybills is available for free on the USU website and is ideal for acquaintance, has a convenient design and many functions.

Who is the developer?

Akulov Nikolay

Expert and chief programmer who participated in the design and development of this software.

2024-05-18

Video of fuel write-off accounting

Your company can greatly optimize the cost of fuels and lubricants and fuel by conducting electronic accounting of the movement of waybills using the USU program.

The program for accounting waybills is required in any transport organization, because with its help you can speed up the execution of reporting.

It is easy and simple to register drivers with the help of modern software, and thanks to the reporting system, you can identify both the most effective employees and reward them, as well as the least useful ones.

Make the accounting of waybills and fuel and lubricants easier with a modern program from the Universal Accounting System, which will allow you to organize the operation of transport and optimize costs.

The program for accounting waybills allows you to display up-to-date information on the consumption of fuels and lubricants and fuel by the company's transport.

Accounting of waybills can be carried out quickly and without problems with modern USU software.

The program for accounting of fuels and lubricants will allow you to track the consumption of fuel and fuels and lubricants in a courier company, or a delivery service.

The program for recording waybills will allow you to collect information on costs on the routes of vehicles, receiving information on the spent fuel and other fuels and lubricants.

Any logistics company needs to account for gasoline and fuels and lubricants using modern computer systems that will provide flexible reporting.

You can keep track of fuel on routes using the program for waybills from the USU company.

Download demo version

It is much easier to keep track of fuel consumption with the USU software package, thanks to full accounting for all routes and drivers.

The program for filling out waybills allows you to automate the preparation of documentation in the company, thanks to the automatic loading of information from the database.

For registration and accounting of waybills in logistics, the fuel and lubricants program, which has a convenient reporting system, will help.

The program for the formation of waybills allows you to prepare reports within the framework of the general financial plan of the company, as well as track expenses along the routes at the moment.

The program for fuel accounting will allow you to collect information on fuel and lubricants spent and analyze costs.

The program for accounting of fuels and lubricants can be customized to the specific requirements of the organization, which will help to increase the accuracy of reports.

It is important for transport companies to have correctly completed cargo documentation that meets the requirements of all authorities; it is generated automatically.

To fill out an application for transportation, a special form is filled out, where all the details of the client, cargo, own are indicated, on the basis of these data the entire package is compiled.

In addition to accompanying documentation, the automated accounting system also generates all other documents independently, freely operating with data and forms for them.

Automatically generated documentation includes financial statements, invoices of all types, waybills, standard service contracts, and other mandatory reporting.

Order a fuel write-off accounting

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Fuel write-off accounting

To form waybills, a special form is also filled out, where the cells for filling contain a drop-down menu with a full list of options for choosing an answer.

When choosing a vehicle, clicking on the required line makes a selection, while other fields will give out options that are directly related to this vehicle.

Similarly, a driver is selected, if such is not assigned to the transport, if assigned, then his personal data will automatically appear in the required field, like date and number.

When filling out the waybill in electronic format, tabs open, which detail the characteristics of the route, such as Operations, Tasks, Fuel consumption.

In the Operations tab, the mileage is noted, registering the speedometer readings before departure and after returning, the time of each of the operations according to the plan and the actual time.

In the Tasks tab, intermediate points along the route are indicated, the time of arrival and departure from each point, the mileage traveled by the transport is noted.

In the Fuel consumption tab, the actual consumption is noted - the remaining fuel before departure and after returning, the amount of fuel issued and which one is immediately recorded.

Based on the data in the last tab, the write-off is recorded, described in detail above, the indicators can be entered both by the driver himself and by the technician serving the car.

The log of waybills is generated for the selected period of time, a register report is automatically generated for it, indicating all issued waybills.

When you select the appropriate option, the waybill for a specific transport is displayed on the screen with full route details, the form is selected and approved by the company.

The fuel write-off program does not have a monthly fee, maintains automated warehouse accounting, generates statistical and analytical reports for the management staff.